The collapse of the US stock market 2025, what awaits American companies in the future

After the high -profile statements of US President Trump and the subsequent actions to introduce trade duties, the stock markets rushed to the bottom.

In response to these actions and other countries, they said that they would also limit the sale of American goods in their markets

The named events led to the collapse of the US stock market and the fall in the cost of most shares of American companies, which have already been cheaper since the beginning of the year.

In two days alone, the S&P 500 and NASDAQ indices lost more than 10%, and the total market losses amounted to over $ 3 trillions of American dollars.

Not only trading wars served as a signal of a new descending trend . Experts call the main reasons the greatest collapse since 2020:

- Trade wars: the introduction of high tariffs for imports from China, the EU and other countries.

- Political instability: threats of displacement of the chairman of the Fed Jerome Powell.

- Economic fears: growth in inflation, a decrease in consumer confidence and fears about the recession.

At the time of April 2025, as a result of the collapse of the US stock market, the following sectors suffered the greatest losses - primarily those that are sensitive to macroeconomic risks, trade restrictions and a decrease in consumer demand:

| Sector | The reasons for the fall | Average fall |

|---|---|---|

| Technologies | Trade wars, growth in bets, correction after overheating | −25% to −40% |

| Consumer goods | Decrease in demand, price increase, reduction of household expenses | −20% to −35% |

| Semiconductors | Dependence on global chains, restrictions with China | −25% to −30% |

| Financial sector | Risks of recession, pressure on banks, reduction of marginality | −15% to −25% |

| Advertising and media | Reduction of marketing budgets of companies | −20% to −30% |

It is not surprising that the most popular and famous companies were the most affected in these sectors:

| Company | Sector | Fall since the beginning of 2025 |

|---|---|---|

| Tesla (TSLA) | Electric cars / technology | −40% |

| Alphabet (Googl) | Technology / Advertising | −35% |

| Apple (Aapl) | Consumer technologies | −32% |

| Intel (Intc) | Semiconductors | −31% |

| Trade Desk (TTD) | Adtech / Advertising | −29% |

| Deckers brands (Deck) | Consumer goods | −27% |

| NVIDIA (NVDA) | AI / semiconductors | −25% |

| Meta Platforms (META) | Social networks / advertising | −24% |

| Amazon (Amzn) | Electronic commerce | −22% |

| Jefferies Financial (JEF) | Financial services | −21% |

True, it is not entirely clear why some of the shares presented in the list have fallen in price, because these companies will practically not affect the trade war. Perhaps they simply succumbed to the common trend and will restore their value in the near future.

Opporters for investors: crisis as a chance

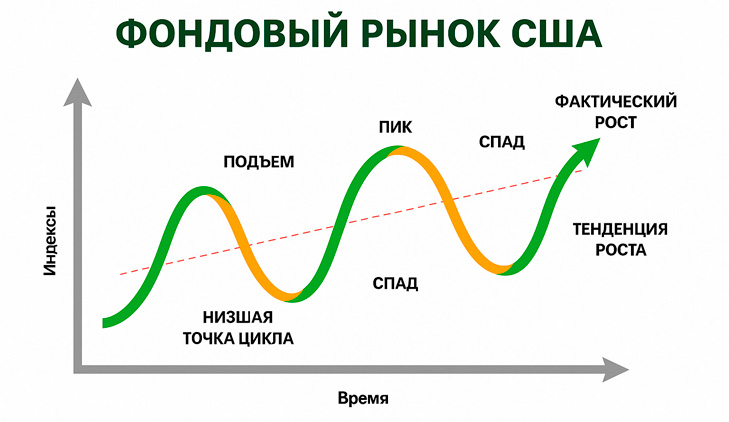

The collapse of the US stock market is not only a reason for anxiety, but also a unique window of opportunities for long -term investors.

The story has repeatedly proved: during periods of a sharp drop in prices for shares, you can purchase strong companies at a significantly low cost, which means to get the maximum growth potential in the future.

Historical examples of recovery:

DOTCOMS collapse (2000-2002)

- Nasdaq index fell by more than 75%

- Amazon shares were traded below $ 6 (now> $ 3,000 to Split)

The recovery took several years, but brought investors tens of a short profit

Financial crisis (2008–2009)

- The S&P 500 index lost more than 50%

- Banks, Auto Conceases, IT - all were on the verge of collapse

From 2009 to 2020, the market has grown more than 5 times

Coronavirus collapse (March 2020)

- Markets fell by 35% in 1 month

However, by the end of the year, historical maximums were updated and the company's technological sector showed explosive growth.

Therefore, in the current situation, only you decide whether to sell existing shares of American companies, wait for recovery, or can buy more.