Myths about Forex and reality.

Forex is an over-the-counter interbank foreign exchange market, in which today, thanks to intensive technical progress, everyone can make money.

There is a myth that to get a stable profit on Forex you will need a specialized economic education.

This is partly true, but it is not at all necessary to obtain a university diploma.

All the necessary knowledge can be obtained online or through paid and sometimes free training at one of the brokerage companies.

You can also study on your own; at the moment, a lot of useful information is posted on specialized websites about Forex.

It is important to pay attention to:

- principles of fundamental analytics;

- methods of technical analysis of price charts;

- study the functionality of indicators to confirm the correctness of the forecast.

On the Internet on specialized resources you can find many “profitable” strategies, the use of which supposedly guarantees a monthly profit of 100%.

Double your capital in a month on Forex.

What's the catch? It is indeed possible to make money trading currency pairs.

Optimal profitability indicators are considered to be 15% -25% per month. Beginning traders can count on receiving 10% of the capital amount based on the results of work for the month.

The level of profit is directly related to proportional risks. There are capital management standards, according to which the risk for each open order should not exceed 3% -5% of the deposit.

Recently, the concept of “ deposit acceleration ” has been popular, but even in the intensive earnings mode, the risk should not exceed 10%.

If you do not want to lose your invested funds during the first month, then you should adhere to this rule. Before opening an order, it is important to calculate the volume based on the estimated Stop Loss level.

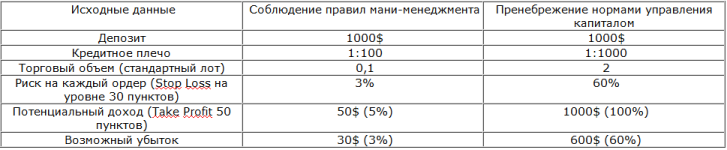

For example:

According to the presented comparative table, it is obvious that ignoring the rules of money management will allow you to earn more, however, in the case of just one unprofitable transaction, the deposit will have to be restored throughout the month and this is no longer a myth, but the reality of Forex trading.

It is important to understand that a profitable strategy does not guarantee accurate trade openings.

It is important to understand that a profitable strategy does not guarantee accurate trade openings.

The main task of the trading system is to ensure that profitability prevails over drawdown.

The characteristics of an effective strategy look something like this: 1. The ratio of profitable trades to losing ones is 70:30.

2. The profit received as a result of closing an order is from 3% to 5% of the capital.

3. The maximum loss for each order is no more than 3%.

As a result, it turns out that 25% per month is a good income that only an experienced trader can boast of.

Profitability of 100% or more is possible only in 2 cases: 1. Neglect of the rules of money management.

2. Application of the doubling method, which sooner or later is guaranteed to lead to the loss of invested funds.

This method involves doubling the trading volume each time after fixing a loss. It is important to understand that stable earnings on Forex are possible only if the following factors are present:

1. The presence of an original and practice-tested strategy with a proven result.

2. Compliance with capital management standards.

Ready-made strategies for trading on Forex -

http://time-forex.com/strategy In addition, the emotional component should be excluded from the work, since the human factor prevents making the right trading decision. At the same time, you should always try to ensure that Forex myths do not interfere with real trading.