Central banks are increasingly giving their preference to “non-reserve” currencies when building reserves

The US dollar has long been one of the key currencies in the world. Today it continues to play a leading role, even as the American economy's share of global output declines.

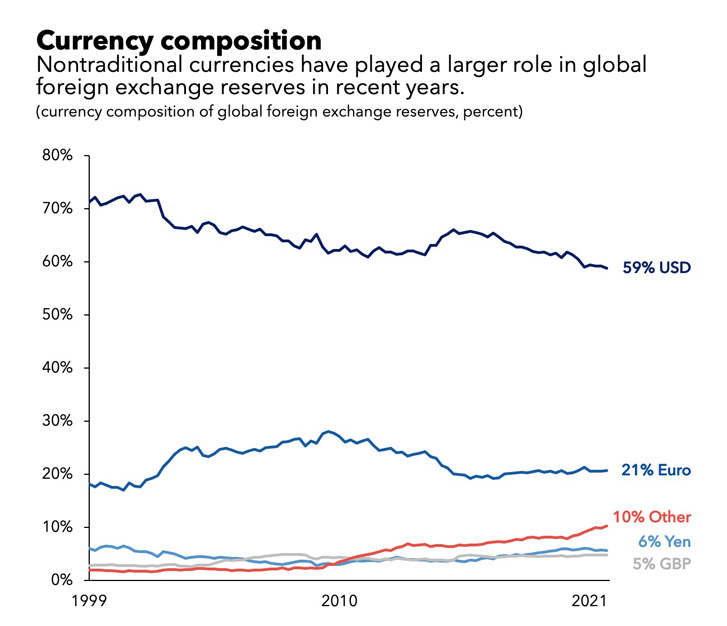

However, central banks hold fewer dollars in their reserves than before. Last year, the dollar's share of global foreign exchange reserves fell below 59%, continuing a trend over the past 20 years.

The first blow to the dominance of the American currency was the emergence of the main competitor of the Euro; currently the European currency occupies about 20% of the Central Bank's reserves.

In recent years, the economies of Europe and the United States have been going through difficult times; this fact cannot but affect the popularity of the currencies of these countries. Therefore, new trends are beginning to appear in the policies of central banks.

In addition to the US dollar, the share of other traditional reserve currencies, such as the euro, yen and pound, is gradually declining.

At the same time, the share of currencies from smaller economies, such as the Australian and Canadian dollars, the Swedish krona and the South Korean won, is growing.

Why do central banks prefer less liquid currencies ?

- These currencies offer higher returns with relatively low volatility.

- New financial technologies make it easier to trade illiquid currencies.

- The economies of the countries that issue these currencies are in a stable state.

- Central banks have bilateral swap lines with the US Federal Reserve. This means that the central banks of these countries can quickly exchange their currencies for US dollars if necessary.

At the same time, it is important to note that swap lines are not a perfect substitute for actual reserves. Non-traditional reserve currencies tend to float, meaning their value can fluctuate against the dollar.

The best explanation for this situation is that “non-reserve” currencies are issued by countries with open economies and stable policies.

Such countries are more reliable partners for doing business, and this increases the demand for their currencies and makes currencies more attractive for reserve.

Given this trend, it is worth thinking about introducing new assets into your investment portfolio, such as the Canadian and Australian dollar, Swedish krona, or AOE dirham. Such diversification will help to more reliably protect your own savings.