The main mistakes of Warren Buffete, which cost him a lot of money

Warren Buffett is one of the most successful investors in the world. Over the course of his career, he has made billions of dollars investing in corporate stocks.

Brief biography of the investor - https://time-forex.com/treyder/uorren-baffet

However, even an experienced investor like Buffett made mistakes that cost him billions of dollars.

But this did not stop him from moving on and earning even more money; the mistakes he made brought invaluable experience, and did not become the basis for depression.

In this article, we'll look at some of Warren Buffett's major mistakes that caused him to lose his money and investors' money.

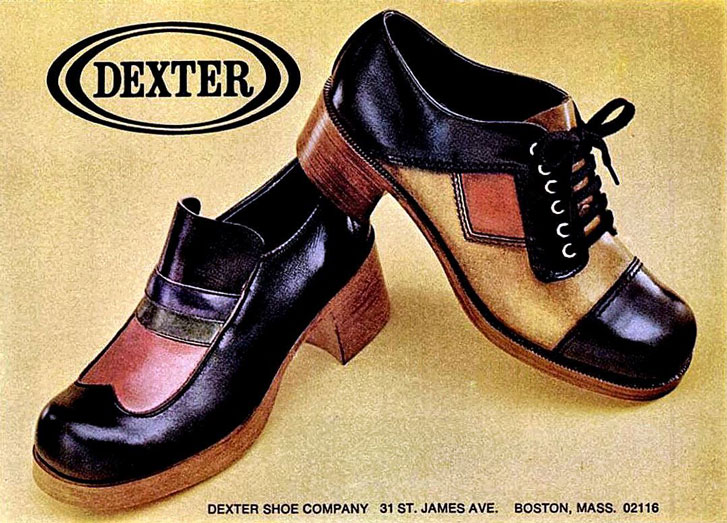

In 1993, Buffett invested $433 million in Dexter Shoe stock. Dexter Shoe produced shoes for running and other sports. Buffett believed that Dexter Shoe was an undervalued company with great growth potential.

But Dexter Shoe faced stiff competition from other shoe companies such as Nike and Adidas. As a result, Dexter Shoe failed to meet investor expectations, and in 1995, Buffett sold his Dexter Shoe shares at a loss of $350 million.

Investment in ConocoPhillips

In 2008, Warren invested $6.5 billion in securities of the oil company ConocoPhillips. Buffett believed that ConocoPhillips had very good potential and its shares would soon begin to rise in price.

But this purchase was another mistake. As a result of the fall in oil prices in 2008, ConocoPhillips suffered significant losses. After three years of waiting, Buffett sold his shares to ConocoPhillips at a loss of $1.5 billion.

Investment in IBM

In 2011, Buffett invested $10.7 billion in IBM shares. HE believed that IBM still had good growth prospects and its shares could generate profits.

Unfortunately, IBM faced stiff competition from other technology companies such as Amazon and Microsoft. As a result, the investment failed to meet Buffett's expectations.

In 2017, Buffett began selling his shares of IBM, and to date he has sold more than half of the securities he purchased.

Investment in Kraft Heinz

In 2013, another unsuccessful investment was made worth $23.3 billion in Kraft Heinz shares. All of Kraft Heinz's economic indicators indicated good growth prospects.

But the market does not always take into account reporting indicators. Kraft Heinz faced several challenges such as changing consumer preferences and stiff competition. In 2019, Kraft Heinz wrote down $15 billion of the value of its assets. As a result, Buffett lost billions of dollars on his investment in Kraft Heinz.

Missed opportunities can also be attributed to Buffett's mistakes.

In addition to the mistakes mentioned in this article, Buffett also made a number of other mistakes during his career. For example, he did not invest in companies that later became very successful.

Here are some examples of companies that did not attract the attention of investors:

Amazon. Buffett first spoke publicly about his mistake with Amazon in 2018. He said Amazon was "the best company in the world" and that he regretted not investing in it in the 1990s.

Apple. Buffett invested in Apple in 2016, but he could have invested in it much earlier. Apple was founded in 1976, and at the initial stage its shares were worth 1000 times cheaper than in 2016.

Microsoft. Buffett also regrets investing in Microsoft in 1996, when he could have invested in it much earlier. Microsoft was founded in 1975, and it has become one of the largest and most successful companies in the world.

These mistakes show that even the most experienced investor can miss opportunities. It is important to carefully research the companies you are considering investing in and not be afraid to take risks.

In addition, Buffett prefers strategies in companies with sustainable growth. He often avoids companies that are in the early stages of development because they are considered riskier. However, some of the most successful companies in the world started as small startups.

If Buffett had been more open to investing in early-stage companies, he could have made even more money. At the same time, it is important to note that even the most successful companies do not always meet investors' expectations.