Bitcoin trading indicator

The enormous popularity of cryptocurrencies has appeared not only due to the fact that this asset is characterized by incredible growth rates, which allow large and small investors to receive significant profits just by owning a precious coin.

In fact, cryptocurrencies have the greatest volatility, which implies versatile price movements over a certain unit of time.

The leader in such volatility, of course, is Bitcoin.

It is to this cryptocurrency that the main attention of all traders and speculators in the world is attached, and it is precisely the peculiarities of Bitcoin’s movement that allow them to implement a wide variety of trading strategies on it. In recent years, this asset has become the main refuge of traders using technical analysis and technical indicators.

And since the market is now favorable to all technical analysts, we will look at an indicator for Bitcoin trading in this article.

MACD+OSMA + STOCHASTIC 3XSIG MTF is a comprehensive technical analysis tool based on a number of standard forex indicators, which allows you to evaluate short-term and long-term Bitcoin trends, as well as provide a number of accurate signals to enter the market.

Thus, this indicator can be considered a full-fledged strategy that will allow you to effectively trade Bitcoin intraday.

Installing an indicator for Bitcoin trading

Despite the fact that trading through cryptocurrency exchanges is gaining immense popularity, they have one significant drawback - their trading platforms are not full-fledged and work only in web mode with a limited number of tools.

In our case, the indicator for trading Bitcoin is designed for traders trading through a broker in the professional trading platform MT4.

Since the MACD+OSMA + STOCHASTIC 3XSIG MTF indicator is a custom indicator technical analysis tools, in order to use it you will have to go through the standard procedure for installing the indicator.

To do this, go to the end of the article and download the indicator. The next step is to place the downloaded indicator file through the data directory into the appropriate folder in the terminal data directory, namely in the folder called Indicators.

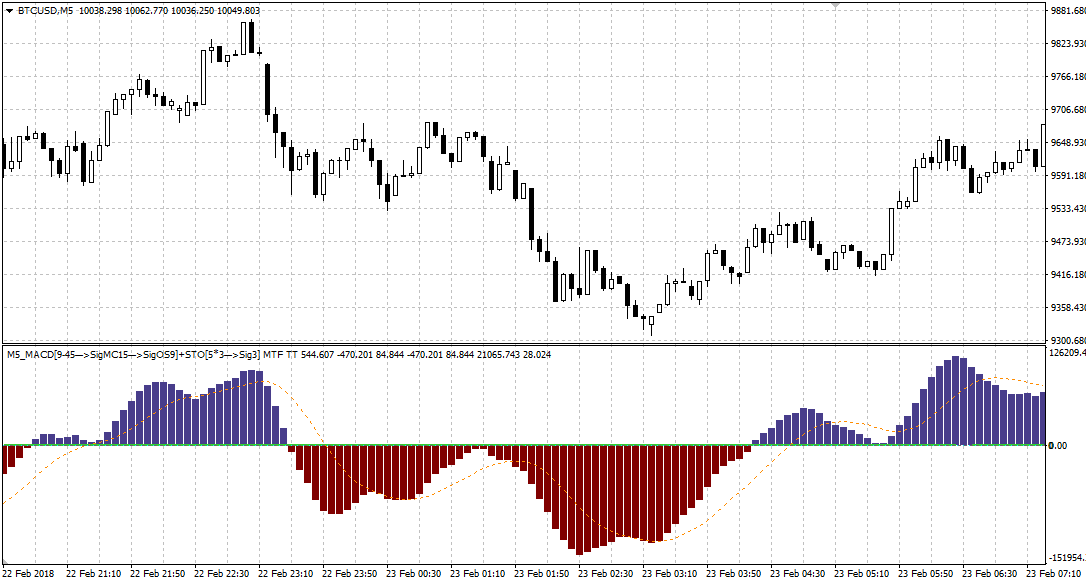

After you install the indicator, you will need to update the trading terminal in the “Navigator” panel, or restart it completely, so that the indicator appears in the list of custom ones. Once you plot the indicator on a Bitcoin chart, it will look like this.

Practice of using the indicator on Bitcoin

Since its creation, Bitcoin has demonstrated crazy growth rates and high volatility.

However, after the collapse of the cryptocurrency market, when the price of Bitcoin for the first time in several years fell below the 10 thousand dollar mark and revolves around it, while before the collapse the price was about 20 thousand, volatility has increased noticeably .

Of course, at large intervals it is less noticeable, but on five-minute charts whole battles and multiple reversals unfold, which all scalpers correctly catch.

