Accurate Forex indicator – check on different timeframes

The search query “accurate Forex indicator” is one of the most popular in the financial markets.

It is difficult to find a trader who has not at least once entered it into the Yandex or Google search bar at various stages of his FX career, trying to find a suitable script.

It is difficult to find a trader who has not at least once entered it into the Yandex or Google search bar at various stages of his FX career, trying to find a suitable script.

The essence of the problem is that the scripts available today are not always of high quality and can objectively assess the market situation.

Many of the technical analysis indicators give an unreliable forecast, and then correct the history of their work in order to improve the result.

Is there even a really accurate indicator for market analysis or is it a myth? We addressed this question to the experts of our information partner, the brokerage company (NEFTEPROMBANKFX).

|

NPBFX (NEFTEPROMBANKFX) is a brokerage company providing financial services since 1996. The broker's clients are retail and institutional investors from around the world. The broker provides direct access to Tier 1 interbank liquidity; orders are executed using STP/NDD technology through its own liquidity aggregator. All NPBFX clients are insured for 20 thousand euros, which they can receive from the SRO fund of The Financial Commission, where the broker has category A status. |

Let's return to our request. According to the experts of our partner NPBFX, an indicator that meets our requirements should be as simple as possible and allow working in the direction of the trend.

Here we immediately remember the classic phrase that the trend is our friend. One of these accurate indicators is the Moving Average. This is exactly what this article will be about.

We will not only introduce you to the named technical indicator, but also check how accurately it allows you to predict the market on different time periods (timeframes).

Briefly about the accurate Moving Average

Why briefly? The fact is that moving averages could be the subject of a full tutorial.

We did not set such a goal for ourselves; anyone who is interested in the indicator can easily find detailed information about it on the Internet. Moreover, we will only consider the exponential Moving Average - EMA.

EMA is interesting because it has a serious advantage over other moving averages, for example, the simple moving average (SMA). When calculating, more weight is given to recent price values, and less weight to more distant ones.

This allows the trader to react to any price changes as efficiently as possible. When using the EMA, it is important to understand that the weight given to the latest price value is directly related to the period of the moving average. That is, the shorter the period, the more weight the last price has.

This feature of the EMA is successfully used by traders to analyze the market and find the most successful entry points into a transaction. Typically, at least two EMA moving averages with different periods are used. For those who are not aware, the period is the number of candles that are taken to calculate the EMA.

For example, if you are working on a daily chart of an instrument and have chosen an EMA period of 10, then the average will be calculated based on the price values of ten daily candles. In practice, traders use the following periods of exponential moving average:

- 10 and 25 are periods of fast and sensitive EMA.

- 100 and 200 are periods of slow, smoothly moving EMAs.

- 50 is somewhere between fast and slow EMAs.

Application of EMA with short and long periods

After installing a long period EMA on a chart, you will be able to very accurately determine what trend is currently present in the market. If the EMA has an upward slope, the trend is bullish; if the EMA has a downward slope, the trend is bearish.

Determining a trend allows a trader to work in its direction, which minimizes risks and significantly increases the likelihood of generating income.

The second EMA with a short period is used to determine market entry points and can also indicate reversal movements in the market. A short EMA is more sensitive to price changes, so you can enter with the trend on corrective pullbacks or even enter at the very beginning of a new trend.

Next, we suggest going to price charts and seeing how the EMA behaves over different time periods. Let's try to determine on which timeframes the indicator provides the trader with the most accurate information for trading.

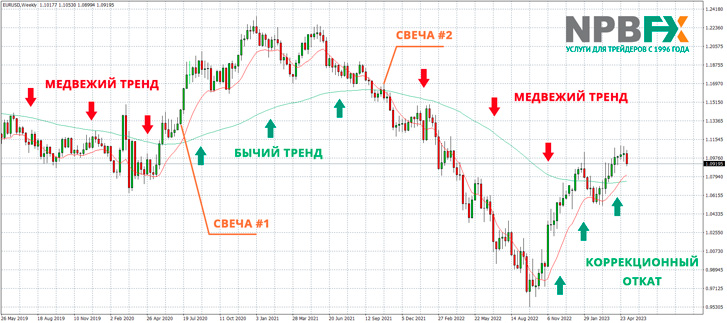

Testing EMA on the weekly timeframe W 1

For the test, we will use the most popular currency pair EURUSD and the settings for EMA periods - 10 and 100. Pay attention to the price chart:

A moving average with a period of 100 perfectly reflects the direction of the current trend in the market. The average with a period of 10 indicates the points where the trend changes. If the fast MA (red) crosses the slow MA (green) from bottom to top, this signals the emergence of a bullish trend in the market. In the case when the fast MA crossed the slow one from top to bottom, the trend changed to bearish. As can be seen in the chart, after crossing the averages, the trends actually changed, and the quotes moved in a new direction for large distances in points. Candle #1 and Candle #2 are the levels at which the trader could open buy or sell trades.

