Triple Exponential Average Oscillator

Market irregularities, its constant deceptive maneuvers and oscillatory movements around an invisible axis are the main reasons for losses for most traders.

It would seem that the entire trading process comes down to identifying a trend and opening a trade in its direction.

However, in practice, kickbacks are perceived as new trends, and side kicks are perceived as something separate, and not as a regular break that players took for a while.

The so-called market noise is to blame, which can be combated in several ways.

Change the principle of presenting information, as happens with the use of Renko charts, or average the price, using the average price as the basis for analysis.

Triple Exponential Average (TRIX) is an oscillator of the famous technical analyst, trader Jack Hutson, which is based on triple price smoothing, which allows you to discard the maximum number of irregularities and present the price movement in the form of a solid line.

In practice, the indicator perfectly displays the current price movement, which allows it to be used as a momentum indicator, as well as track changes in trends with its help.

This feature makes the Triple Exponential Average universal, because it can be successfully used on any currency pairs, metals and CFD contracts, and there is no relationship between efficiency and the time frame used.

This, in turn, suggests that TRIX is excellent for scalping and for finding promising opening points for long-term traders and investors.

Installing Triple Exponential Average

The script was created for the MT5 trading terminal back in 2010, when the terminal was just beginning its development and introduction to the broad masses of traders and brokers.

That is why this development was one of the first files that were posted in the official library.

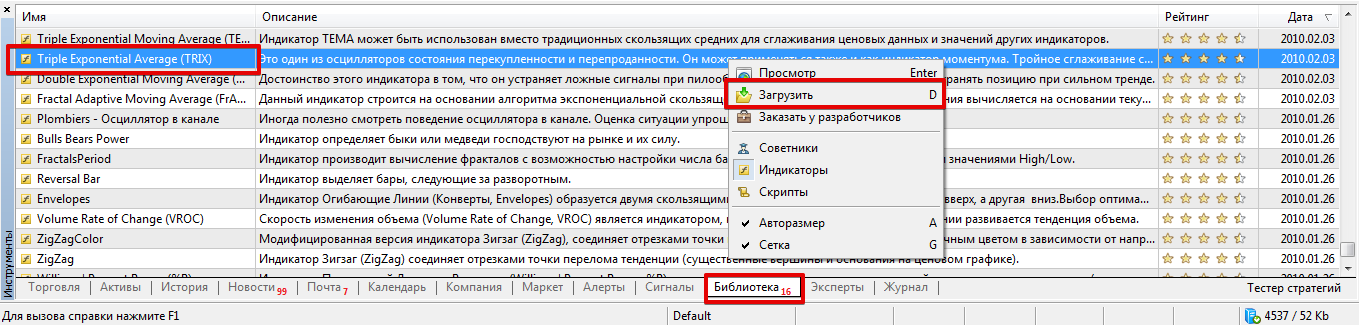

Thanks to this, installing TRIX takes no more than a couple of minutes, because to implement it you don’t even need to resort to downloading files. The installation process can be broken down into just three steps.

The first step is to open your platform and get into the library itself, which in turn is easy to find, since it is in the same window as your balance information. The second step is to do a deeper sorting of the resulting list of files, namely sort it in such a way that the list is formed exclusively from indicators, and by date of addition.

The third step is the final one, namely, you just need to load the indicator using the additional menu in exactly the same way as shown in the image below:

If the installation scheme described above does not suit you for some reason, you can always download the indicator file itself from our website and drop it into the Indicators folder.

If the installation scheme described above does not suit you for some reason, you can always download the indicator file itself from our website and drop it into the Indicators folder.

After restarting MT5, the platform will update itself, and Triple Exponential Average will definitely appear in the list of indicators.

Use in real trading

Jack Hutson, the author who created TRIX, positions this indicator as an excellent tool for overbought and oversold markets.

However, its use differs from the use of the same properties in other oscillators, for example, RSI or Stochastic .

It contains only one signal level, which is also responsible for delimiting the trend, since the instrument is based on a moving average. So, if the line crosses the 0.00000 mark from bottom to top, we open a buy position, and if the line crosses the same level from top to bottom, we open a sell position.

Also, do not forget the fact that if this line is above 0.0000, it indicates that the global trend is upward, and if it is below this level, the global trend is downward.

Traders use this feature to determine the global trend to filter their transactions in order to open positions only in the direction of the global price movement.

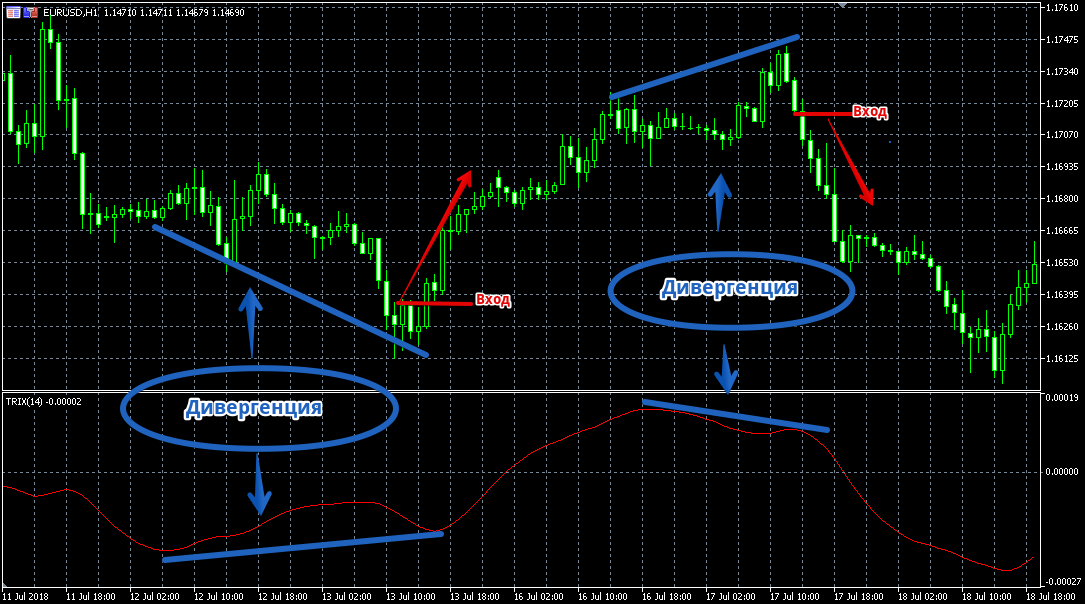

Also, the script, like other oscillators, can predict a reversal, showing us the discrepancy in its data and price behavior, also called divergence in professional circles.

Also, the script, like other oscillators, can predict a reversal, showing us the discrepancy in its data and price behavior, also called divergence in professional circles.

So, if the trend has updated its minimum, and the depression formed by TRIX is displayed above the previous one, the trend will reverse upward.

When a trend forms a new high, and the top of the TRIX oscillator shows it as lower than the previous one, the trend will turn down. An elementary example of two divergences on one chart:

Triple Exponential Average is the most effective oscillator that allows you to average the price and even out its market noise. However, the price for this information content is the lag of the indicator line and the complete absence of signals on small price fluctuations.

Therefore, if your task is to catch major trend changes, then the tool will cope with this task in the best way.

Download Triple Exponential Average