Margin level in the trader’s trading platform, its optimal size

The margin level is an extremely important indicator that characterizes the level of risk for open transactions in the trader’s trading platform.

It is he who warns that a margin call or stop out may soon be triggered, protecting the broker’s funds and forcibly closing the position.

Also, the margin level can be a kind of guideline when opening new transactions; thanks to it, the trader gets an idea of whether there are enough funds to open a new transaction.

How is the margin level calculated in the metatrader trading platform

This indicator is calculated automatically in modern trading platforms. True, this happens only after the first order is opened.

But if you want to make the calculation manually, then the following formula is used for this:

Margin level = (Equity/Margin) x 100%

Where “Funds” is the account balance taking into account the result (+ or -) of open transactions, and “Margin” is the funds pledged.

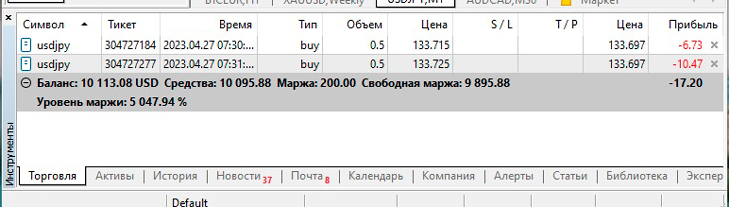

If we substitute the data from our figure into the formula, we get the following calculation:

Margin Level = (Equity/Margin) x 100% = (10095.88 / 200) x 100% = 5047.94%

The question immediately arises: is it possible to calculate the free margin before opening an order in order to immediately determine the level of risk?

It couldn’t be easier to do this, just switch to a demo account and open an order there, with similar parameters to what you are planning on a real account.

It is also recommended to pay attention to another interesting indicator - “Free Margin” and it is its size that allows you to assess whether or not you can open new orders. If the free margin is 0, it means you have no funds left for collateral for new transactions.

What should the margin level be?

If the margin level indirectly characterizes the risk of open transactions, then what is the optimal size of this indicator?

We can definitely say that the higher the percentage of the margin level, the better.

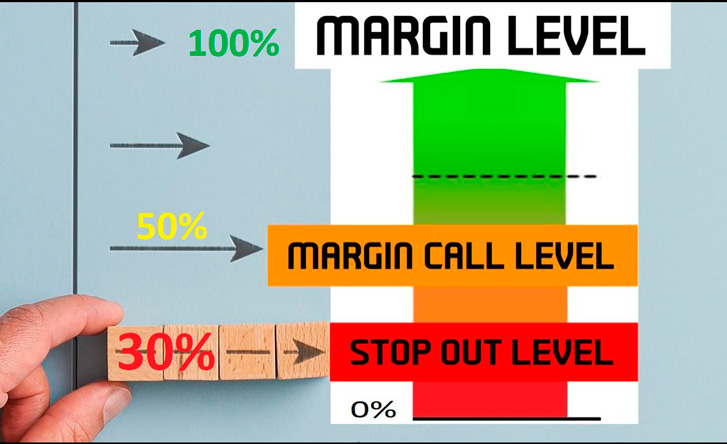

Many experts recommend not to fall below 100%, this is due to the fact that most brokers resort to forced closing of a position when the stop out 10-30% of the margin level:

But I would advise not to fall below 500%, since as the speed of the trend increases, the price can very quickly reach unfavorable values.

But I would advise not to fall below 500%, since as the speed of the trend increases, the price can very quickly reach unfavorable values.

It all depends on the strategy you use in your trading; for scalping, the margin level can be below 500%, and for long-term trading it is advisable to stick to even higher margins.

How to increase your margin level?

If you notice that the margin level is approaching a critical level, you should take steps to increase it; for these purposes, there are two ways:

Increase the account balance - that is, simply deposit an additional amount of funds, thereby increasing the balance indicator.

Close an order - if you have several orders, you can close the most unprofitable positions; in the same case, when only one position is used, you can close it partially. How to do this is described in the article - https://time-forex.com/sovet/chastich-zakrytie-poziciy

But it is better not to allow a critical fall, but to plan transactions with a reserve of funds.

What is margin in stock trading - https://time-forex.com/terminy/margin-forex