Where to get money for trading on the stock exchange

Almost any person is familiar with the proverb - “money makes money” Therefore, the problem of increasing working capital to Forex is especially acute. It is on the value of the trader’s account that such indicators as earnings and risk depending on.

working capital to Forex is especially acute. It is on the value of the trader’s account that such indicators as earnings and risk depending on.

There are many ways how to attract additional funds and thereby increase the profit. But this should only be done if within a few months you already have a positive financial result.

At Forex, with the same speed, you can lose both $ 1 and $ 10,000, so before you have not learned how to make money, you should not attract additional funds to your account.

Selecting a currency pair.

When starting work on the Forex currency market, first of all, you should choose a trading instrument with which you will earn profit.

When starting work on the Forex currency market, first of all, you should choose a trading instrument with which you will earn profit.

Each trader makes this choice based on his own criteria. For example, Americans and Japanese prefer to trade the currencies of their countries, or rather the pairs in which it is included; some pay attention only to the size of the spread, while others simply choose the most popular trading instruments.

The choice of a currency pair, based on generally accepted criteria, is based on the following indicators - liquidity, volatility, spread size, swap commission, availability of technical analysis tools and programs for automatic trading.

Tips for a beginner forex trader.

There are a number of the most necessary tips and recommendations for a novice Forex trader, which will not only help you make a profit from currency trading, but will not allow you to quickly lose your initial deposit. It is “not to lose quickly,” since you will lose your first deposit in any case, but the longer this process lasts, the more benefit it will bring you.

There are a number of the most necessary tips and recommendations for a novice Forex trader, which will not only help you make a profit from currency trading, but will not allow you to quickly lose your initial deposit. It is “not to lose quickly,” since you will lose your first deposit in any case, but the longer this process lasts, the more benefit it will bring you.

Forex tips will be of interest not only to a novice trader, but also to a professional, because you cannot know everything; it is the exchange of experience that allows you to achieve perfection in trading. Now let's move on to specific recommendations:

Forex risks and methods of dealing with them

When starting Forex trading, every trader should be aware that this type of trading is characterized by increased risk and instead of the long-awaited profit, there is always the possibility of losing your own money.

Risks in Forex can consist not only in unpredictable changes in exchange rates, but also be associated with purely technical reasons that do not depend on the skill of the trader.

Therefore, this issue should be treated with increased attention, since it is always easier to prevent a possible danger than to try to compensate for losses afterward.

The main risks in Forex are currency, organizational and technical.

Let's move on to a more detailed review of them and ways to reduce these dangers.

How to choose a PAMM account and manager

The Internet is one of the most profitable ways to invest your own money, and one of the opportunities to earn money is investing in PAMM accounts.

Typically, this option is resorted to by former traders who understand that Forex is not a scam, it’s just that in order to make money on the currency exchange, a lot of knowledge and practical experience is required.

But often the question of how to choose a PAMM account arises for the average person who simply wants to profitably invest their money in stock trading.

You can make the right choice if you know some points that you should pay attention to first of all; surprisingly, this is not the profitability of transactions at all, but the stability of the manager’s work.

As well as several other aspects, which we will discuss in more detail in this article.

Requotes and slippages

When working in the foreign exchange market, there are a lot of technical issues, without knowledge of which it is simply not possible to achieve the planned profit.

Moreover, it should be taken into account that there are times when a transaction simply does not open or is opened at a completely different price than you indicated in the order.

These two points have long been familiar to any trader and are called requotes and slippage.

Requote is a refusal to execute an order at the requested price; instead of opening a deal, you see a message on your screen like “The price has changed and the order cannot be executed at the requested price,” followed by the question of whether to accept the new price or not.

As a result, you find yourself far from a good place to enter the market.

This moment is especially unpleasant if trading is carried out according to a short-term strategy, in which every point of profit is important, and if a refusal occurs, sometimes you even have to change the direction of the transaction.

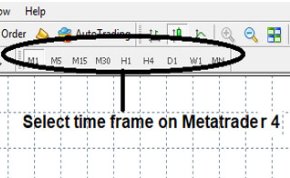

Which timeframe is better

Timeframe is a time period that characterizes the movement of the exchange rate over a certain period of time.

The effectiveness of opening positions and many other nuances will depend on how correctly you have determined which timeframe is best suited for you.

Each option has its own characteristics and requirements for leverage, deposit size and the applied strategy for working on Forex.

There are several options for dividing the timeframe depending on the chosen strategy for working on the Forex currency market; each option is based on the amount of funds at the trader’s disposal, the availability of free time for trading and experience in the foreign exchange market.

Choosing a timeframe is a rather complex process; when implementing it, you should carefully analyze your work strategy and all its tactical aspects.

You should first decide whether you will work exclusively during the day or transfer positions to the next day.

The main qualities of a broker

In order to choose the right broker for Forex trading, first of all you should know what qualities you need to pay attention to.

It should be borne in mind that what is on the company’s website does not always correspond to reality.

Many of the important points can only be verified in practice, and sometimes it is too late to change something.

Therefore, before making the final choice, you need to carefully weigh the pros and cons, and only then make a decision and fund your trading account.

It should always be remembered that the main quality of any broker is its reliability.

In my practice, I once had to deal with a company that positioned itself as a large dealing center; I was very surprised to discover that the company’s website had only existed for three months, and its traffic was only 10 people a day.

For practical trading, the most important qualities of a Forex broker are:

The best entry points into the market

In order to make a profit on Forex, you need not only to choose the right direction of the transaction, but also to enter the market on time or, in other words, to find entry points into the market.

This determines how much profit you will get from one trade; whether you can take the entire trend or only a small part of it.

