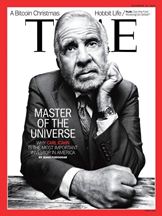

Financier Carl Icahn. The path from raider to Trump adviser

The financial world, and especially the stock market, is cruel and merciless. In an interview, the greatest billionaire Carl Icahn once said that there are no friends on Wall Street, but only enemies, and if you want to find a friend, it’s better to buy a dog.

The words of a trader and investor with more than 55 years of experience in this field completely reveal the ins and outs of a stock exchange career.

After all, behind a beautiful suit and a neat appearance there is a very dirty struggle for money, and the higher your goal, the more you will have to get your hands dirty.

One of the toughest players, who is also called the executioner of companies, is Carl Icahn.

Actually, now this merciless raider is a direct adviser to the current US President Donald Trump, and his biography is an excellent example of all the toughness of the stock exchange world.

Carl Icahn was born in 1936 in Brooklyn. The family of the future financier was of average income, namely his mother was the most ordinary teacher in a public school, and his father cherished the dream of an opera career, but in the end he became just a singer.

It is worth noting that a huge mark on Karl’s life was left by his uncle, who was a very rich and influential man in the financial world.

First money. Studies

While still a schoolboy, Karl worked part-time at a local beach club, where he worked as a servant for rich and influential people. He quite often saw how rich people often played large sums of money in poker and naturally became interested in this game.

One day, watching the players, he began to realize that he could easily beat them, which is exactly what he did, earning his first thousand dollars.

The first thousand Karl earned was not wasted, but became the basis for obtaining a higher education.

So, with the money he earned, he was able to pay for his studies at the University of Pristan, where he actually entered the Faculty of Philosophy and successfully received a bachelor's degree.

After receiving a bachelor's degree in philosophy, his mother persuaded him to enter the medical faculty of New York University, but after studying for two years, Icahn dropped out and went to serve in the army.

Trader career

After returning from the army, his influential uncle Schnell was able to get Icahn a job as a broker at Dreyfus and Company, where his main task was only to carry out client transactions.

Having won another sum of four thousand dollars in poker, he successfully invests money in stocks and earns the first 30 thousand dollars on the stock exchange.

The next step in his career was a position at Tessel Patrick and Company, where he was engaged in options trading, and then Gruntal, where he and his partner created an options department and made money through hedging.

Own business. First steps in corporate raiding

Carl Icahn did not intend to work for an employer for a long time and clearly saw himself in his own business. However, he did not have 400 thousand dollars to buy a place on the stock exchange, so he once again turns to his uncle for help.

Schnell saw how much acumen Carl had, so he quickly provided money for a share in the business, and Icahn & Company was founded.

Carl Icahn's operating principle was tough and merciless. So, having the support of investors and enormous lending opportunities, Icahn bought a blocking stake in the company he had chosen and began blackmailing shareholders.

Almost all shareholder decisions were blocked, and Icahn played such a tough game to the detriment of the company that almost all shareholders could not stand it and bought his shares back at exorbitant prices just to get rid of him.

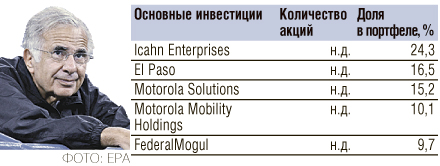

Such companies as Trans World Airlines, Viacom, General Motors, Motorola, Yahoo, Herbalife fell under Icahn's skating rink.

Also, once in an interview, Carl Icahn specifically said that Apple shares were undervalued and he was buying shares en masse, after which during one trading session their price soared by more than four percent.

Today, Carl Icahn has been appointed as Trump's adviser on business deregulation, as he has vast experience in this area. The octogenarian billionaire's fortune is estimated at more than $20 billion.