Stop out (Stop out) forced closing of a position by a broker

The main attraction of trading on the currency exchange is the use of leverage provided by the broker, which allows you to increase the funds available for trading many times over.

In order to protect your funds from loss, the broker uses a stop out.

Stop out is an order to force the trader to close a position as soon as the loss reaches a certain level specified in the trading conditions.

Serves to protect the broker's funds when using the broker's borrowed funds to support an order of a larger volume than the trader's deposit.

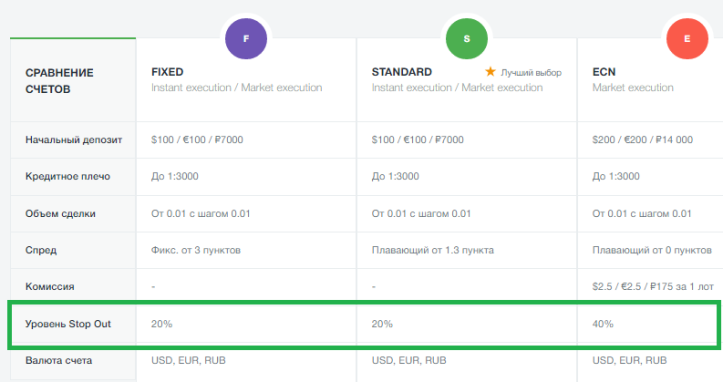

Each brokerage company independently sets the loss value, upon reaching which the order will be automatically closed.

Usually brokers set the Stop out size at a level of 10 to 30 percent; you can get more accurate information in the trading conditions of your broker:

Let's look at a similar situation using a specific example.

The stop out level is 10%, the trader's deposit is $2000, the leverage used is 1:100. A trade with a volume of 1 lot or 100,000 is opened, with the trader’s funds in the amount of 500 US dollars serving as collateral.

At the same time, the broker’s trading conditions say that the stop out level on this type of account is 20%, this is from our deposit - 500*20/100 = $50.

An unfavorable situation developed in the Forex market and the loss on the open order began to gradually increase, as soon as it reached the amount of $1950, the position was automatically closed.

At the same time, the trader’s account does not necessarily have exactly 50 dollars left, because it also takes time to close a position, and the price does not stand still.

Stop out is a kind of stop loss order, but only from the broker’s side, it allows you to save him from losses if the trader cannot cope with the situation on his own:

When calculating it, one should not forget that several positions can be opened simultaneously in the trader’s terminal and the total volume of transactions must be taken into account.

When calculating it, one should not forget that several positions can be opened simultaneously in the trader’s terminal and the total volume of transactions must be taken into account.

It is advisable not to wait for the forced closure of a position to occur and to close the order upon notification of a possible shortage of funds to maintain it.

This signal is called a margin call. It is usually sent to the trader when the loss exceeds 50-70 percent of available funds.

Today it is not necessary to perform calculations manually; it is enough to install the appropriate script:

Download the Stop out script for installation on the chart - https://time-forex.com/skripty/ind-stop-out

Can a stop out not work and the deposit go into negative territory?

Surprisingly yes, this usually happens for two reasons:

• Weak collateral for an open position , when a large leverage is used for trading and the transaction volume significantly exceeds the trader’s deposit. For example, the deposit is equal to 100 dollars, and the transaction is opened with a volume of 1 Forex lot (100,000).

In this case, the trend only needs to go 10 points to reset the deposit. • The occurrence of a gap – a stop out may not work if a price gap ( Forex ) occurs; sometimes its value sometimes reaches several tens of points.

Which leads to a negative deposit. But fortunately for traders, almost all brokers guarantee that the negative deposit value will be restored to zero.

But it is still better to independently regulate the level of possible loss by placing stop loss or trailing stop orders.