Volatility indicator with increased efficiency

In the process of trading, probably every trader has come across such a problem when, after opening a trade based on a signal from the strategy, the price stops and comes flat.

Unfortunately, in 90 percent of cases, such transactions result in losses for the trader, even if closed early.

A completely logical question arises: why does this happen? What is actually missing from a strategy to make it truly effective?

The answer is very simple and lies right on the surface - before opening a position you need to study market volatility!

From this article you will become acquainted with a very effective tool that will help you not only sensibly assess market activity, but also build an impulse trading strategy.

The VolatilityAverageSingleHighLimit Volatility Indicator is a custom technical analysis tool that allows you to not only measure volatility based on the ATR indicator, but also give a clear assessment of how strong market activity is relative to its average over a certain period.

It is worth noting that volatility is a qualitative characteristic of price, so the indicator can be used on absolutely all trading assets, from currency pairs to metals or CFDs on stocks, futures or indices.

The indicator can be used on completely different time frames, but it will be most effective on small time frames as part of a scalping or pips strategy.

Setting the volatility indicator VolatilityAverageSingleHighLimit

The VolatilityAverageSingleHighLimit volatility indicator is a completely new development, since the date of appearance of the instrument dates back to 2018.

The tool itself is distributed completely free of charge; moreover, the author of the indicator has placed it in the official library of MT4 developers for public viewing.

Therefore, you can install it in two ways, namely through the data directory according to the standard scheme, or through the library without any downloads.

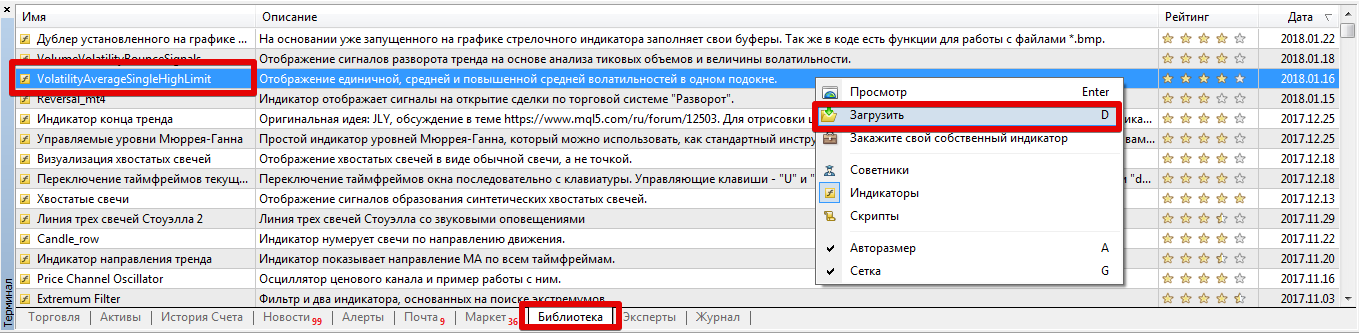

To install the indicator through the library, open your MT4 trading terminal and move to the “Terminal” panel, where important information on the balance and open transactions is located.

After this step, go to the library tab, and then perform a simple filtering so that the list contains only indicators and not mixed with scripts and advisors.

Then find VolatilityAverageSingleHighLimit in the list, then use the additional menu as shown in the image below to load the indicator.

If the indicator is removed from the library for some reason, move to the end of the article and download it.

Then it is enough to place this file in the appropriate folder of the terminal data directory, namely in the indicators folder.

After you update the terminal in the navigator panel or restart the platform, VolatilityAverageSingleHighLimit will appear in the list of indicators. To work with the tool, you only need to drag its name onto the chart of the currency pair.

Principle of operation. Decoding the received data

As you may have already understood, the volatility indicator is not a signal tool, so it simply cannot indicate the entry point, since when volatility increases, the line will rise, and when it falls, on the contrary, it will fall.

