Forex trading on Mondays

Exchange trading is influenced by many factors, one of which is the dependence of trend behavior on the day of the week.

Therefore, when analyzing trend movements, one should also not forget about this point; the greatest influence of the day of the week factor is visible on Monday.

It’s not for nothing that Monday is usually called a hard day of the week; this can also be attributed to stock trading.

Moreover, the difficulty of trading on a given day of the week lies not only in the fact that you need to return to work after the weekend, but also in some other aspects.

Features of trading on Mondays

The beginning of the trading week is known for its treachery; many traders, after two days of rest, begin to open transactions and here the following surprises await them:

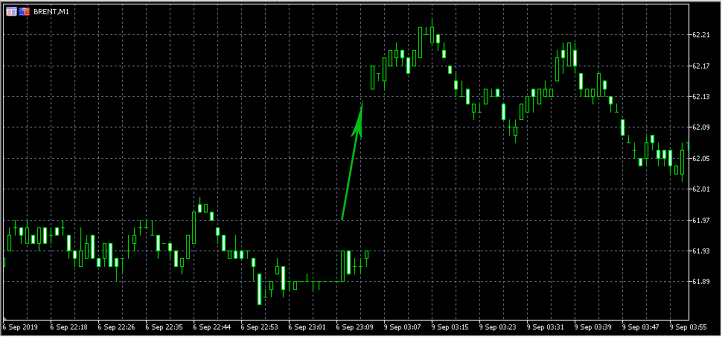

• Gaps – Mondays happen more often than ever, because it’s rare that a weekend goes by without news that doesn’t affect a particular currency.

And since, due to the weekend, news cannot immediately be reflected on the charts of currency pairs, the market reaction occurs only after the opening of the trading session:

True, there is also a pleasant moment: as a rule, a gap appears immediately after the opening of a trading session, when traders have not yet opened new transactions.

True, there is also a pleasant moment: as a rule, a gap appears immediately after the opening of a trading session, when traders have not yet opened new transactions.

In this case, those who have left unclosed orders since Friday are the ones who suffer first, since the price gap does not always occur in the direction of the open position.

At the same time, those who opened positions immediately after the price gap in its direction may also suffer, since there is a rule according to which the price gap must close within one session.

That is, positive news came out on the euro over the weekend and on Monday the price of the EURUSD currency pair opened with a gap at a higher price and began to grow.

You naturally take off a buy deal, since there is an upward trend in the market, but the rule for closing the price gap is triggered, and your stop loss also triggers with it.

Therefore, it is more rational to wait for the gap to close and only then determine the trend or use a trading strategy to close the price gap.

Thus, make the disadvantage of this day of the week your advantage. • Trend reversal – it would seem that the situation has stabilized, the gap has closed, and the price moves on, but even here troubles may await you.

The beginning of a new week is characterized by new news; as a rule, there is much more of it on Monday than on other days of the week, since many weekend events simply did not make it to the press.

The beginning of a new week is characterized by new news; as a rule, there is much more of it on Monday than on other days of the week, since many weekend events simply did not make it to the press.

And news is the basis for changing the existing trend, so when opening a new deal you should be prepared for a change in trend.

At the same time, you can try to make money using a news trading strategy , monitoring new events and opening trades when strong signals appear.

It should be noted that Monday is a rather ambiguous day, but with all its complexity, here you can with equal probability both lose money and make a profit.

Many strategies are specially created specifically for trading on Mondays, because even an unpleasant pattern is a pattern on which you can make money.

Read about the features of trading on other days of the week here - http://time-forex.com/sovet/forex-dni-nedeli