What is the Kelly formula and how is it used in trading?

In any investment field, money management is always an integral part of the process of profitable investment.

There are quite a few experts who argue that a good trading system may not contain elements of money management.

But in practice, ignoring the rules of money management usually results in large losses or complete loss of the deposit.

Money management is most simply understood as constructing an effective plan that allocates the investor's available funds, taking into account risks and potential returns.

Kelly formula

Kelly's formula, also known as the Kelly criterion, is a mathematical formula named after its founder John Kelly:

While working at AT&T's Bell Labs, Kelly developed a mathematical formula for his work, originally intended to deal with long-range telephone interference.

After some time, the Kelly formula began to be used in calculating bets on horse racing; the main purpose of the calculations was to select horses in such a way as to obtain maximum profit with minimal risk. A little later, the formula began to be applied in other areas of the gambling business.

After this approach proved its effectiveness, its use began in financial markets. Even financiers such as Warren Buffett and Bill Gross began to use the Kelly Formula in their work.

Investors later used the Kelly formula for capital management in many different financial markets to find the percentage of capital per trade to optimize returns over the long term. Some financiers have successfully used the Kelly formula, such as Warren Buffett, Bill Gross and Edward Thorpe.

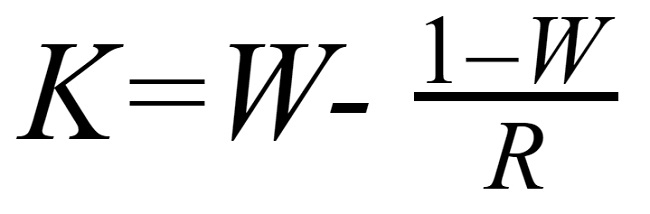

Kelly formula:

Kelly % = W – [ (1 – W) / R ], where:

%: percentage of the deposit that can participate in the transaction

W: win rate , the probability of winning based on the total number of trades.

R: Reward:Risk Ratio, the ratio of average profit to average loss per trade.

For example: In your trading history, you have traded a total of 50 orders in which the number of winning (profitable) orders is 30. The output of the winning ratio (W) will be 30/50 = 0.6. On average, each winning trade will bring you 120 pips , and on average, each losing trade will bring you 75 pips in loss. Then the Reward to Risk ratio will be 120/75 = 1.6.

Add the data to the formula and get Kelly% = 0.6 - [(1 - 0.6) / 1.6] = 0.35.

How to determine the value of W and R.

To calculate the value of W using the example, you need to determine the total number of your transactions in history. If you have been trading for a long time, you can use cycles such as 1 month, 3 months, 6 months or 1 year... or you can choose a certain number of orders, for example around 50, in the case when you are using scalping you may have to take and more.

Once you have the total number of trades, you determine how many winning trades there were, from which the W value can be calculated.

With R you can also easily calculate this ratio by adding all the winning points (or the amount of profit) and then dividing by the total number of winning points, adding all the losing points (or the amount of loss) and then dividing by the total number of losing trades, then dividing these 2 averages are combined to get the R result.

Traders who already have a stable trading system built on the ratio between take profit and stop loss can also use this ratio as R.

How to use Kelly's formula?

How do market traders use this formula? Will they stick with it or adapt it to each market and just use the results of this formula as a benchmark?

The fact is that we cannot determine the true probability of winning, nor the most accurate ratio of profit and loss.

Firstly, the probability of winning at one point in time will be different from another, the ratio of profits and losses in normal market conditions will be different than during market volatility.

Secondly, both the winning probability and the profit/loss ratio are average values, so of course they will not accurately reflect actual values and will change over time.

Thirdly, due to the fact that the formula has a fairly wide application - betting on sports, casinos, stock trading, its universality does not give a 100% result.

Therefore, traders often use the Kelly formula only as a reference value, while modifying the result to better suit their own conditions and market.

If you have calculated the Kelly ratio yourself, you can use it to create a graph showing your long-term risk/reward relationship.

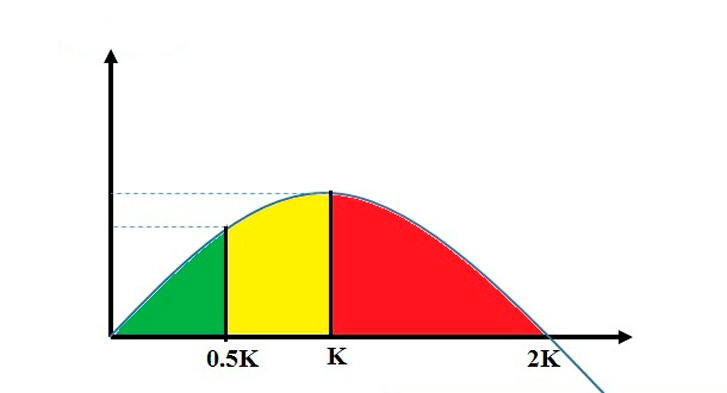

Typically the graph looks like this:

If we use the Kelly ratio correctly, then achieving profit is more likely in the long term. But if your Kelly ratio is too high, even if you maintain your profitability level, the risk will be too high.

The standard Kelly ratio is typically 0.25 (25%), which is for the average trader with a 50% chance of winning, a 2:1 profit/loss ratio (profit must be at least twice the bet, taking into account risk).

If your Kelly ratio is greater than 0.25, you should consider lowering it.

On the graph, you can divide it into 3 areas, marked with 3 different colors.

Region 0 to 0.5K: This is considered a relatively safe zone. Safety does not mean no risk, but the risk will be low and the desired rate of return will still be achieved. 0.5K is an excellent ratio in this safe zone.

Zone from 0.5K to K: considered a risk zone. If you use the Kelly ratio in this zone, your profit will be optimal, especially with the correct K ratio, but the return is not much higher, but the risk is double compared to 0.5.K.

Zone > K: The long-term optimal profit margin decreases while risk increases, so this zone is considered the highest risk zone.

The standard Kelly ratio is 0.25, but each trader will have a different value depending on the individual and market conditions.

For example, Edward Thorpe also advises reducing your position size (reducing your equity ratio or decreasing your Kelly ratio) when the market is volatile and increasing it again when the market stabilizes.

Find the ratio that works best for you, but remember the principles of using Kelly above to reduce your risk as much as possible.