Lowest spreads in NPBFX: broker test drive

The size of the spread is one of the main factors by which millions of traders around the world select a broker for further trading.

This is due to the fact that most financial market participants use short-term trading strategies (scalping, pipsing).

This is due to the fact that most financial market participants use short-term trading strategies (scalping, pipsing).

For such strategies, the size of the spread plays a key role, because... the profit is sometimes only a few points. High spreads can simply “eat” it.

In practice, choosing a high-quality and reliable broker is not so easy. Often, the spread sizes indicated on the official websites of companies differ significantly from real trading ones.

In addition, during news releases, many brokers' spreads widen significantly. Unfortunately, a trader can only learn about this from his own experience, losing not only his profit, but also part of his deposit.

Today we will introduce you to a broker that truly provides the lowest spreads on the brokerage market. This is our long-time reliable partner - the international STP/NDD broker NPBFX (NEFTEPROMBANKFX). We will briefly talk about the company itself, its trading accounts, as well as the spreads that apply to them. The “highlight” will be our test drive on a real broker account, where we will study the broker’s spreads not only in a calm market, but also during the release of significant economic news. We really hope that our test will be useful to many readers.

About the NPBFX briefly

The broker can rightfully be called a “dinosaur” in the financial services market, because NPBFX began its activities in 1996. At that time, customer service was carried out on behalf of the famous Russian bank JSC Nefteprombank. It should be noted that the company was one of the first to offer its clients STP/NDD order processing technology. The broker worked in this format until 2016. When it became difficult to work with the previous trading conditions on the market, and due to regulator restrictions it was not possible to introduce new ones, restructuring became the optimal solution. Rebranding was carried out and the bank's FX clients moved to NPBFX (NEFTEPROMBANKFX).

Since 2016, NPBFX has managed to seriously scale up its services; the pool of trading instruments has grown significantly: clients can trade not only currency pairs, but also cryptocurrencies, stock market shares, world indices, precious metals and raw materials. In total there are more than 130 trading instruments. The line of trading accounts has also expanded significantly; cent, swap-free, and spread-free accounts have been added. We will talk about them in the next section of the article. The broker launched several unique services for clients - Analytical portal, investment service NPB Invest. There is also a monthly competition for clients on demo accounts called “Battle of Traders”. The prize fund is $2,500, as well as a super prize - an IPhone smartphone of the latest model.

Clients rate the quality of services provided by the broker very highly. You can read about this in hundreds of reviews posted on various resources on the Internet. It is also worth noting that the company, despite sanctions barriers against the financial industry, serves clients from the Russian Federation, providing a full range of services. There are no problems with replenishing your trading account, as well as withdrawing profits. The broker offers about two dozen methods for depositing/withdrawing funds.

Trading accounts with NPBFX

To consider spreads in a company, you need to become familiar with the types of trading accounts offered by the broker. For convenience, we have divided the accounts into groups and indicated the main trading conditions.

- Educational demo accounts – Demo Master, Demo Expert, Demo VIP and Demo Standard Cent . Spreads from 0.4 points. Leverage up to 1:1000. There is no commission for the lot. Trading on demo accounts is completely identical to trading on the same types of real accounts.

- Trading real accounts. This includes classic NPBFX accounts - Master, Expert, VIP, as well as the Master - Chinese Yuan account (in Chinese yuan). Spreads from 0.4 points, margin leverage up to 1:1000. There is also no commission on turnover. There are several cent real accounts - Standard Cent and Zero Cent. The latter implies trading with zero spreads, but with a commission of 0.08 USD/lot. Let us separately highlight the Zero real trading account. Like its cent version, there are zero spreads, but there is a commission. Margin leverage 1:1000. Trading instruments: currencies, stock indices, precious metals, commodities, stocks and ETFs, cryptocurrencies.

- Signal account NPB Invest. Designed for investing in the investment platform of the same name NPB Invest. We will not consider it in this article; information about it can be found on the official NPBFX website.

