The relationship between price and volume in stock trading. Equivolume graph

Many traders, when conducting their analysis on the stock exchange, use only one indicator - volume. The fact is that market volume is the engine of the market, the face of the market and characterizes many processes occurring on the chart.

It is the volume that reflects the liquidity of the instrument, shows the possibility of buying or selling at a favorable price, and is also a magnet that attracts many players.

Each of you who has at least once observed the movement of shares and volume could repeatedly see a picture when a mass of players entered, creating a large volume of positions, simply upsetting the price and taking it far beyond the established range.

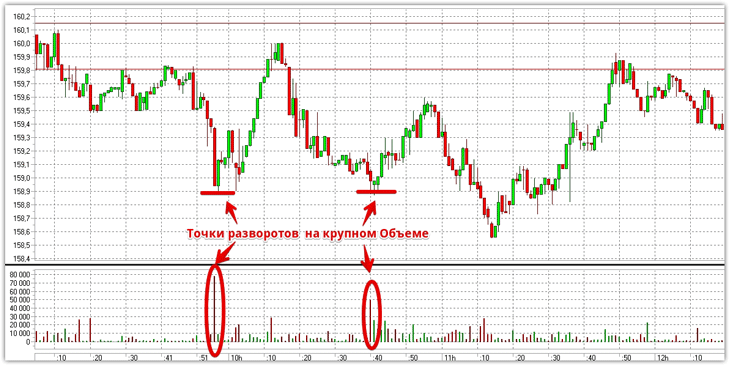

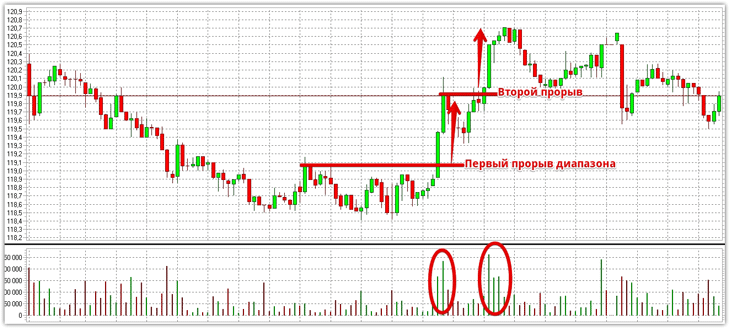

This situation is extremely often observed at a time when a key mass of players is trying to break through a certain psychological price level. It is the appearance of a large volume that can serve as a signal for the end of a trend and a market reversal .

Market volume is a kind of fuel that makes quotes move. The ability to correctly read market volume allows you to promptly recognize the fading of a trend, confirm the strength of a market breakout, or determine whether it is false.

The chart above clearly shows how the price moved by inertia and before the reversal, the volume attenuated.

Thus, an experienced trader could easily read from the chart that there is no major player behind this movement and that a stop and then a reversal may soon occur. Also, the appearance of a large price volume near an important level or at the moment of its breakdown can become confirmation for entering the market.

For example, let's look at the shares of Sberbank, the volume of which shows that behind the breakthrough of local support and resistance levels there was a crowd and a mass of orders, and not market inertia.

Equivolume graph.

Creation in MT4 The so-called equivolume charts are especially popular among traders.

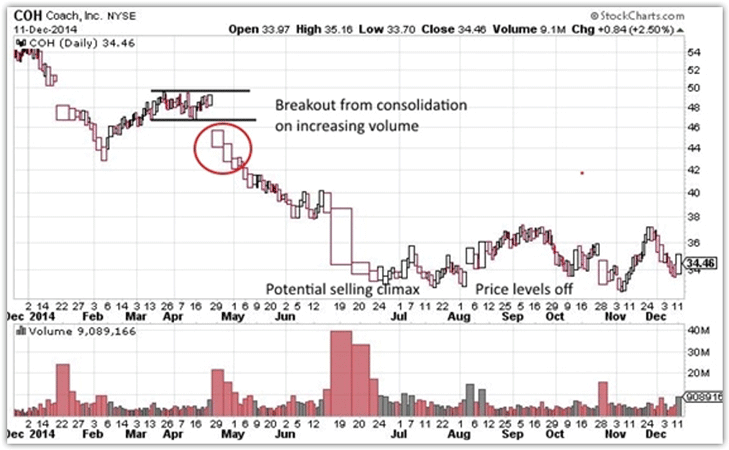

The world first learned about them back in 1971, and their essence is to display market volume not by separately displaying information, but by creating special charts based on it. The implementation of this chart looks visually simple; the higher the volume, the wider the bars are drawn by the terminal. Thus, the trader does not need to look for additional information, and breakout moments or other market situations are perfectly explained by the chart itself.

