Exchange assets with the smallest spread

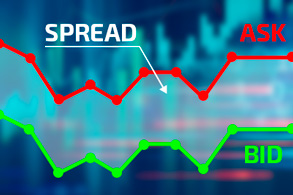

For each transaction opened on the exchange, you have to pay, be it a volume commission or a spread for opening a transaction; in any case, the paid amount is displayed as a debit from the deposit balance.

At the same time, the size of the fee for opening an order can differ tens of times, depending on the brokerage company or the asset being traded.

It is clear that it is most profitable to trade assets with the smallest spread for opening a transaction; this will allow you to implement any of the exchange strategies.

It is generally accepted that it is cheapest to open a transaction on currency pairs, since currencies have an almost zero spread.

Usually brokers indicate the average spread size in the specification, but it would be more objective to use the Spread Monitor indicator , and then make the calculation for the volume we need.

Currency pairs – the cheapest pair here is EURUSD, the average spread on EUR/USD is $2.0 for a transaction of $100,000:

True, such a spread size can only be obtained by trading on ECN accounts or PRO accounts; in addition, you should also take into account the session in which trading is carried out.

Cryptocurrencies are one of the most popular exchange assets today, and the asset with the lowest spread among cryptocurrencies is Bitcoin:

The Bitcoin contract size is 1 coin, so at today's price the cost of opening a $100,000 trade would be approximately $150.

Gold is a precious metal that is loved by all investors. Surprisingly, opening an exchange trade in gold is not that expensive:

Taking into account the indicator readings and the fact that 1 lot of the XAUUSD pair is 100 Trinity ounces, a transaction of $100,000 will cost only $20.

Oil is the most popular futures, which means the most liquid, that is, you can hope for a small spread for this asset:

For example, let's take Brend oil, the contract size is 1000 barrels, when opening a deal in the amount of $100,000, the spread will be about 120 US dollars. However, it is worth noting that if you wish, you can catch a spread that is half as much.

Shares of companies - the stock market leads in terms of the volume of transactions concluded, so it will be quite interesting to find out how expensive trading on it is:

Everything is not so simple here, at first glance, it seems that the amount of the $ 0.1 from one promotion of Adobe Systems Inc is not much, but taking into account the fact that this action costs only $ 344 in terms of a volume of $ 29, a commission is released.

As a result, we can say that there is indeed a minimum spread size today for currency pairs, followed by gold and securities.

Therefore, these assets are the best suited for intraday trading and scalping .