Bill Hwang From Cashier at McDonald's to Managing Billions

Among the financiers known to the world, there are not many people of Korean origin who were able to climb to the top of the financial Olympus.

One of the most famous Asian investors is Bill Hwang, an Asian American who managed to become the owner and manager of the largest hedge fund.

Who is Bill Hwang?

Sung Kuk Hwan or Bill Hwang, born in 1964, is a Korean who immigrated to the United States in 1982. According to Hwang, when he first came to the United States, Hwang did not know English and only began to learn while working part-time at McDonald's.

After his father's death, Hwang's mother moved the family to Los Angeles. Hwang studied economics at the University of California and then received an MBA from Carnegie Mellon School in Pittsburgh.

Colleagues say Hwang is one of Robertson's most successful protégés. No wonder Robertson himself called Hwang “the Michael Jordan of Asian investors.”

Julian Robertson and Bill Hwang

In 2000, Hwang launched his own fund, Tiger Asia Management. At first he used CFDs, investing only in Korean, Japanese and Chinese companies.

2007 was an extremely successful year, investments helped Hwang gain up to 40% of income and increase the fund's capitalization to $10 billion.

But the joy “did not last long”; at the end of 2008, after opening a large sale transaction on shares of Volkswagen AG, the price of the shares began to rise rapidly, bringing enormous losses.

At the end of 2008, the fund lost 23%; many investors withdrew their money, dissatisfied with the company’s policies and its approach to doing business.

In 2012, the US Securities and Exchange Commission (SEC) accused Tiger Asia of insider trading and stock manipulation of two Chinese banks. The agency said Hwang violated the law by obtaining confidential information about pending stock offerings from underwriting banks and then using it to make illegal profits:

Hwang and the company must pay $60 million to settle criminal and civil charges. At the same time, the SEC banned Hwang from setting up a fund, and the Hong Kong government banned Hwang from trading on the Hong Kong Exchange for four years (the ban ended in 2018).

After failing in 2013, Hwang founded Archegos as a family office with a capital reserve of US$200 million! This time there were no external investors, only our own funds.

Features of Bill Hwang's stock trading strategy?

Swap trading. While US law prohibits individual investors from purchasing securities in excess of 50% margin, this does not apply to hedge funds and family offices.

According to the SEC indictment, Hwang's trading strategy involved excessive leverage, reaching up to 1:10.

Long positions account for 1/3 to ½ of the total value of the company, which will contain the 10 most valuable companies (top 10 holdings).

To execute the swap, Archegos will offer a percentage of the cash value of the position as margin to the bank as collateral.

Because swaps always pay out daily based on profits and losses, Archegos had to include a second type of collateral.

If the transaction value increases, the bank will pay Archegos an appropriate amount in cash depending on the rate at which the share price increases:

If the value falls, Archegos will have to add more collateral, what the industry calls “armor pumping.” That is, as long as Hwang has enough money to pump in more margin, if the transaction fails, the bank can continue to lend Hwang more money to buy more, or keep the original value of the assets unchanged without having to liquidate.

The bank charges a commission for its services. To avoid market risk, the bank buys the underlying shares and simply pays the profits on those shares to Archegos. As Archegos buys more swaps, banks also buy more shares, which also pushes prices higher.

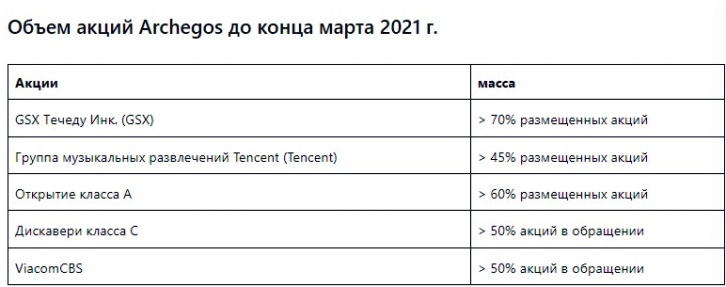

The exchange has another advantage for Hwang, namely anonymity: people who lend money to Hwang will only know about their transactions with him, without knowing that Hwang also trades - the same shares - with other banks. Viacom CBS Inc. for example, helping Hwang perfectly conceal both the identity and the size of his open position. Thus, at the end of March, Archegos owned 59 million Viacom shares from Morgan Stanley, Goldman Sachs Group Inc., Credit Suisse and Wells Fargo & Co.

As Archegos buys more and more shares, they will increase in value according to the laws of the market. As the price rises, Archegos makes even greater profits because shares purchased at low prices are worth more. Archegos used these profits, leveraged swaps and bank loans to buy more and more of certain stocks, thereby creating something of a price pyramid.