As an example, we suggest looking at what a level breakout with confirmation looks like on an exvivolume chart:

Unfortunately, in the forex market, unlike the stock exchange, there is no way to measure or see the real volume of transactions, however, tick volume can be measured.

Naturally, for obvious reasons, MT4 does not have this type of chart, but this does not mean that it cannot be implemented in your MT4. In order to implement an equivolume chart in the MT4 trading terminal, we will need to collect the smallest basic information - tick history.

For some reason, the developers do not save tick history, so to collect it we will need a special advisor, TickSave, which, once applied to the chart, will automatically save all tick changes. It is worth understanding that ticks will be saved as long as the trading terminal and the Expert Advisor are working for you.

This history can become the basis for tests, as well as help in constructing equivolume graphs. After collecting data, you need to go directly to transforming your ticks into a special chart.

The principle of constructing an exvivolume chart in MT4 is very similar to constructing a Renko chart. To do this, use the EqualVolumeBars expert. To begin, install the expert in the trading terminal by dropping the EA file into the expert folder of the trading terminal. You can access this folder through the file menu.

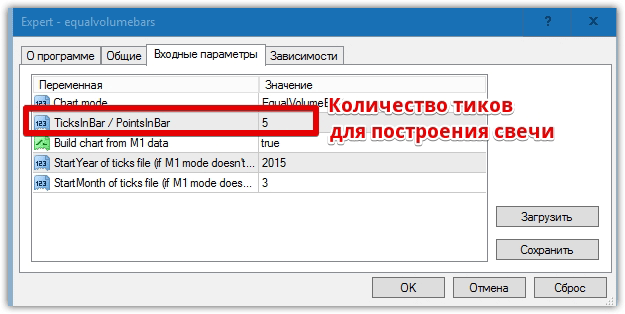

After you have installed the Expert Advisor, apply EqualVolumeBars to the minute chart of any currency pair. In the settings that appear, in the Ticks in Bars line, specify the number of ticks from which one candle will be built.

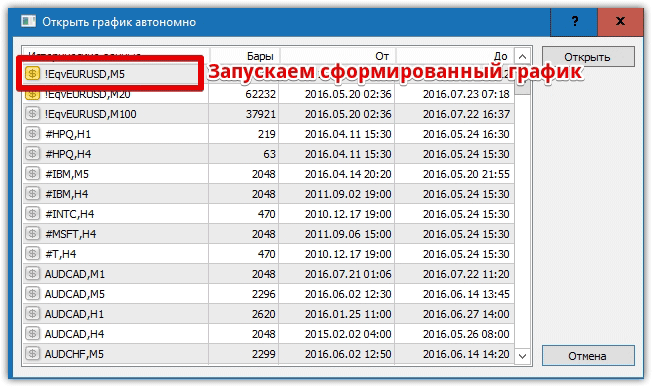

After the expert starts working, you will need to open an offline chart with the assigned name in the number of ticks for one candle. To do this, open the file menu and select the “Open offline” menu item, and then launch a chart corresponding to the size of ticks in candles.

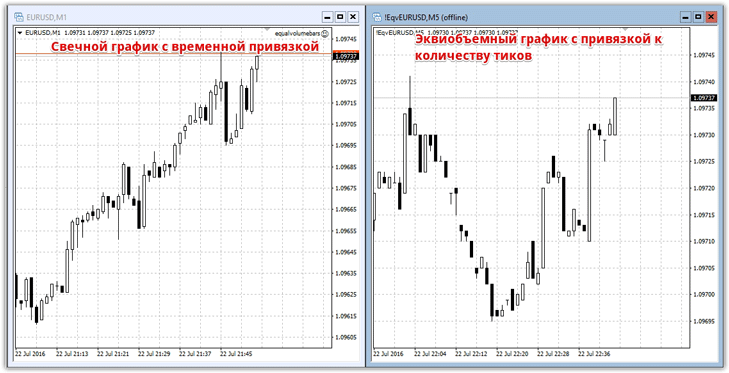

For full operation and the appearance of an equivolume chart online, you must constantly ensure the operation of the EqualVolumeBars expert in a separate window, which will relay ticks to our chart. For an example of a comparison between a regular and an equivolume graph, see below:

In conclusion, I would like to note that volumes have a huge impact on the movement of quotes, and in the first part of the article we tried to show this clearly with examples. If we talk about the equivolume chart for the Forex market, it can be noted that it allows you to look at the price from a completely different angle and will be especially useful for traders using strategies based on pipsing and scalping .

Download the necessary scripts.