Fundamental analysis of the Forex currency market

Forex trading requires not only the ability to open trades and work with a trader’s trading terminal, but also knowledge of fundamental analysis.

analysis.

This type of studying the foreign exchange market is easier for a novice trader to understand, so it is recommended to start learning the basics with this discipline.

Fundamental Forex analysis - studies the main factors that influence the formation of exchange rates; the resulting data allows not only to obtain information about the current situation on the market, but also serves as the basis for making forecasts.

Learning the basics of this discipline will only take you a few weeks, but after that you will no longer open trades blindly, but will be able to develop your own effective trading strategy.

It should be noted. that we are talking about the basics, since a full course of studying fundamental analysis can take you more than one month.

What does fundamental analysis study?

1. The economy of the country of issue of the monetary unit - it is the improvement or deterioration of economic indicators that causes a change in the value of the currency. And the publication of data on the state of the economy serves as signals for opening transactions on the Forex exchange.

The main economic indicators are inflation or devaluation, employment and unemployment levels, GDP and trade balance.

Positive changes in the economy lead to an increase in the exchange rate of the national currency, while negative changes, on the contrary, lead to a decrease in prices.

2. Finance – this section includes conducting a fundamental analysis of the state of the country’s financial sector. To be more specific, the analysis examines the stability of the banking system, the level of the national bank discount rate, the state of gold and foreign exchange reserves, the volume of money supply in circulation and some other indicators.

A change in each of the above indicators can also lead to an increase or decrease in the exchange rate. For example, a statement about a reduction in gold and foreign exchange reserves always causes a fall in the price of the national currency.

3. Political situation - instability of the political situation, then always instability of the exchange rate, and changes can be directed in any direction depending on the situation. Currencies are sensitive to elections or changes in key figures holding important positions.

4. External factors – also included in the scope of study of fundamental Forex analysis; these can be events related to any of the above groups. For example, the refusal of one of the countries to use the euro as a reserve currency relates to the sphere of finance and leads to a weakening of the position of the euro in relation to other world currencies.

This is why it is so important to monitor not only news within the country, but also outside it; this can be achieved quite simply by subscribing to the news feed of one of the leading news agencies.

Sources of information for analysis

The main sources for obtaining information that can be used for Forex trading are news feeds and the Forex events calendar.

News feeds allow you to track the release of unplanned news, such as weather disasters, catastrophes, terrorist attacks, statements by politicians and leading financiers. You can also use a special news indicator as a news feed. It allows you to receive the latest news directly in the trader’s trading terminal.

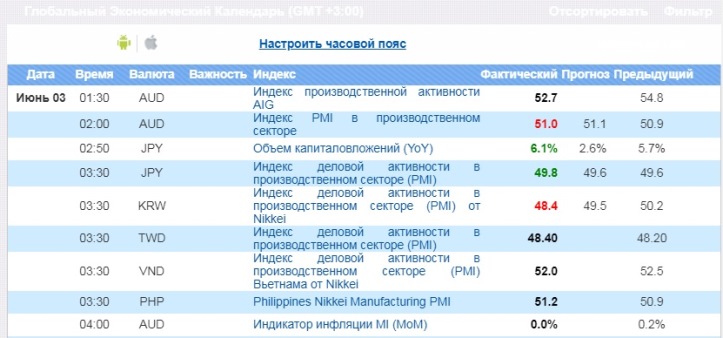

The Forex calendar provides information about planned news, such as the publication of various economic and financial indices, scheduled speeches by heads of financial institutions.

We should also not forget about the so-called anticipation factor, when bookmakers place bets on a particular event, thereby pushing the price towards the forecast even before the news is released.

Using the obtained data in Forex trading

The data obtained as a result of fundamental analysis is excellent for trading on the forex exchange. There are two main trading strategies:

1. Short-term - or the so-called news trading, is one of the simplest options for trading on the currency exchange, a transaction is opened immediately after the release of important news, and its direction depends on the nature of the event.

2. Long-term – this is a more complex version of trading; the duration of transactions when using it ranges from several weeks to several months. Its essence is to identify long-term trends in exchange rates and open transactions in the direction of the prevailing trend.

Such trade requires a deeper study of the country’s economy and the study of possible scenarios for the development of events. Long-term trading requires much more time and effort spent on analysis.

For beginners in Forex, it is recommended to use the first option of strategies, since the second requires some special knowledge in the field of economics and analysis.

Important points of fundamental analysis in the Forex market - http://time-forex.com/fundamental