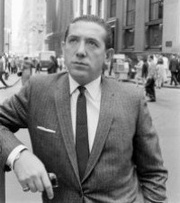

Nicholas Darvas - the path of a recognized dancer to recognition on Walt Street

Nicholas Darvas is an excellent example of a self-taught person who was able to write his name in capital letters in the history of the stock exchange world. Nicholas Darvas is the author of five famous books that have been translated into Russian.

the stock exchange world. Nicholas Darvas is the author of five famous books that have been translated into Russian.

Anyone who has read his personal books can certainly say that there is no boring or incomprehensible terminology, and all the information on his success and achievements is an autobiography that can be read in one breath.

However, Darvas is famous not for his books, but for his amazing results in stock trading, which few can boast of. Actually, the success story of Nikolos Darvas will be close to the liking of those traders who independently strive to achieve success step by step.

Nicholas Darvas was born back in 1920 in Romania. There is very little information about Nikolos’ childhood and youth; the only thing that is known is that he graduated from the University of Economics in the city of Bucharest.

However, with the beginning of the second world wave, Nikolos had to flee his country. To do this, he bought fake documents and first migrated to Turkey with his family, after which he moved to the United States in search of stability.

First acquaintance with stocks

Upon arrival in the USA, Nikolos Darvas fully realizes his talent. However, this talent was far from the stock market, but at the same time his wonderful ability to dance gives him the opportunity to earn more than one thousand dollars. Having formed a duet with his sister, Nicholas becomes the highest paid dancer in the United States and disappears for years on various tours.

One day, one of the club owners offered to pay with shares for a future performance in a restaurant. Nicholas was far from the world of stocks, so the only thing he knew was that stocks can both rise and fall in value. However, after consulting with his financial advisor, Nikolos was persuaded to come forward.

However, it so happened that Nicholas simply could not come on the announced day for health reasons, so in order not to lose his reputation, he decided to offer to buy out these shares. Actually, the customer was satisfied with this option for resolving the conflict, so the deal went through.

One day, while walking down the street, after a long time, he decided to inquire about the value of his assets. Nicholas was pleasantly surprised when he learned that his fee had increased from three thousand dollars to eight in such a short time. For Nikolos Darvas, this moment became a turning point, so he decides to invest his accumulated capital in shares.

First deals. Path of the Fool

Nicholas had virtually no idea about investing in stocks. Therefore, he followed the path of rumors and questioning. Due to the nature of his activity, he very often had to speak in front of rich people. Therefore, taking advantage of the chance, he always asked various rich people what stocks were worth investing in.

Actually, listening to various rumors from quite rich people, Nicholas begins to buy various shares, and as he himself said in his autobiography, he did not understand at all what companies he was investing in.

After unsuccessful attempts to work with rumors and more successful wealthy clients, he decided to get into the swing of things in more detail. To do this, he found a successful speculator recommended by all his clients and got in touch with him.

When he entered the broker’s , he was immediately immersed in the world of statistics and fundamental analysis, so when he saw the positive performance of companies, he quickly invested money. Actually, disappointment awaited him here, too, so he came to the conclusion that he finally needed to think with his head.

Sound thoughts leading to success

Nicholas begins to actively analyze his transactions, studies stock exchange literature in depth and begins to conduct his first experiments. It turned out that most of the deals based on rumors, statistics and news were failures for him.

However, technical analysis gave more positive results, so he gradually comes to create a universal approach. So from now on, Darvas sees the market as areas consisting of so-called boxes or ranges, the breakdown of whose boundaries should be traded.

The technical analysis method created by Nikalos Darvas allows him to turn his initial capital of 36 thousand dollars into two million, after which he decides to retire and engage in a safer traditional business. Having written a number of successful books, Nicholas passed away at the age of 57.