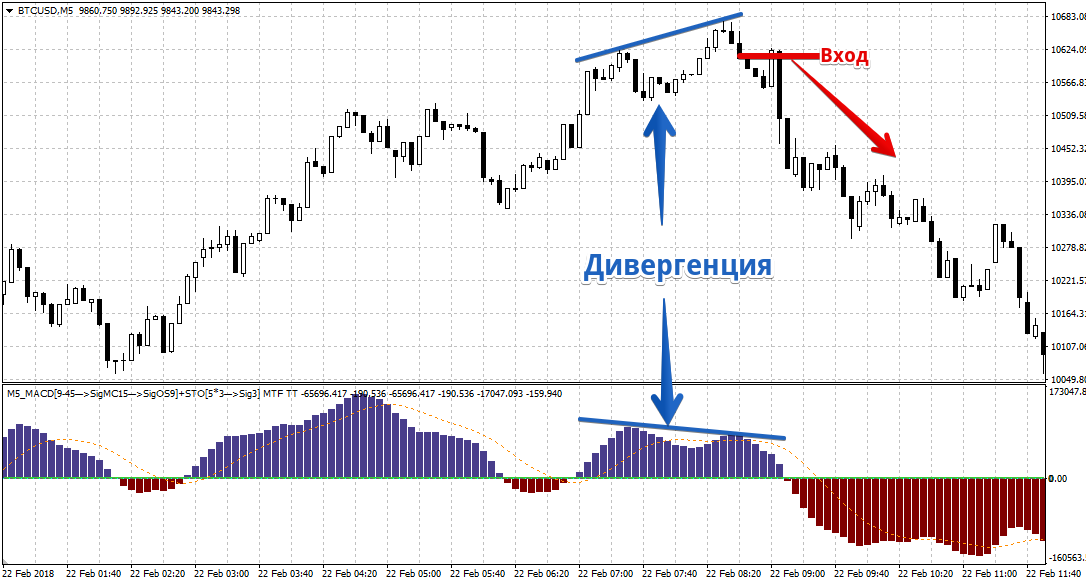

One of the strongest signals for a market reversal, which is given by all oscillators without exception, is divergence.

Since Bitcoin storms like no other asset, divergences appear quite often on it and, most importantly, they are an excellent source of signals for scalpers.

It is worth noting that divergence implies a discrepancy between the indicator data and the actual price behavior. Thus, a buy position should be opened if the peak of the histogram located below the zero line is higher than the previous one, while the price updates its historical minimum.

A sell position should be opened if the peak of the histogram located above level 0 is lower than the previous one, while the price updates a new historical maximum.

An example of Bitcoin divergence is shown below:

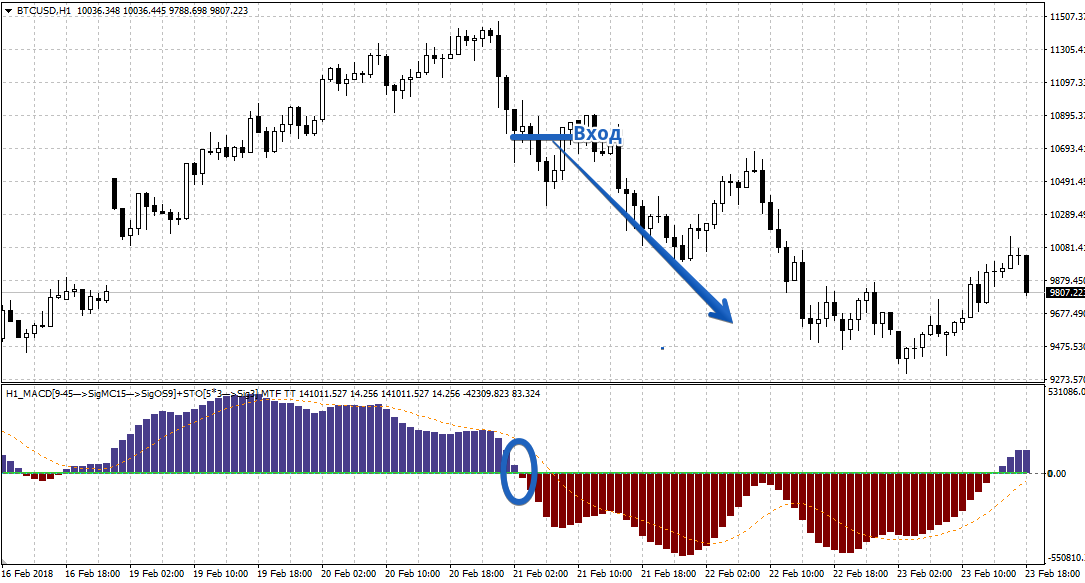

In addition to divergence, the Bitcoin trading indicator allows you to capture medium-term trend changes, which can also be successfully captured when trading intraday.

The zero line of the indicator is the demarcation of the trend, namely, the appearance of a histogram above it indicates an upward trend, and the appearance below it indicates a downward trend.

Trading occurs when a trend change is detected, namely, if the histogram breaks through level 0 from bottom to top and changes color from red to blue, we buy.

If the histogram has broken through the zero mark from top to bottom and changed its color from blue to red, we open a sell position.

Example:

In conclusion, it is worth noting that the indicator for trading Bitcoin, which we discussed in the article, is primarily a universal tool.

Therefore, you can use it on absolutely any cryptocurrency; moreover, the indicator demonstrates its effectiveness not only on crypto, but also on currency pairs or CFDs .

Download the indicator for trading Bitcoin .