Larry Williams Strategy

Like any famous trader, Larry Williams wrote a very interesting book about his approach to the financial markets, revealed some of the secrets of his trading strategy and showed the whole world that a simple trading strategy, coupled with competent capital management, can bring simply unimaginable profits.

the financial markets, revealed some of the secrets of his trading strategy and showed the whole world that a simple trading strategy, coupled with competent capital management, can bring simply unimaginable profits.

Many people distrust textbooks on trading, since more and more often it is writers who write books, but not actual practicing players.

Therefore, we increasingly see multi-page publications by various authors, but behind a ton of unnecessary information we do not see the most important thing, namely a truly working tool, thanks to which we can make money on the stock exchange.

Larry Williams does not know how to talk, as other famous traders do, he is not a rather verbose person.

Therefore, he easily included all his knowledge and achievements in just one book, and after a year not a single new edition was published, which indicates his commitment to his views and system to this day.

Larry Williams strategy highlights.

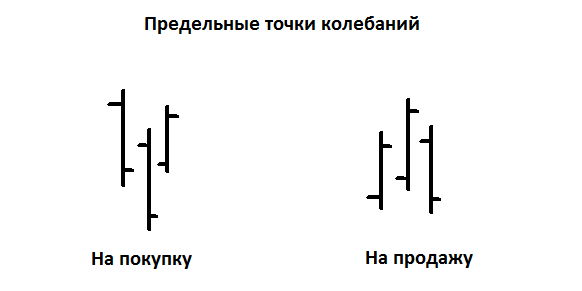

The signals that Larry Williams' strategy generates are based on bar analysis, so make sure that your chart looks not like Japanese candlesticks, but like bars. This can be easily done by changing the chart type in the top panel of MT4 or MT5. So, the first combination of bars is called “Limit points of fluctuations”.

This formation consists of three bars that form a kind of local high or low. In order to highlight this formation for buy signals, the low of the central bar must be below the left and right.

The bar is taken as a basis, the minimum of which is greater than the previous one, and if the next bar appears, the minimum of which is also less than the average, then we enter a buy position upon its closure. A sell signal appears exactly according to this principle, but the middle bar must form a high, and two adjacent bars form highs below the average. For a better understanding, I suggest you look at the picture below.

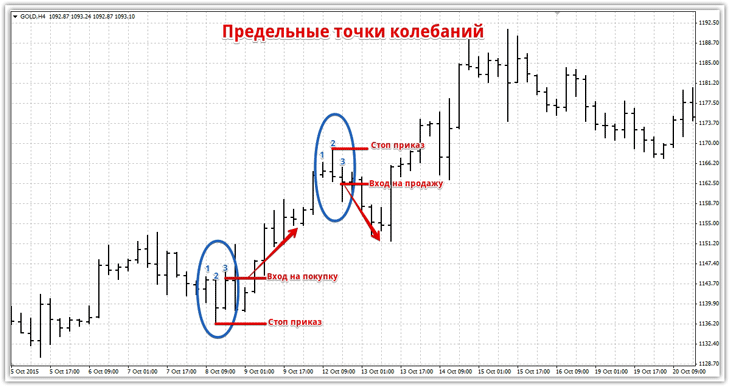

Larry Williams argues that signals can arise against the main trend, so it is necessary to clearly understand what the trend is in the market in order to cut off false signals. To do this, the author suggests focusing on moving averages or other trend tools.

When there is a buy signal, the author recommends placing a stop order, retreating several points from the low of the middle bar, and for selling from the high of the middle bar. An example of a signal to enter a position is shown in the picture below:

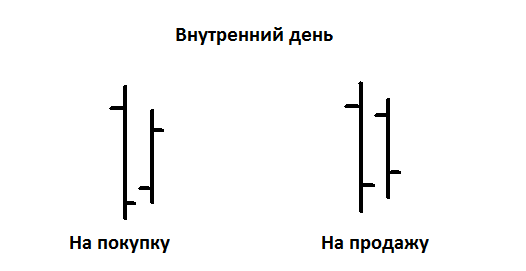

The second combination of bars that Larry Williams identified for his trading is called “Inside and Outside Day”. An internal day consists of two bars, and the first bar is taken as a reference point, and the second must be inside it, and its minimum and maximum must be less than that of the previous bar.

How to determine in which direction to open a trade?

