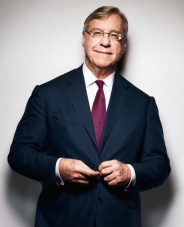

Trader Jim Chanos. The biggest bear in financial markets

If you study the success stories of many traders, the idea appears that they were all typical “Bulls”, namely they managed to find undervalued stocks and after buying them they became millionaires in a matter of months.

However, it was extremely rare to come across a success story when a trader, without any insider information, managed to predict the collapse of a company or economy and make a profit from these events.

Of course, you can give the example of George Soros, but he was repeatedly accused of using insider information, and the so-called Black Friday could not have been an accidental victory, as many believe.

However, if all hedge funds are constantly busy searching for undervalued shares, then the Kynikos fund and its head, founder Jim Chanos, are the largest short sellers who make money on the weaknesses and vulnerabilities of companies and states.

Jim Chanos has a truly flair for finding scam companies and magically making money from their bankruptcy.

The family had enough income to provide their son with a decent education, since they were the owners of a chain of laundries in the city.

Jim Chanos himself spent all his summer holidays working part-time in a laundry, which allowed him to earn money for his education. So, having successfully graduated from Birmingham Groves High School, he entered Yale University to study economics and political science, after which he successfully graduated from the university in 1980.

Trader career

The future legend and the biggest bear in the financial markets began his career from the very bottom rung - as an analyst. So, for 12 thousand dollars per year (a thousand per month) and an eighty-hour weekly schedule, Chanos compiled analytical forecasts and reviews for the Blyth Eastman Dillon company.

In an interview, Jim Chanos admitted that by removing snow in his hometown, he would earn more in a year than working for the company. However, Chanos’s career ladder did not stand still, because after the collapse of the company, Jim was invited to a new one and was considerably promoted, giving him the opportunity to realize his ideas.

Chanos' position as an analyst at the new company Gilford Securities brought enormous fame to Chanos, as thanks to his forecasts the company was able to capitalize on the fall of Baldwin-United shares, since it was Chanos who predicted the bankruptcy of the company, and the Gilford Securities fund began to short a couple of months before bankruptcy.

A successful career as an analyst at Gilford Securities allowed him to earn good money and reach a new level, namely to become an analyst and then vice president of Deutsche Bank Capital Corp.

Working in a company where the potential of a trader and manager is limited could not bring moral satisfaction to Jim Chanos, so he decides to resign from his position at the bank.

And opened his own hedge fund in 1985 called Kynikos, which is translated from Greek as “Cynic.”

The company, which specializes purely in short positions, greatly attracted the attention of inverters, especially since at the time the fund was founded, the authorized capital amounted to no less, but as much as 16 million dollars.

However, the fund gained its greatest fame and wealth after the major collapse of Enron. Jim Chanos studied the financial statements of this company and found out that it was engaged in fraud on a particularly large scale.

By involving the media, Jim Chanos created a huge scandal, which months later led to the collapse of the company, while Chanos had been in sales for a long time and was earning billions of dollars from this deal.

During the period of 2013, the size of the fund’s assets decreased by almost 13 percent and amounted to $4 billion, but already in 2014 the fund successfully carried out short transactions on falling prices for oil and precious metals, making an increase of more than 19 percent per annum.

To date, the fund's size is more than $8 billion, and its founder is actively involved in teaching and philanthropy.