Woodies CCI indicator

Standard indicators are the most popular tools technical analysis in the forex market.

However, as they gain experience and knowledge, sooner or later each more experienced trader begins to doubt their information content and effectiveness.

This is caused simply by the fact that each trader develops his own view of the market, his own ideas and developments.

Standard indicators reflected the idea of those traders who created these tools.

The lack of information content and self-realization of the trader leads to the fact that already popular standard indicators are constantly improved, refined and modified beyond recognition.

Despite this, the new woodies cci tool has gained enormous popularity among traders and has become an excellent part of the set forex trading strategies.

The Woodies CCI indicator is a technical analysis tool that is based on two CCI indicators with a higher and lower period. The indicator was originally created for the stock exchange, but over time it began to be actively used in Forex.

It is worth noting that Woodies CCI is primarily an oscillator that performs a signal function.

The indicator itself is universal, namely, you can use it on any currency pairs and time frames, which makes it an indispensable part when building your own strategy.

Installing the Woodies CCI indicator

As already noted, Woodies CCI is a custom indicator, so in order to use it you need to download the tool at the end of the article and then install it in the MT4 trading platform.

The Woodies CCI installation process is no different from installing any other custom indicator, namely, you will need to drop the downloaded tool file into the appropriate folder in the terminal data directory.

Accessing the data catalog is quite easy. To do this, launch your trading platform and go to the “File” menu in the upper left corner. You will see a list of options, among which find and run the option called “Open data directory”.

Having opened the directory, a list of platform system folders will appear on your monitor screen, among which find the folder called Indicators and drop the previously downloaded Woodies CCI indicator file into it.

In order for the trading terminal to be able to see the installed file, you need to close the data directory and update the terminal in the navigator panel, or simply restart it.

After restarting the Woodies platform, CCI will appear in the list of custom indicators, and in order to start using it, you need to drag the name of the instrument onto the chart.

Practice of using the Woodies CCI indicator

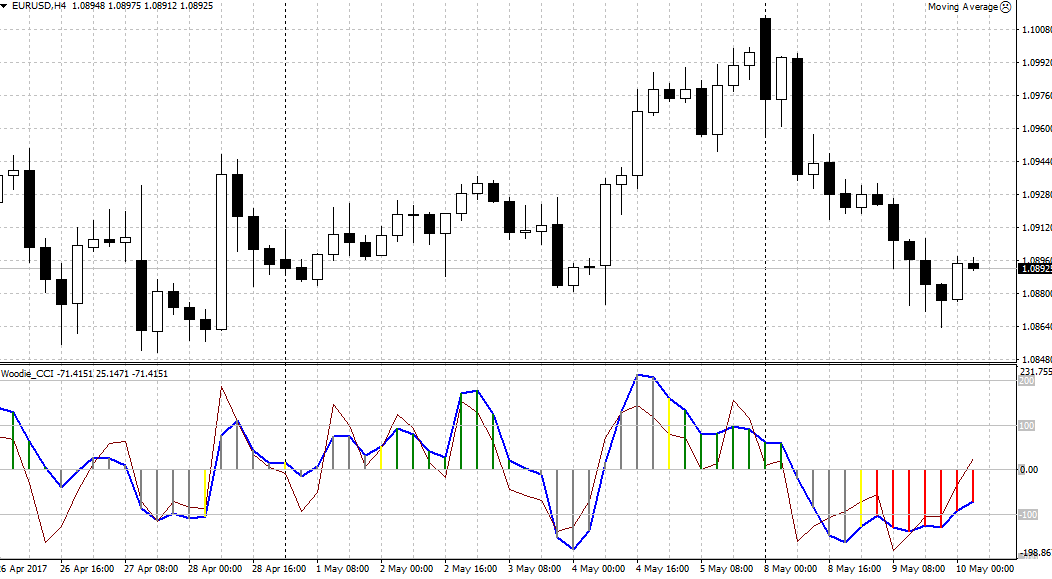

The Woodies CCI indicator is very rich in market signals, making it an excellent signal tool. So, the first thing you should pay attention to is the indicator histogram.