Entry points into the exchange market are the most favorable places in which a transaction will be opened; they can have not only price, but also time parameters.

There are several effective ways to find market entry points; each option should be applied depending on the current situation, making decisions based on market analysis.

It should be remembered that it is better to wait and earn more than to rush and lose profits.

Lot size on different exchanges

Trading in the foreign exchange market involves taking into account many different nuances that determine the profitability and riskiness of trading operations.

Moreover, some “little things” can play a decisive role in a certain situation on the stock exchange and significantly change the possible financial result of trading.

The Forex lot size is precisely the significant point that should be taken into account when calculating the volume of future transactions.

The main thing is to correctly determine the ratio of the value of this indicator and your own deposit, to identify the optimal indicator taking into account the risk and the desired profitability of operations.

Many traders do not even suspect how important this parameter is in the initial stages of trading, trying to conclude a deal of maximum volume.

In this material I will try to tell you the easiest way to calculate the optimal Forex lot size.

Is there break-even trading on Forex?

The main task of any trader is to reduce the number of unprofitable transactions, and thereby increase the overall level of profit.

It should be noted that completely break-even Forex trading is practically impossible; you can only reduce possible losses to a minimum, thereby improving the overall financial result over a certain period of time.

In order to solve the problem, you should know exactly the main causes of losses when trading on the currency exchange, since it is much easier to prevent a problem from occurring than to correct it afterward.

Break-even Forex trading lies in a competent approach to risk management.

The risks are different, so for maximum effect you should consider all possible options.

Forex trading without deposit

There are a lot of reviews about Forex trading, some believe that it is an absolute scam, others boast of earning millions, but you can figure out where the truth is only by trying to trade on your own.

There are a lot of reviews about Forex trading, some believe that it is an absolute scam, others boast of earning millions, but you can figure out where the truth is only by trying to trade on your own.

At the same time, it is not at all necessary to have a large initial capital; if you wish, you can earn money on Forex without a deposit, that is, practically from scratch.

Forex trading without a deposit involves choosing one of the options - receiving a no-deposit bonus (a small amount, but immediately), participating in ongoing tournaments (large prizes, but you will have to work hard) or attracting an investor.

You should not think that working with other people’s money is much easier; additional psychological pressure always occurs when trading with an investor’s money, and finding such an investor is not easy.

1. Receiving a no deposit bonus – usually the bonus is only a few dollars, the amount ranges from 5 to 30 dollars. But with the right skill and luck, you can increase your deposit several times.

Forex recommendations that will help make your trading profitable

Currently, working on Forex has become extremely popular; every day there are new people who want to engage in online trading, but they have no idea that in practice it turns out that not everything is as simple as in the advertising booklets of brokerage companies.

This is why most novice players are left without money on the first day of trading, and the main reason for this phenomenon is lack of experience.

Forex recommendations are nothing more than a short list of the most necessary tips for trading in the foreign exchange market, they will be especially useful for novice traders.

In this article I will give some simple Forex recommendations that will not allow you to lose your deposit at the initial stage of trading.

If you follow these recommendations, the risk of losing your initial capital is reduced several times.

It is quite possible to conduct profitable trading, the main thing is to understand the essence of the process and take into account other people’s experience in your work, and now let’s move on to the question itself.

Exchange trend trading, strategy, indicators and templates

Trading with the trend is one of the most common and safest on Forex; there is nothing simpler than making a deal in the direction of the prevailing trend and waiting for the profit to reach the planned level.

But everything is simple only at first glance, because the trend does not move in a straight line, and it is quite difficult to choose the direction of the transaction.

In addition, you should take into account a lot of other indicators that characterize this trend, the main one being the strength of the existing trend, how long it can last and what caused this movement.

We also must not forget that for any of the time periods there is its own direction, which can simultaneously be a rollback for a longer time frame.

It is about the features of trend trading that we will talk about in this article.

Mobile trading on Forex and stock market in a few clicks

It is not always possible to trade Forex from a desktop computer or laptop; sometimes they are simply not at hand, and you need to urgently close an order or, conversely, open a new deal.

It is at this moment that a trading terminal installed on a smartphone, iPhone, tablet or other mobile device comes to the rescue.

Mobile trading – full-fledged Forex trading using mobile devices with an Internet connection, allows you to monitor the status of open orders at any time and enter the market at the most opportune moments.

It is advisable not to use this option as the only one; the trader’s stationary terminal still has great capabilities. than its mobile version.

Now let's move on to what you need to trade from a mobile device.

Intraday trading on the forex market

There are quite a few trading strategies on the Forex currency market, but they can all be divided into two main groups.

The first includes those that do not require moving the position to the next day, the second includes longer-term transactions.

Intraday trading allows you to earn the maximum even with a small initial capital; it is this trading option that has allowed most famous traders to make a fortune.

In this article we will talk about the most common trading option, namely intraday trading.

This is what most novice traders choose because of its apparent simplicity. Although, according to statistics, it is long-term transactions that bring the greatest profit.

First of all, I would like to dwell on the main pros and cons of intraday trading on Forex:

How to make guaranteed money on Forex

This question “How to make money on Forex” is the first thing that worries any novice trader; the answer to it is quite complicated.

In order to become a successful trader, you will first need some time and personal practical trading experience.

Knowledge of the basics of the movement of exchange rates, namely the factors that cause changes in the price of a currency, is also important.

Anyone can make money, but for some reason, most novice traders, on the contrary, leave their money on the currency exchange, the main reason for this is the wrong trading strategy.

In this article I will try to cover the main points of trading and share a simple trading strategy, which in most cases brings quite good results.

Page 4 of 4

- To the begining

- Back

- 1

- 2

- 3

- 4

- Forward

- In the end