To do this, we look at the second bar, and if its closing price is higher than the opening price, then we enter to buy, and if the closing price is lower than the opening price, we enter to sell. I recommend that you familiarize yourself with the picture below to understand the essence of the combination:

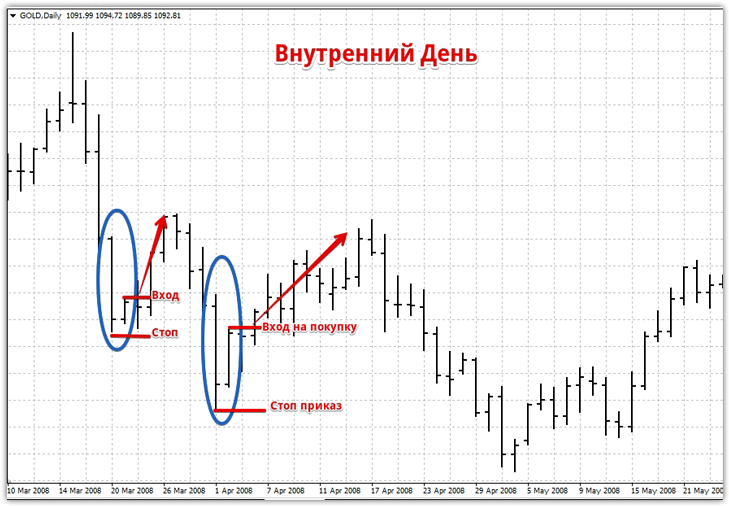

Working with this signal, when entering a buy position, we limit risks at the low of the first bar, and when entering a sell position, we set a stop at the high of the previous bar. An example of the appearance of a signal and its processing on a real chart is shown in the picture below:

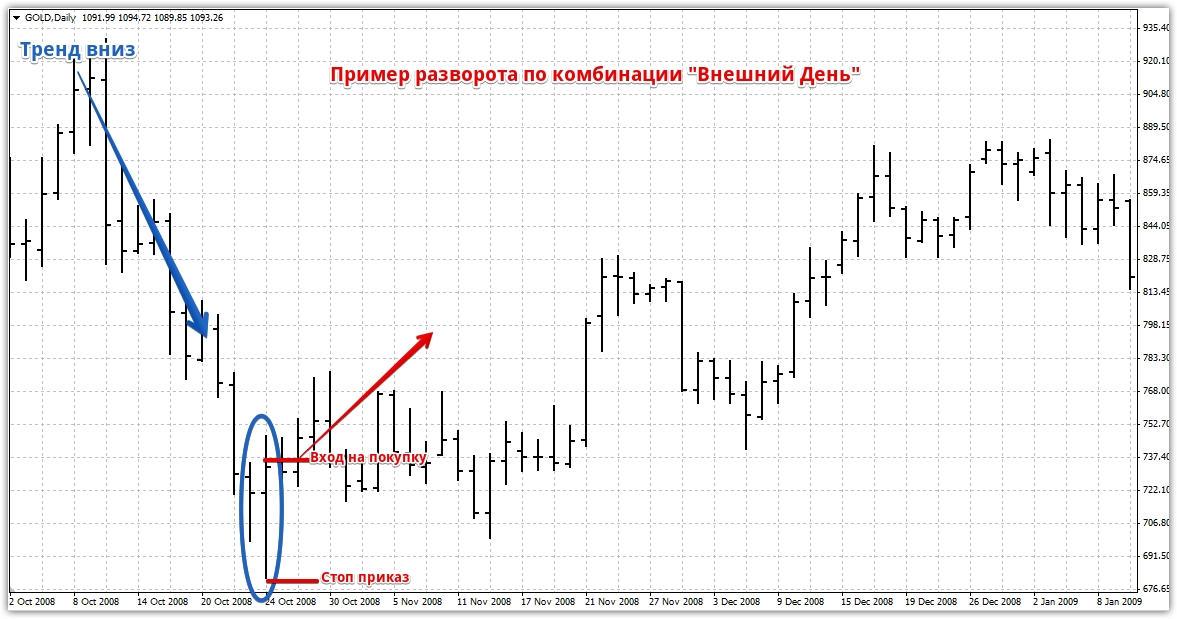

The “External Day” is formed exactly the opposite of the “Internal Day”. This combination also consists of two bars, and the price of the minimum and maximum of the second bar must be greater than the first, while the first bar is inside the second. This combination does not indicate exactly where to enter a position, but is a signal for a trend reversal. For a visual view of the “External Day” combination, see the image:

The “External Day” is formed exactly the opposite of the “Internal Day”. This combination also consists of two bars, and the price of the minimum and maximum of the second bar must be greater than the first, while the first bar is inside the second. This combination does not indicate exactly where to enter a position, but is a signal for a trend reversal. For a visual view of the “External Day” combination, see the image:

The use of the “External Day” comes down to trading the opposite trend. For example, if the market grew and a combination appeared, then we enter a sell position. If there was a downward trend in the market, then after the combination appears, we buy. The stop must be placed at the minimum or maximum of the second bar, depending on which direction we are entering.

The use of the “External Day” comes down to trading the opposite trend. For example, if the market grew and a combination appeared, then we enter a sell position. If there was a downward trend in the market, then after the combination appears, we buy. The stop must be placed at the minimum or maximum of the second bar, depending on which direction we are entering.

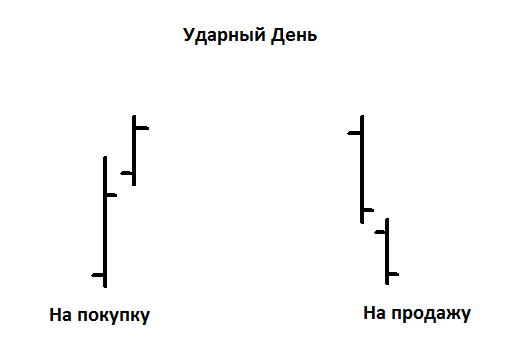

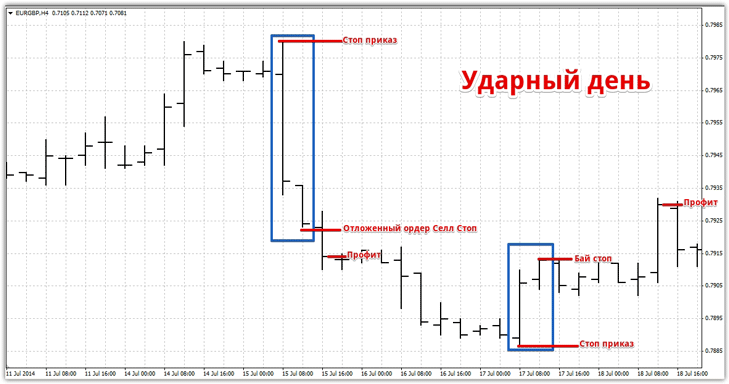

The third combination of bars that gives excellent buy or sell signals is called the “Shock Day”. This combination consists of two bars going down or up, but between the closing price of the previous bar and the opening price of the current bar there should be some distance in the form of a Gap. In order to better understand the essence of “Shock Day”, I suggest looking at the picture below:

The third combination of bars that gives excellent buy or sell signals is called the “Shock Day”. This combination consists of two bars going down or up, but between the closing price of the previous bar and the opening price of the current bar there should be some distance in the form of a Gap. In order to better understand the essence of “Shock Day”, I suggest looking at the picture below:

The combination is extremely simple to apply. If you have a buy signal, then you must place a pending buy stop order at the high of the second bar. When there is a sell signal, a pending sell stop order is placed at the low of the second bar. Larry Williams clearly defined the targets for the Impact Day, namely exactly 1 bar. A stop is placed at the high or low of the first candle. An example of working with a signal is shown in the image:

The combination is extremely simple to apply. If you have a buy signal, then you must place a pending buy stop order at the high of the second bar. When there is a sell signal, a pending sell stop order is placed at the low of the second bar. Larry Williams clearly defined the targets for the Impact Day, namely exactly 1 bar. A stop is placed at the high or low of the first candle. An example of working with a signal is shown in the image:

As you may have noticed, Larry Williams' trading strategy consists of simple signals that are based on bar combinations. Thanks to simple and clear rules for entering a position and setting stop orders, Larry was able to earn more than one million dollars.

As you may have noticed, Larry Williams' trading strategy consists of simple signals that are based on bar combinations. Thanks to simple and clear rules for entering a position and setting stop orders, Larry was able to earn more than one million dollars.