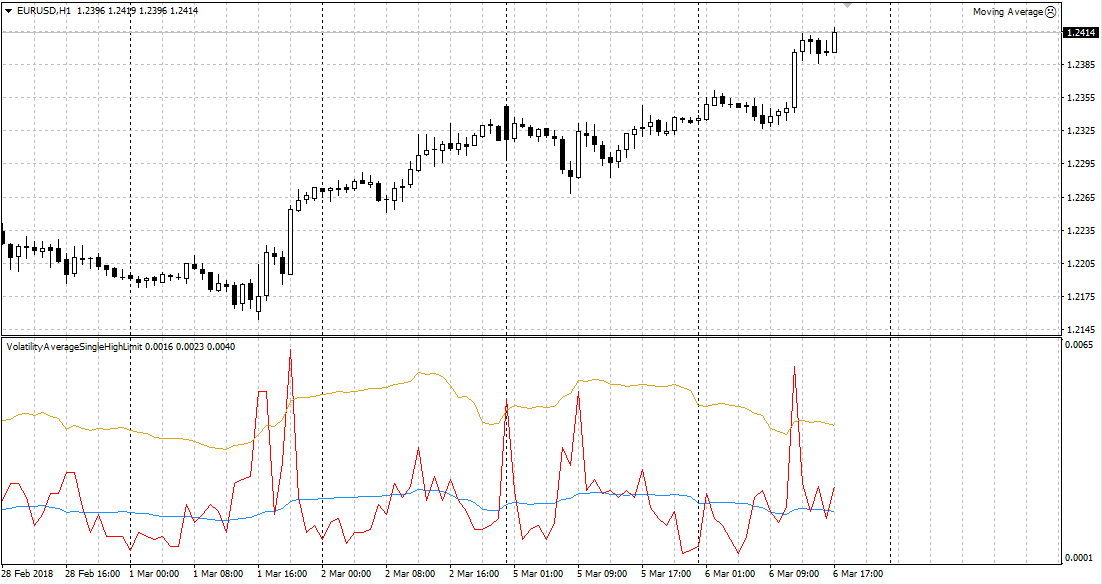

Once plotted on the chart, you will be able to see three lines in red, yellow and blue. In fact, each line is an ATR line with a different period. Thus, the red line displays the current volatility, while the blue line shows the average volatility, and the yellow line shows the increased average volatility.

To evaluate the market, you need to compare the location of the red line relative to the blue and yellow lines.

So if the red line is above the blue line, the market is lively. If the red line is located above the yellow line, there is strong activity in the market, while the location of the red line under the blue line indicates market sluggishness, an accumulation stage or a flat.

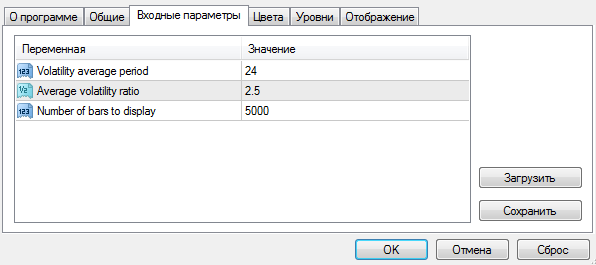

The settings contain a number of simple variables that will allow you to customize the indicator to suit your needs.

So in the line Volatility average period you can specify the period of the average volatility value, which we can see on the chart as a blue line.

The Average volatility ratio variable allows you to set a multiplication factor to calculate the line of increased average volatility, namely the one that can be seen in yellow on the chart.

The Number of bars to display variable allows you to set the number of history bars on which the indicator will be displayed (you can reduce the value if the platform starts to slow down).

In conclusion, VolatilityAverageSingleHighLimit is a volatility indicator with enhanced performance, so it can be a great filter for any strategy!

Download a volatility indicator with increased efficiency.

In addition, download the volatility script - http://time-forex.com/skripty/skr-volotilnost