The broker's Analytical Portal will provide professional assistance to the client of any trading account. The portal is a multi-market online resource, including a news feed, analytics, trading signals, a catalog of trading strategies, video courses and reference materials on the market. Access to the portal is free, it can be launched from your Personal Account after registering on the NPBFX website.

As you can see, the broker provides its clients with a very wide range of trading accounts, which can be used both for training and testing trading strategies, as well as for trading with real money. You can choose a trading account for absolutely any strategy, including scalping or long-term trading.

Test drive of a real trading account

Let's move on to the most interesting part - testing spreads on a real NPBFX account. For this purpose, we decided to open what is probably the most popular classic real account among traders, Master. Trading conditions on it are as follows:

- Spread from 0.8 points (average 1.2). Example for the EURUSD pair.

- There is no commission on trading turnover.

- Minimum deposit from 10 US dollars or euros, from 500 Russian rubles.

- Maximum leverage 1:1000.

In our test drive we will test spreads on the EURUSD, GBPUSD and USDJPY currency pairs. In our opinion, a test of these majors will be enough so that, for example, those same pip traders can draw the necessary conclusions for themselves. We will test spreads in a calm market, as well as during the release of important economic news, when spreads are likely to widen. Such news is usually marked with the highest degree of importance in economic calendars. So, let's begin.

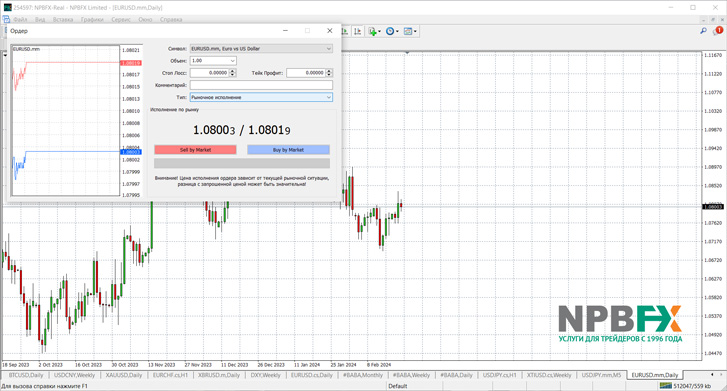

- Publication of minutes of the Fed meeting. February 21, 2024.

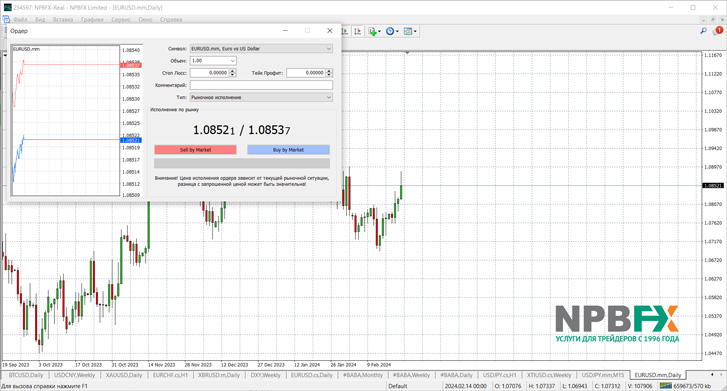

Half an hour before the news came out, the spreads for the EURUSD pair were 1.6 points . Now let's see how spreads changed during the release of economic information.

As soon as the minutes were published, the EURUSD spread dropped to 0.9 pips . It will be interesting to see how spreads will behave on other important news.

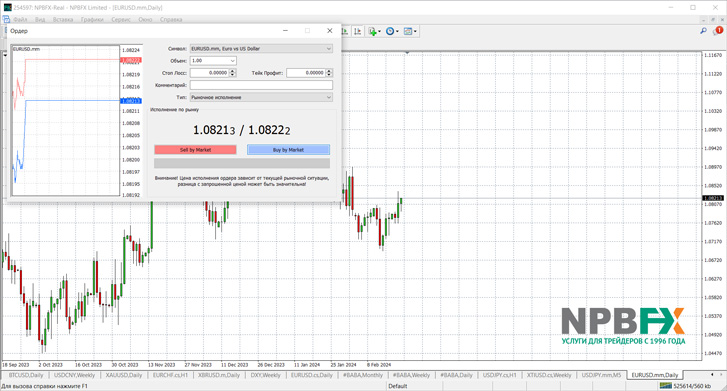

- Publication of the EU Consumer Price Index (CPI) (YoY) (Jan). February 22, 2024.

