Pips on Forex without errors. How not to lose your deposit?

Piping has been one of the most popular strategies among traders with different levels of trading experience for several decades in a row.

They pip in Russia, pip in Europe, and pip in African countries. This mega-interest is due to only one reason.

This trading strategy (TS) allows you to realize the desire with which the majority of traders come to the market - to earn money quickly and a lot.

Indeed, pipsing within a week can bring profit amounting to several hundred, or even thousands of percent of the invested funds.

However, there is one BUT - with such trading, the risks of losing a deposit are equal to 100%.

How not to lose your deposit and make money with pips on Forex? Let's discuss it in this article. The material will be useful to those who have recently entered the market and consider this vehicle as a priority.

With the information support of experts from the international broker NPBFX (NEFTEPROMBANKFX), we have identified the main errors that lead to the loss of a deposit when pipsing.

- Wrong broker selected for trading.

- Lack of a working strategy when opening trade transactions.

- Ignoring risk management.

Next, we will analyze each point in detail, and also provide specific examples using the services of the NPBFX broker.

#1: Wrong broker for trading

Many novice traders do not even suspect that the effectiveness of their pips may directly depend on the broker. The company in which you plan to open an account is selected completely differently from the criteria that are necessary for pipsing. Traders fall for various colorful promotions, bonuses and other goodies, and then it turns out that pipsing in the company has a number of restrictions or is completely prohibited. Let's look at the parameters that need to be analyzed when selecting a brokerage company for pipsing.

- No trade restrictions. Unfortunately, not all traders carefully read the documents in which the broker specifies the terms of service for clients. The Regulations of some companies may contain restrictions on the minimum profit in points for each transaction, as well as for the “lifetime” of a trade transaction.

For example, your profit must be at least 3 points, and the time from opening to closing a transaction is at least 3 minutes. You definitely won’t be able to pip under these conditions.

- Minimum spreads. Spreads play a key role in short-term strategies such as pips. When your goal is to make just 2-3 points of profit in a few seconds, spreads of 3, 5 or more points can seriously affect your plans.

To make a profit, you will need to wait until the quotes of the trading instrument “beat off” the spread, and then your 2-3 points will pass. This may take more than one minute, which is unacceptable for pipsing. The longer a transaction remains open, the higher the risks that the market situation may change. The trader’s task is to quickly enter the market, take a couple of points of profit and have time to exit before the quotes reverse.

- Good liquidity providers. The broker must provide a very good liquidity flow for most instruments, then you can make money on pips. If the broker has low-quality liquidity providers, there are few of them, then on the minute chart, which is mainly used for pips, you will see price gaps. As a result, having sent an order to open a transaction at one price, it can be executed at a completely different, worse price.

The larger the liquidity providers, the more of them there are in the broker’s pool, the more buy/sell orders are included in the order book in a short time period. This minimizes price gaps on minute (M1, M5) charts of trading instruments.

Let's look at NPBFX as an example. The Regulations on Trading Operations, which are publicly available on the company’s official website, do not contain any restrictive clauses on the minimum profit or holding time of a transaction. Moreover, on the main page of the site it is stated that the broker welcomes absolutely any trading strategy, including scalping/pips and HFT trading.

Spreads in the company start from 0 pips, which allows pip traders to make maximum profits. The broker's liquidity providers are Tier 1 banks, as well as large ECN systems (Integral, Currenex, Hotspot). The excellent liquidity flow that NPBFX provides has been repeatedly positively assessed by clients in reviews on various online resources.

#2: Lack of a working strategy when opening trades

At first glance, pipsing seems very simple to novice traders and does not require deep knowledge in trading. I opened a minute chart, looked at where the quotes were moving and entered into a trade. I saw a profit and closed it. However, in reality, such traders lose their deposits very quickly. Transactions literally immediately after opening go in the opposite direction.

The trader closes his losses, begins to rush around, and open new trades thoughtlessly. This approach to trading can be classified as intuitive trading. Yes, it can also happen when a trader has vast trading experience and feels the market. For beginners, this strategy is tantamount to suicide.

NPBFX broker experts recommend using technical analysis for short-term trading. You need to develop your own trading strategy or take a working one that has been tested on the NPBFX Analytical Portal. Next, test it on a demo account until the vehicle gives a stable result.

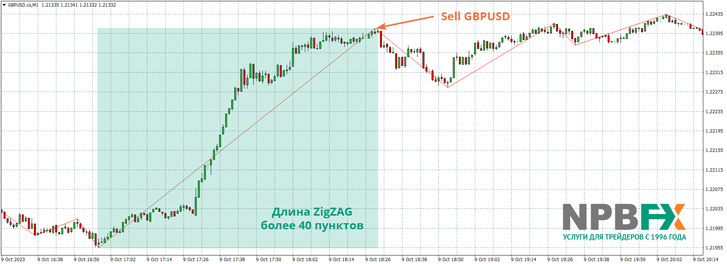

Let's look at a specific example using the ZigZag technical indicator. At the initial stage, the H4 chart of the trading instrument is analyzed. The goal is to determine the short-term trend in the market.