If the histogram is above its zero line, an upward trend prevails in the market, and if it is below the zero line, a downward trend prevails in the market.

Based on this, a fairly simple signal appears to change the trend, namely, if the histogram crosses the zero line from bottom to top, we enter to buy, and if from top to bottom, we enter to sell. See an example below:

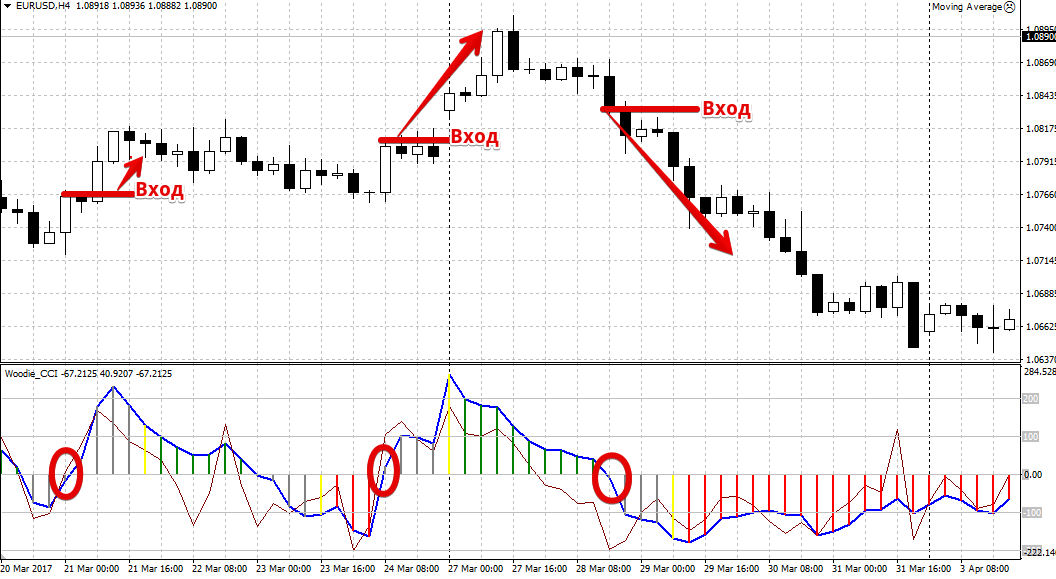

The second signal, which is often used as a secondary signal to supplement the existing trend in case of missing the main one, appears as a result of the intersection of the indicator signal lines. So, you should enter into purchases if the histogram is above level 0 and the red line has crossed the blue line from bottom to top.

You should enter a sell position if the histogram is below level 0 and the red line has crossed the blue line from top to bottom. The intersection of these lines without an additional histogram filter can also be used. Example:

The author of the indicator himself recommended carrying out a simple graphical analysis on your own instrument, namely, build a trend line along the peaks from the blue line.

So, to draw a trend line you will need two peaks on the Woodies CCI indicator, and entering the market occurs immediately at the moment the blue line breaks the trend line. For more details, please see the image below:

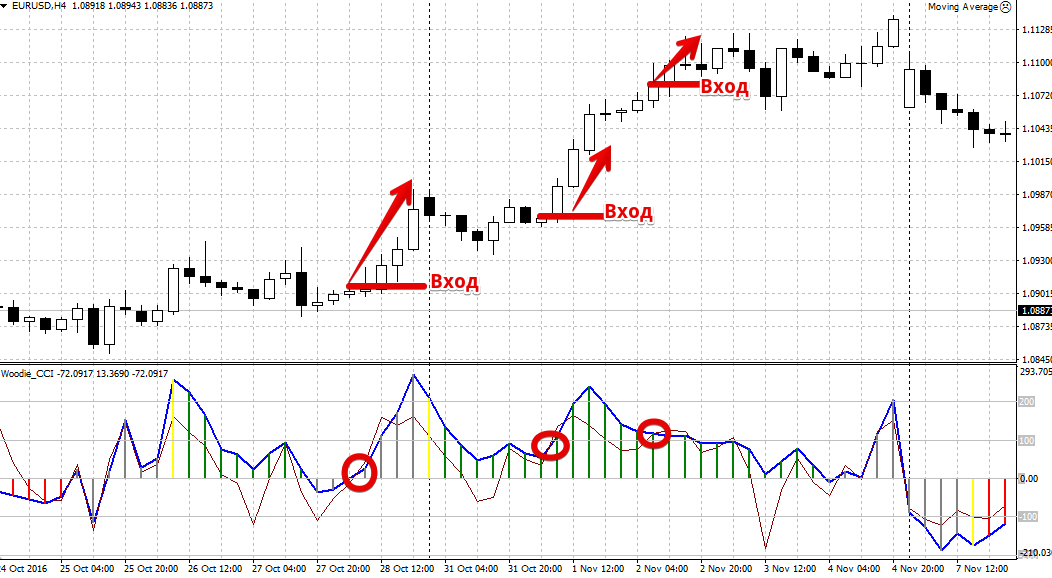

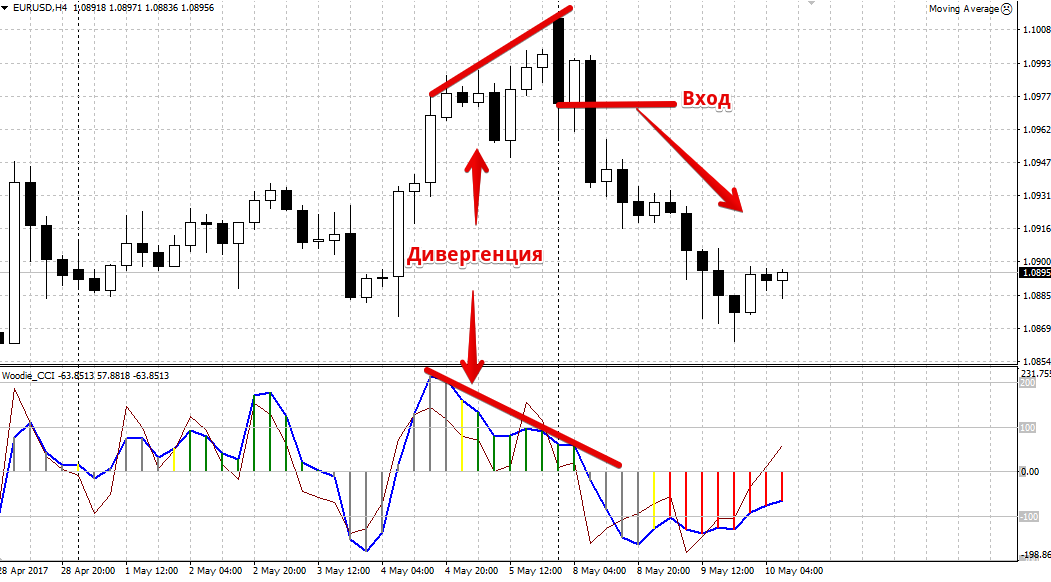

The Woodies CCI indicator also gives a leading Divergence signal. Divergence is the discrepancy between the histogram readings directly and the value one.

So, if the price forms a new peak, and the indicator fixes it as lower than the previous one, we enter a sell position. If the price has updated a new low, and the indicator displays a depression smaller than the previous one, we enter a buy position.

I suggest taking a closer look at the example of divergence in the picture below:

In conclusion, it is worth noting that the Woodies CCI indicator is a huge storehouse of market signals.

However, it is worth understanding that Woodies CCI is a common technical analysis tool, so in order to prevent false signals, it is better to use it in conjunction with any other tool.

Download Woodies CCI Indicator