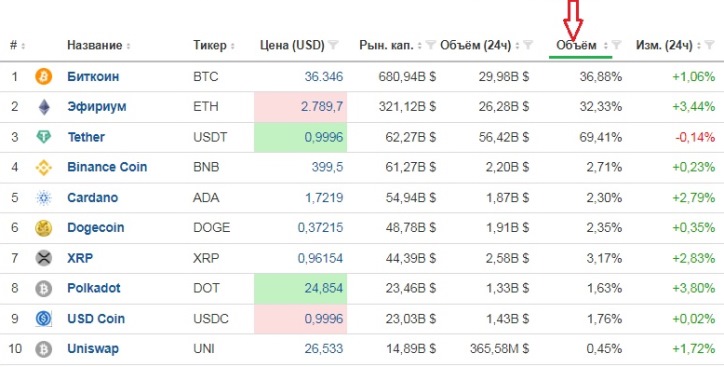

Trading volumes as an assistant when trading cryptocurrencies

One of the biggest things about trading cryptocurrencies is that even in this unusual market, standard market laws apply.

Here you can also apply strategies that are successfully used on currency pairs and conduct technical analysis using indicators.

There are many indicators that characterize the trend, one of the most striking of which is the total volume of transactions performed.

That is, for what amount are transactions concluded during a certain time period - an hour, a day, a week.

The table of cryptocurrency quotations itself is available on the site - Plugins/System/Oyl/SRC/Redirect.php

What do cryptocurrency transaction volumes show?

An increase in transaction volumes for a certain cryptocurrency confirms the existing trend, that is, when the price falls, most sellers sell because they are confident that the price will continue to decline, and with an upward trend, the number of buyers who hope for an increase in the rate of the chosen cryptocurrency increases.

This means that by observing changes in the daily volume indicator for a particular cryptocurrency, we can say how much market participants support this trend.

If volumes fall, we can say with great confidence that the price will soon change its direction or the market will enter a flat state .

As an assistant when trading on volumes, you can also use standard indicators from the metatrader trading platform:

There are as many as four of them, and if you wish, you can install your own volume indicator that will fully satisfy your needs.

It should be noted that the volume indicator is not a one hundred percent guarantee of trend confirmation, and any important news can quickly reverse the existing trend. Therefore, when opening trades, always control the situation and insure your positions with stop orders .