Eurobonds - an investment tool

Private investors in their practice sooner or later come to the desire to start investing in highly profitable assets that

provide the opportunity to earn more than bank interest on foreign currency deposits or deposits in the national currency.

Receiving a fixed foreign exchange income, usually in dollars, can be achieved through the purchase of Eurobonds and Eurobonds.

This investment provides protection against unexpected troubles that happen in the foreign exchange market, such as inflation, devaluation or jumps in currency quotes.

What are Eurobonds?

Eurobonds are a special type of Eurobond. The simplest definition of Eurobonds is that they are debt securities denominated in a currency that is foreign to the state or company issuing these bonds.

For example, Rosneft's Eurobonds are denominated in dollar debt, and Apple's Eurobonds are their bonds, denominated, in particular, in Chinese currency.

Why did bonds receive the prefix “euro”?

The fact is that this type of securities was first issued in Italy in 1963 and now it has simply become a tradition. There is no longer any connection to the geography of Europe, since such debt obligations are common throughout the world.

How do these securities work?

For example, the issuer (as the state or company is called) has planned to finance a current or future project, expand its activities, or close some financial issue.

To implement these plans, they attract loans.

This happens through the production of emissions, i.e. issue of securities called Eurobonds. Investors purchase issued Eurobonds, which means they provide finance to the issuer.

In return, investors receive fixed income payments, usually 1-2 times a year. This method of financing can be described more simply: investors lend money to the issuer, and the issuer pays investors interest on the borrowed funds that were designated when the bonds were issued.

At the end of the loan term, the issuer returns the debt in full. The most reliable are government bonds, since debt obligations are assumed by the state. Interest on bonds issued by the state is lower than on corporate bonds:

The yields on Eurobonds issued by companies are somewhat higher, but the risks are also high.

The yields on Eurobonds issued by companies are somewhat higher, but the risks are also high.

Typically, the higher the percentage, and it can be up to 10%, the riskier the investment is considered. As a result, an investor who has made an investment in Eurobonds can receive dollar income within the range of 2-3% and up to 6-8% per annum.

The main risk and feature of Eurobonds is the exposure of their yield to the influence of not only the interest rate on the bond, but also the exchange rate, which is not constant.

In 2014-2015, it was Eurobonds that became the most profitable for investors, significantly exceeding income from investments in bank deposits, from the purchase of gold, shares and real estate.

However, another scenario should be taken into account: if the exchange rate of a currency, for example the ruble, strengthens, the yield on Eurobonds calculated in rubles may turn out to be negative.

Which is better - Eurobonds or dividend shares?

Investing in Eurobonds is reminiscent of investing in shares, although they are only the same at first glance.

Each type of security has its own characteristics, which means it must be based on the individual needs of investors. In addition, there is no general opinion as to whether an investor should make a better choice – dividend shares or Eurobonds.

As we have already said, everyone decides for themselves. Here's what we can tell you to help.

Shares can be purchased for long-term investment, but in times of crisis their prices may decline sharply. Therefore, the recommendations of experienced investors come down to having both stocks and bonds in your portfolio.

Debt securities continue to generate income during a crisis, and these funds can be invested in buying stocks that have fallen in price. When the economy is booming, stocks rise, and investors already make money on their growth, while continuing to receive fixed income on Eurobonds.

How to buy Eurobonds

There are 3 ways to buy Eurobonds for an ordinary investor:

1. Independent purchase.

This will require $1000 or more. Yes, this investment is not for the average investor; 2. Investing in Eurobond ETF shares.

Eurobond ETFs include shares of many companies included in the top lists: Severstal, Sberbank, Rosneft, Gazprom, etc.; 3. Buy a share in a mutual fund (we can say that this is a kind of analogue of an ETF).

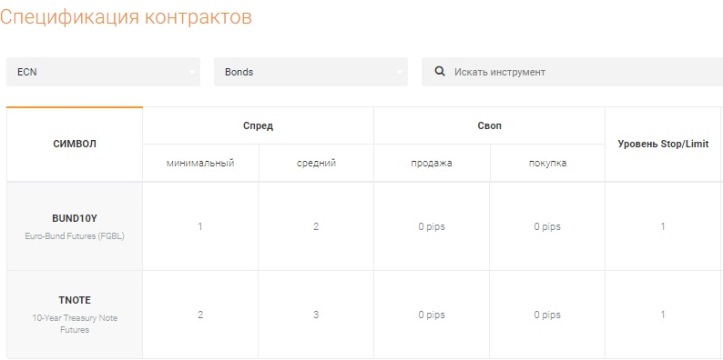

There is a fourth way to invest - buying Eurobonds from a Forex broker. Let's take for example the company AMarkets , which has two types of bonds: BUND10Y and TNOTE:

Here's what you need to do to be able to trade them:

Here's what you need to do to be able to trade them:

- open an account with a broker. Eurobonds are available on an ECN account ;

- download the trading terminal to your computer;

- contact a manager who will advise how best to organize the transaction.

An investor has the opportunity to install a trading application on his smartphone or tablet.

AMarkets client gets access to charts, the ability to determine the trend and conclude transactions on Eurobonds. Advantages of trading with a broker:

- You will not need to go through the qualification procedure, which is necessary to gain access to sites when trading bonds.

- Relatively small initial capital.

- Margin trading opportunities.

When you trade with a broker, his entire team is on your side, all of his analysts are ready to help you, and this is another plus in favor of trading with a broker.