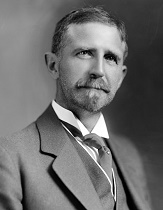

Trader Analyst Roger W. Babson

Roger W. Babson is a famous stock market analyst who, thanks to his personal trading, was able to earn a huge fortune and even compete for the presidency of the United States with Roosevelt himself.

Roger W. Babson was a well-rounded man who wrote more than twenty books in the field of business as well as investing.

It is worth noting that it was Babson who became the first harbinger of the stock market crash, and his combination of statistics and the laws of physics during the analysis of trading assets caused bewilderment and misunderstanding among his colleagues.

While many scoffed at his approach and comments on the crash, Babson earned himself not only capital, but also enormous prestige in the financial world.

It is worth noting that Roger W. Babson was an excellent careerist, which may have allowed him to write his name in history forever.

Thus, the main breadwinner of the family was the father, who ran a small shop where he sold textile materials.

Roger's grandfather owned a large farm. Since childhood, Roger had a special approach to money, namely, he knew how to extract it from all possible services that he provided.

So, while still just a child, he carried buckets of water from the well to the local laundry, for which he received a monetary reward.

The boy also showed great entrepreneurial ingenuity when the circus came to the city. Instead of going to school, he came to the tent and gave water to the animals for money, and also tried to look after them.

One day, his father found out about his entrepreneurial spirit and constant absenteeism from school, for which, as punishment, he sent him to work for his grandfather on the farm for the summer.

But even here Roger was not at a loss and instead of doing hard work with the land, he went out to the side of the road and began selling his grandfather’s products, which he actually did very well.

It was at this moment that Roger realized that selling a product was much easier and more profitable than creating it.

Education.

Roger's father saw his son as an excellent engineer, so when choosing a university, he insisted that Roger enter the University of Massachusetts for this specialty. Despite the fact that Roger did not see himself in this field, he listened to his father and entered the specified faculty.

At that time, the university was very weak, but this did not stop him from establishing an excellent relationship with the dean of the faculty and persuading him to launch a new subject related to business creation and self-realization.

Subsequently, the proposed subject not only took root, but also became a separate program at the university.

Job.

After graduating from university in 1898, instead of engineering work, Roger W. Babson got a job as an ordinary bank clerk. His career in the bank developed at a rapid pace, because he found himself in exactly the right place.

After working briefly as a clerk, Roger showed talent in forecasting and became head of the department for trading securities, stocks and bonds.

Unfortunately, Roger became very ill with tuberculosis, so he simply had to forget about working in the office forever.

Business.

Instead of losing heart, he created his own company at home, which was engaged in the selection of stocks and securities based on statistical analysis. Later, the company was partially bought out, which brought considerable wealth to its owner.

In late 1920, Roger W. Babson gave a speech at a public conference in which he made a defiant statement that the stock market would crash and the most stable stocks would make major new lows.

Instead of hoarding shares, Roger urged them to sell them immediately and buy gold, which will greatly increase in price as the most popular asset when diversifying risks.

Despite the fact that everyone did not accept his speech, after some time the market collapsed and it was those who listened to him who were able to earn huge fortunes, like Roger W. Babson himself.

The brilliant trader and analyst died on March 5, 1967, being a widower.