The effectiveness of the news strategy in relation to futures

The use of fundamental analysis in stock trading has many supporters who prefer it to the technical method of market research.

At the same time, the impact of news on the price of assets is quite ambiguous; often after the news is released, the price remains in place or even moves in the wrong direction as expected.

This happens especially often when trading on the foreign exchange market, but what about futures?

After all, the futures market has its own laws and fundamental analysis here often turns out to be more effective than technical analysis.

Indeed, this fact occurs since the price of futures often forms a direct relationship with news, and news that is taken into account when trading currencies in most cases affects the economy of the country that issued the currency, and not the monetary unit itself.

The easiest way to evaluate such an impact is to use specific examples.

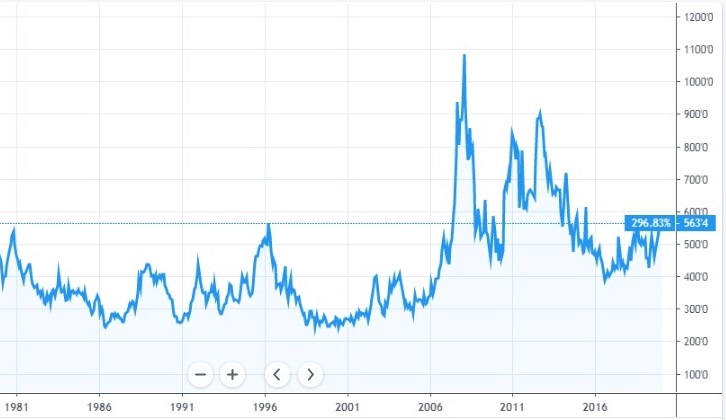

You can see how the Brent oil futures price reacted to this news in the chart:

As a result of the attack, Saudi Arabia was forced to cut oil supplies in half, which led to a quick market reaction.

As a result of the attack, Saudi Arabia was forced to cut oil supplies in half, which led to a quick market reaction.

The price of oil formed a gap and jumped from 60 to 68 US dollars per 1 barrel of Brent, that is, a decrease in supply immediately led to an increase in price.

A similar reaction can be observed when trading other futures.

For example, reports of a wheat harvest failure and a decrease in the volumes of grain harvested can raise prices for this product on the world market several times. This situation was observed in 2010, 2011 and 2012:

Moreover, the market reacts not only to the publication of data on the collected volumes of grain, but even to expert forecasts and statements by meteorologists.

Moreover, the market reacts not only to the publication of data on the collected volumes of grain, but even to expert forecasts and statements by meteorologists.

The reason for such a reaction in the price of futures is obvious, because the news indicates a possible change in the supply of goods, which cannot but affect the market.

Therefore, trading on news in relation to the futures market always turns out to be more effective than a similar strategy when trading currencies.

The only drawback is that the exact time of the news release is never known, because no one plans a drought or a hurricane, and only those who carry them out know about terrorist attacks.

Read also:

Scalping in the futures market - http://time-forex.com/skalping/skalp-fucners

Futures in the trader's terminal - http://time-forex.com/praktika/fuchers-metatreyder