Cryptocurrency correlation. Determination method

Cryptocurrencies are represented by a huge number of digital currencies, which have both similarities and are radically different from each other.

However, the huge excitement caused by the daily introduction of new electronic money into all areas of the economy, and especially the banking sector, led to huge demand, and as a consequence to incredible rates of exchange rate growth.

Now, not only far-sighted investors are actively investing in this area, but also ordinary citizens who can see every day that Bitcoin has reached another high and has risen in price again.

However, investing is a rather complex science, so it is very important to structure your portfolio in such a way that in case of sudden market changes you do not lose everything you have accumulated through backbreaking work.

Method for determining correlation. Summary of major cryptocurrencies

The correlation of cryptocurrencies is of utmost importance when compiling an investment portfolio. The definition of correlation means the identity of the price movements of completely different trading assets.

It is worth noting that correlation is measured using a coefficient, and assets can move either identically, completely oppositely, or there will be no relationship at all.

If we talk about the problems of creating investment portfolio based on cryptocurrencies, we can note the fact that all digital currencies belong to the same industry, so the influence of industry-wide news, for example, problems with working with the exchange, can bring down the rate of all cryptocurrencies simultaneously.

That is why it is very important to balance the portfolio in such a way that in the event of strong market impacts, the investor can minimize his losses.

And to do this, you will need to select assets in such a way that the direct relationship between their movements is minimal.

To determine the correlation, there are both mathematical approaches based on long calculations and three-story formulas, and ready-made solutions in the form of special indicators.

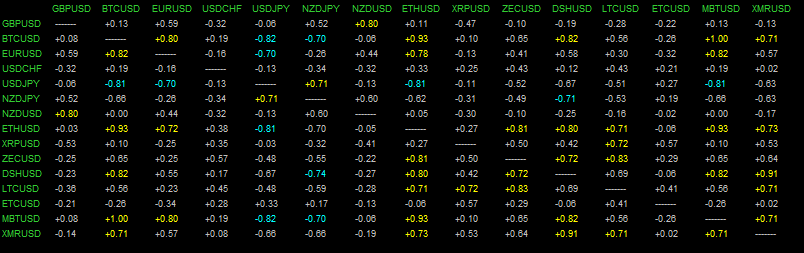

In this article, we suggest you use the iCorrelationTable indicator, which allows you to calculate the correlation coefficient not only between cryptocurrencies, but also between currency pairs, indices and even stocks.

After you download the indicator at the end of the article, drop it into the Indicators folder inside your data directory.

After plotting the indicator on the chart, a table of currencies will appear in front of you, which must be supplemented with cryptocurrencies by dragging their name inside the table.

The correlation coefficient is measured from +1 to -1. One indicates complete coincidence of the price movement, while -1 indicates the complete opposite of the movement of assets (if one is growing, then the second is falling at that moment).

So, if you rely on the table data generated by the iCorrelationTable indicator, you can see that the Bitcoin/Dollar currency pair has a correlation coefficient of +0.93 with the Ethereum/Dollar pair, as well as 0.82 with the Dash/Dollar pair.

Such a high correlation indicates to us that when Bitcoin rises or falls, Dash, as well as Ethereum, will repeat the dynamics of Bitcoin price movement. That is why, in the process of trading Dash and Ethereum, Bitcoin can act as an indicator of future price changes for these assets.

If we talk about neutral cryptocurrencies that practically do not correlate with each other, we can highlight the combination of Ripple/Dollar and Bitcoin/Dollar. Their correlation coefficient is only 0.1, which indicates to us a complete lack of relationship.

There is also no correlation between Monero/Dollar and Ethereum Classic/Dollar, since the correlation coefficient is only 0.02. Dash/Dollar and Ethereum Classic/Dollar move neutrally relative to each other, since their coefficient is -0.05.

In conclusion, I would like to note that the correlation of cryptocurrencies may be of interest not only to investors for the purpose of hedging risks, but also to traders who want to build their forex strategies.

Download the iCorrelationTable correlation indicator