Cryptocurrencies for staking with the highest interest rates

Cryptocurrency staking has become one of the most popular ways to make passive income in the cryptocurrency industry.

The process involves “freezing” a certain number of coins in a wallet or on an exchange to ensure the operation of the blockchain, for which users receive a reward in the form of interest.

However, profitability varies depending on the chosen cryptocurrency and staking platform, taking into account these indicators you can get up to 40% per annum.

But is staking today as profitable as they say?

In this article, we will look at which cryptocurrencies offer the highest interest rates and compare conditions on different exchanges.

Top cryptocurrencies for staking with high profitability

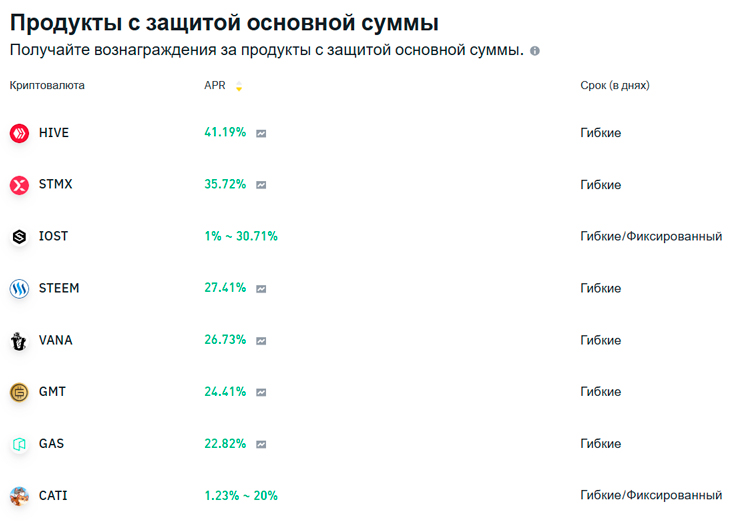

Typically, cryptocurrency exchanges offer quite a lot of tokens for staking; for example, on Binance the following coins can bring the biggest profit:

As a rule, the best interest rate is given on not very popular cryptocurrencies, but for investment it is best to choose the most liquid assets, as this will at least somehow help reduce the risk of exchange rate losses:

Cosmos (ATOM) is a blockchain that offers one of the most stable reward systems for stakers. The average return is about 10-20% per annum depending on the platform. Users can stake ATOM through exchanges such as Binance, OKX and Kraken, or through official Cosmos wallets.

Tezos (XTZ) is one of the first blockchains to support staking, where the process is called “baking.” Tezos staking returns are around 5-20% per annum, making it a popular choice among long-term investors.

Polkadot (DOT) - offers one of the highest returns on the market - about 8-18% per annum. However, DOT staking often requires funds to be locked for up to 28 days, making this option less flexible for traders.

Avalanche (AVAX) - also stands out for its high profitability, reaching 5-11% per year. This cryptocurrency is especially popular on platforms such as Binance and OKX, where AVAX staking is further supported by flexible terms.

USDC (USDC) - offers a yield of about 4-10% per annum. Despite the relatively low interest rates, stablecoin remains one of the most popular cryptocurrencies for staking due to its fixed rate.

Solana (SOL) - provides yield in the range of 5-11% per annum. Staking of SOL is possible through wallets such as Phantom and through centralized exchanges.

Ethereum ( ETH) - provides yield within 2-7% per annum, is popular due to its high liquidity . Staking of SOL is possible through wallets such as Phantom and through centralized exchanges.

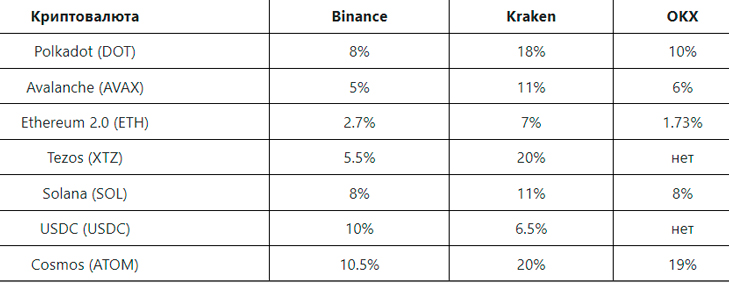

Comparison of staking profitability on different exchanges

For clarity, it is advisable to compare the profitability of cryptocurrencies for staking on exchanges

Please note that the table shows the maximum interest that can be obtained if all conditions are met.

Binance offers flexible staking terms, allowing users to choose between fixed and floating rates.

Kraken is easy to use and offers the highest interest rates on selected cryptocurrencies

The OKX exchange actively promotes high-yield staking, but it may lack some popular assets.

Cryptocurrency staking provides investors with a unique opportunity to receive passive income, but the maximum income that can be received from reliable cryptocurrencies is limited to 20% per annum.