Profit was guaranteed on all transactions! On average, trends lasted from six months to a year, and the profit that could be earned on each transaction was in the range of 1000-2000 points.

Testing EMA on the daily timeframe D 1

Let's try to reduce the timeframe to the daily one with the same moving average settings. Agree, not all traders trade on weekly charts.

It would seem that the time period has decreased, there should be more signals to enter a trade, but on the chart we see only one (Candle #1). The bearish trend changed to a bullish one, after which, over the course of six months, the price of the euro grew.

From this we can conclude that the transition from W1 to D1 did not increase the number of trading signals from the indicator. And the trends themselves can also last up to six months or more. Of course, it was possible to make money on the corrective pullback, which we indicated on the chart. However, doing this during an uptrend is quite risky.

Testing EMA on the hourly timeframe H 1

Let's try to switch to the hourly time frame and observe how the indicator behaves here. The settings for moving average periods are the same.

As you can see, there are significantly more intersections of the two averages, only four on the chart. This is a signal to enter a trade. Meanwhile, a phenomenon called flat appeared on the chart, when quotes move in a sideways price channel. Trading in a flat requires a different strategy, as well as the addition of new indicators. If we analyze our hourly chart, there are only two true signals on it. The remaining two intertwining averages can be classified as false signals.

It has become more difficult to determine what signal appeared on the market, and even more so to calculate in which direction the quotes will come out of the “flatness”. In this case, you already need to analyze charts of higher time frames.

It should be noted that the periods of existence of the trends themselves have decreased, as well as the size of potential profits. It turns out that you will be able to open more trading transactions within, for example, a month, but trading risks have increased in direct proportion.

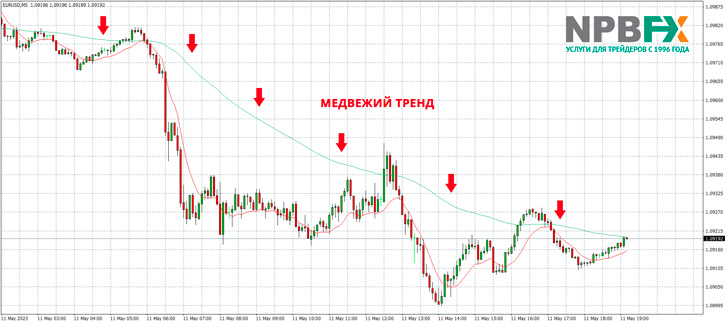

Testing EMA on the five-minute timeframe M 5

Finally, let's do one more test on a five-minute timeframe. The M15 and M5 time periods are used by a large number of traders, especially beginners. Let's see how the indicator behaves and whether it can be used for trading on minute periods.

An interesting situation is observed on the graph. As you can see, the EURUSD pair was in a downward trend almost all night and all day. At the same time, the indicator did not produce a single signal to open a trading position. During the day, the fast average with a period of 10 approached the slow MA several times, but the intersection never happened.

Essentially, these were short-term technical corrections in a bearish trend. From this we can conclude that despite working with a 5-minute chart, you may not receive a signal throughout the day. Of course, you can try to work on corrective pullbacks, but again, all this is associated with an increase in trading risks.

conclusions

What general conclusions can be drawn from our objective testing of the Moving Average (EMA) technical indicator? It should rightfully be classified as an accurate indicator. By using two averages with different periods, you can determine the direction of the current trend in the market as accurately as possible. High accuracy is also observed when generating trading signals with the indicator.

This is especially true for higher timeframes. On the weekly and daily charts, after the signals to enter a trade appeared, the instrument quotes went in the desired direction in 100% of cases. As the time period decreases, the accuracy of the signals begins to decrease, and false ones appear. It is necessary to introduce additional indicators to filter false signals.

In general, traders using long-term and medium-term strategies can use the accurate Moving Average indicator without any problems. But for those who work with short-term transactions on minute timeframes, it will be quite difficult.

And don’t forget that a successful trading outcome depends not only on the strategy and indicator, but also on the broker who serves you. Therefore, we recommend trading only with proven and reliable financial service providers, such as our partner, the international broker NPBFX (NEFTEPROMBANKFX).

The company does not limit clients in choosing trading strategies, offers flexible conditions on trading accounts, low tariffs: 0% commission for trading turnover, from 0.0 spread, no hidden charges.

A specialized analytical portal is available directly in your personal account, where the broker offers many technical indicators, accurate trading signals, 60 trading vehicles, and training from scratch. Access to all portal materials is provided absolutely free. You can register and start trading on a demo, cent or standard trading account on the official website of NPBFX .