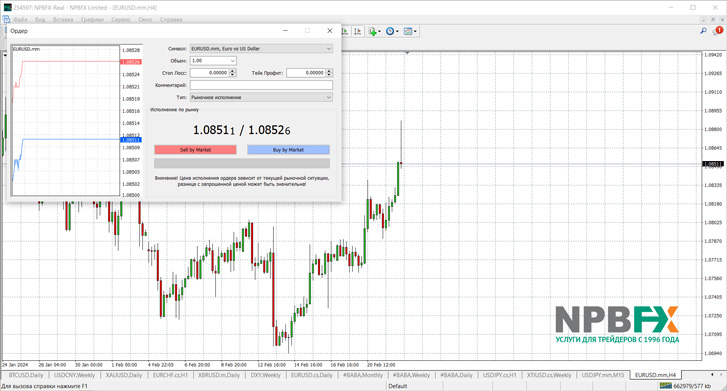

In a calm market, before the news came out, EURUSD spreads were 1.6 pips . The CPI has always been considered one of the most important economic indicators, because... refers to inflation indicators. Let's see what happened to the spreads at the time the news was released.

As can be seen from the chart, the price movement was quite rapid. The single currency began to sharply lose value. At the same time, spreads on the EURUSD pair amounted to 1.6 points . It turns out that the news did not affect them in any way.

- Publication of the number of initial applications for unemployment benefits in the United States. February 22, 2024.

Please note that the GBPUSD currency pair is being tested. Before the news came out, spreads were 1.9 points .

News on the American labor market always leads to significant volatility in the market. This can be seen in the pound/dollar spreads, which widened to 3.5 points .

- Publication of the US index of business activity in the manufacturing and services sectors. February 22, 2024.

Our last test took place during the publication of two important news from the USA at once. The tested pair is USDJPY. Before the news came out, the spread was 1.8 points . Let's see if it expanded like the GBPUSD pair did after the data was released.

This news also led to significant activity in the market. The American dollar began to sharply lose its position against the Japanese yen. The spread on the USDJPY pair at the time of data release was 3.6 points .

conclusions

First of all, we would like to draw your attention to the fact that NPBFX is an STP/NDD broker. This means that the trader will not have to pay an additional commission on trading turnover. All broker profits are included in the spread. With this in mind, you shouldn't expect spreads of 0.2 or 0.4 pips, as you might see with ECN brokers. The latter, in addition to the spread, charge the trader from 14 to 20 US dollars for a transaction of 1 standard lot. If we count all the trader’s expenses that he pays for the circle (opening and closing a transaction), then the amount may turn out to be more than paying the STP spread to the broker.

In order to make it even more profitable for clients to trade with the company, NPBFX has introduced the “Cashback - up to 60% on each transaction!” promotion. It allows you to receive up to 7 US dollars for 1 traded lot on Master accounts. As a result, traders receive even lower trading costs.

To summarize, we can say with confidence that using short-term trading strategies (scalping, pipsing, HFT) in NPBFX is profitable. A trader can easily take his 3-5 points from the market, both from a calm market and during news releases. Please note that even such strong news as we used for a test drive did not lead to the spread widening by tens of points. Yes, spreads have increased, but at most twice, and on one piece of news they even decreased from 1.6 to 0.9 points. What does this mean? The fact that the NPBFX broker works with very serious liquidity providers. These include the world's leading Tier 1 banks and large electronic ECN systems that provide the broker with a high-quality liquidity flow.

You can become a client of NPBFX in just a few minutes. To do this, just register on the broker’s official website and open a trading account.