Trend reversals depending on trading sessions.

Quite rarely, Forex traders associate a trading session with a trend reversal and the troubles that this event brings.

But in reality, the Forex market is no less tied to fundamental news than the stock market, and events that occur can have just as strong an impact on exchange rates as on stock prices.

Therefore, you can observe how an important event changes the rate for a particular currency pair, while tracking a clear relationship between currency pairs and the sessions at which the reversal occurs.

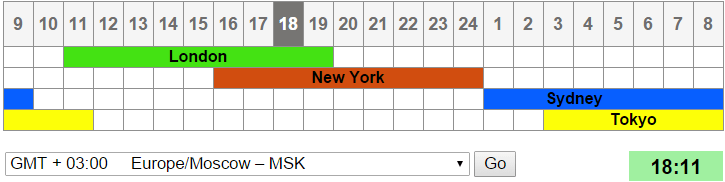

Most often, trend reversals occur in those sessions that coincide with the opening hours of banks and government agencies in the countries that issued the currency into circulation.

For example, changes in the dollar exchange rate more often occur in the American session, and the Japanese yen in the Asian trading session.

At the same time, it cannot be said that these currencies are not influenced by news at other times of the day, but during sessions that coincide with the working day in the USA and Japan, this influence will be stronger.

Which currency pairs will be safer when trading in Moscow?

As it turns out, there are quite a lot of such assets, the main thing is to carefully approach their choice:

- AUD/NZD - Australian dollar The New Zealand dollar can be used for trading from 10:00 to 23:00 Moscow time. It is at this time that the main news on these currencies comes out and there is a high probability of a trend reversal.

- AUD/JPY - Australian dollar Japanese yen is suitable for trading from 12:00 to 01:00 Moscow time.

- NZD/JPY - New Zealand dollar Japanese yen It is recommended to trade from 12:00 to 23:00 Moscow time.

You can also independently find a dozen more currency pairs on which you can work during the day; if you prefer to trade at night, then currency pairs that include the currencies of European countries become available to you.

Using this principle, you significantly reduce the likelihood of surprises on open transactions, but even in this case, you should not forget about the stop loss or trailing stop.

Using this principle, you significantly reduce the likelihood of surprises on open transactions, but even in this case, you should not forget about the stop loss or trailing stop.

Learn about trading strategy at the European trading session - http://time-forex.com/strategy/treyding-evroses