Reduce or stimulate demand 30 minutes before closing

The last thirty minutes is the time to set the closing price, a very important piece of information for investors, many people even base it on this to judge whether the next day's price will rise or fall.

Hwang poured in money to buy large quantities of shares to keep the price high and maintain a leveraged position. Since higher prices will increase margins for SBS Archegos based on end-of-day valuations, Archegos will have more leverage to buy more shares.

According to the SEC indictment, Archegos sometimes sold shares in the morning to “make room” for later trades that could have a major impact on the stock price.

Not only that, maintaining the trading price at important times, such as end-of-day valuations, will attract more people to buy the security the next day, preventing prices from falling and eliminating the need to stimulate demand.

The SEC also accused Archegos of using numerous other non-economic transactions for the sole purpose of maintaining a certain price level and countering selling pressure:

The fourth quarter of 2020 was very strong for Hwang, as the S&P 500 rose nearly 12%, 7 of 10 Archegos stocks rose more than 30%, and Baidu, Vipshop and Farfetch alone rose at least 70%.

All this has made Archegos one of Wall Street's most coveted clients. Many people have said they pay brokerage fees of up to tens of millions of dollars a year, and Hwang's company has surpassed the $100 million threshold.

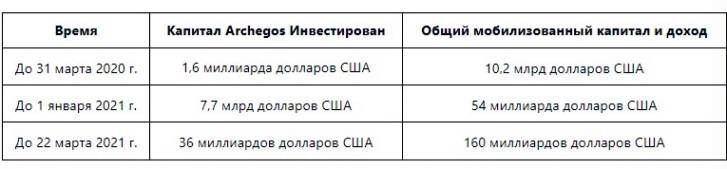

At that time, Hwang already had about $20 billion, starting from $200 million, there were times when Hwang's account balance skyrocketed to $36 billion in less than 6 months. Most of the capital came within 12 to 24 months, from the time Hwang began using leverage to generate profits.

In less than 6 months, Hwang's account increased from 4 to 36 billion dollars!

Banks, hungry for profit, willingly lent money to Hwang. Goldman has agreed to contract with Archegos as a client by the end of 2020.

Increasing capital during a pandemic

However, according to the SEC, when the Covid-19 pandemic began in 2020, Archegos' capital decreased significantly, but since March 2020, it began to increase again at a record pace.

Thanks to leverage and borrowings from many banks, Hwang owns a huge number of shares that can manipulate the market.

At the same time, Viacom CBS benefited twice from the hedge fund's manipulations, not only gaining 300% of the value, but also taking a leading position in the S&P 500 ranking.

When Hwang bought 59 million shares of Viacom, the stock price rose 300%.

Late on March 22, 2021, Viacom announced the sale of $3 billion in stock and convertible debt. Viacom shares fell 9% on Tuesday and 23% on Wednesday, forcing Archegos to exceed margin limits and alarming brokerages.

At the end of the trading session on Thursday, March 25, Viacom shares fell another 5.3% to $66.35 per share. Hwang's partners held an emergency meeting in which a representative from Credit Suisse closed the losing trades and how this would affect the price.

At this time, not only Hwang, but also the banks were faced with a dilemma. If the stock bounces, everything is fine. But if one of Hwang's partners were to sell shares, everything would go downhill. This is why Credit Suisse has not taken overt action.

Beginning of the End

Morgan Stanley ended up taking a preemptive strike by quietly selling $5 billion of its assets to Archegos. On Friday morning, ahead of the first opening session at 9:30 a.m. in New York, Goldman began liquidating $6.6 billion, including: Baidu, Tencent Music Entertainment Group and Vipshop. It was followed by $3.9 billion from Viacom CBS, Discovery, Farfetch, Iqiyi and GSX Techedu.

When the storm passed, Goldman, Deutsche Bank AG, Morgan Stanley and Wells Fargo also exited Archegos with minor losses.

The bank was able to liquidate all of Hwang's positions because in the swap, when the shares fell, the counterparty asked for additional collateral to hold the positions, but Hwang did not have enough money to secure the positions, so the bank took drastic action, forcing the positions to close out.

The risky strategy led to multibillion-dollar losses for the world's largest banks, with the total amount of damage estimated at $10 billion.

The apogee of the story was the arrest in the United States of the founder of the hedge fund Archegos Capital, Bill Hwang, which occurred in April 2022. The financier is accused of manipulating the market and using insider information to make a profit.