A simple strategy for making money on the Shanghai index

Anyone who has been familiar with stock trading for several days knows for sure that during market crashes and various crises, you can not only lose money, but also make good money.

Many of the outstanding traders made their fortune during stock market crashes, since it was at this moment that assets could be bought at the most attractive prices.

Bad news brings down the markets, stocks and other securities rapidly become cheaper, their prices fall to the very bottom.

But as a rule, this situation does not last long; bears (those who play for bulls) begin to actively buy cheap assets, thereby increasing demand.

Due to increased demand, prices begin to rise again and those who bought the security at the minimum price begin to earn money.

Using a similar strategy, you can only wait for the next collapse in the stock market.

Current situation on the Chinese stock exchange

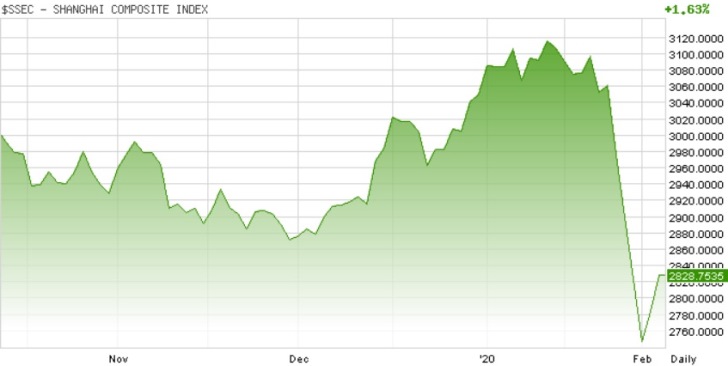

Let's consider the situation that currently exists on the Chinese stock exchange using the example of the popular Shanghai Composite index.

It combines prices for more than 1,000 shares of Chinese companies and perfectly characterizes the situation on the Chinese stock market. After the outbreak of the coronavirus pandemic, most analysts began to give unfavorable forecasts regarding the further functioning of the Chinese economy.

The result of such statements was the collapse of the Shanghai index by more than 8% from 3060 points to 2700 points.

After the Chinese government announced that it would support the stock market by injecting $173 billion into it, the price of Chinese securities indices began to rise.

After the Chinese government announced that it would support the stock market by injecting $173 billion into it, the price of Chinese securities indices began to rise.

It is rather doubtful that such an amount will be enough to significantly influence the situation, since the capitalization of the Chinese stock market is several trillion dollars and the pandemic is still gaining strength.

Therefore, there is every reason to predict a further decline in the price of shares of Chinese companies.

The most favorable time to buy will come after the first reports appear about the end of the coronavirus epidemic or the emergence of a reliable means of combating it.

It is then that it will be possible to enter into transactions to purchase the Shanghai Composite and make money on its increase by 3-4%, which, taking into account the leverage, is quite a lot.

The current situation is a good chance to make money even for a novice trader who is not yet particularly versed in the intricacies of technical analysis.

You can choose a broker for trading indices here - http://time-forex.com/spisok-brokerov