As can be seen from the chart above, since October 4, 2023, the GBPUSD pair has been experiencing a short-term upward trend. Therefore, ideally, you need to pip in the direction of the current trend, i.e. open trades to buy the British pound.

However, trades against the short-term trend can also be considered if the indicators give a clear signal. Now let’s move on to the minute chart of the pair dated October 9, 2023 and demonstrate exactly the trade opened against the current short-term trend.

Initially, the condition for entering a trade was to draw a ZigZag line more than 40 points long. As can be seen from the graph, such a ZigZag was drawn in the direction of the current trend. The trader had a choice whether to open a trade against a short-term trend, relying on the technical indicator signal.

As a result, it was decided to open a deal to sell the pound. The length of the next ZigZag line was more than 10 points. It turns out that the trader received his 3-5 points of profit within a few minutes without any difficulties.

The situation described above is quite delicate. The trader had to work against the short-term current trend. In such cases, to make sure the decision is correct, NPBFX experts recommend looking at higher timeframes. For example, there may be a bearish trend on the daily or weekly chart, while on the H4 chart there will be an upward trend. Naturally, the trend that is present on the higher timeframe will have more weight.

#3: Ignoring risk management

Professional traders say that pipsing and risk management are incompatible concepts. Indeed, when the risks are 100%, what rules for managing them can we talk about? Meanwhile, there are techniques and ways to minimize these risks in order to prevent the loss of your deposit.

First, you need to start with the parameters of the account on which you plan to pip. We wrote about spreads above, but there is also margin leverage. It is highly advisable to take the maximum. For example, with the NPBFX broker you can open accounts with a leverage of 1:1000. The higher the leverage, the lower the margin deposit (the blocked amount in the account) for each transaction. The trader, after opening an order, has more free funds in his account.

This allows you to withstand a floating drawdown on a transaction and have a reserve for maneuver. Let's give an example. With a margin leverage of 1:100, opening a Buy EURUSD transaction at a rate of 1.1000 with a volume of 1 trading lot, the trader’s deposit will be 1100 US dollars. With a leverage of 1:1000, only $110. The difference of $990 can be used to withstand the 99 pip drawdown or to open another trade, which will allow you to earn even more profit.

Secondly, despite the fact that pipsing implies 100% risks, they still need to be controlled. This can be done by adjusting the trading lot size. It is clear that it must be large so that you can earn money by opening transactions of just a few points. However, the transaction volume should not be such that any movement of quotes against you will result in a Stop Out. You must have sufficient free funds in your account after opening a trade (including margin).

For more conservative strategies, professionals recommend maintaining risks of 2-3% per trade. Of course, this is not enough for pipsing. At this level of risk, the lot volume will be small, as will the profit from trading at the exit. When pipsing, you can increase the risk level to 10-15% per trade. For example, with a deposit of $10,000, the trading volume may be 1 standard lot (100,000 units of the base currency). This will allow you to withstand a fairly serious drawdown during a temporary market reversal. You will also be able to open another trade if a clear signal to enter the market for another trading instrument suddenly appears. This approach to trading will allow you to easily open at least 10 trades per day, which will give 20-30 points of profit. Accordingly, 440-660 points per month, which in monetary terms will be 4400-6600 US dollars. It turns out that in a year you can earn about 500% profit or more. In this case, the risks will be significantly reduced.

Conclusion

To summarize, we can draw the following conclusions:

- Piping on Forex can really give a trader significant profits in a short time.

- The risks when pipsing are maximum, but they can be influenced and kept under control. To do this, you need to follow all the recommendations that we reflected in the article, and also trade only through a proven and reliable broker.

We have repeatedly mentioned our long-time partner - the international STP/NDD broker NPBFX - in the material. Indeed, this company provides one of the best trading conditions for using pipsing on Forex: execution speed of 300-600 ms, 0% commission for trading turnover, competitive spreads. In addition, the issue of serving citizens of the Russian Federation is relevant today. The broker has never had any problems with registering, replenishing and withdrawing funds from the accounts of clients from Russia. NPBFX is a member of the international Financial Commission and has the highest Status A. Thanks to this, each client of the broker is insured for 20,000 euros, which can be paid from the regulator’s compensation fund in the event of controversial issues.

The minimum deposit for trading is only 500 rubles, or 10 US dollars/10 euros. Becoming a client of NPBFX is easy; just register on the company’s official website and open a trading account.