How to invest in a PAMM account, registration, choice and profit

In modern conditions, when the inflation rate is simply off the charts, the issue of preserving earned savings becomes especially acute.

Traditional investment options do not provide the required level of income because the interest rates offered are lower than the rate at which money depreciates.

Investments in securities require a certain qualification of the investor, and the stock market itself is now quite unstable, companies often refuse to pay dividends, a clear example of this is Gazprom.

Therefore, almost the only worthy option at the moment is investing in PAMM accounts; with the right approach, you can achieve the best balance of profitability and risk.

How to invest in a PAMM account and how much money do you need for this?

The easiest way to talk about how to invest in a PAMM account will be with a specific example; in general, the process is not complicated and does not require much time.

Selecting a company and Registration - at the first stage, you should choose a company that has a PAMM account rating - https://time-forex.com/pamm-brokery On my own, I would recommend the broker Alpari .

Then register and upload identification documents; usually the whole process takes no more than an hour.

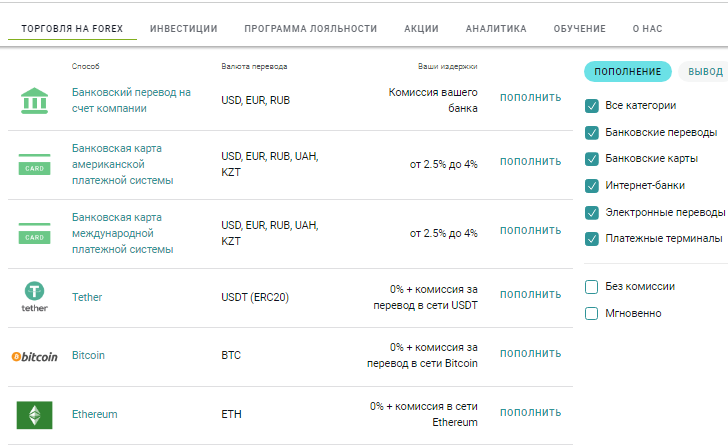

Replenishment of the account and the required amount - to start investing you need to deposit money, top up the account in your personal account:

Money can be deposited in a dozen different ways, from a standard bank transfer to replenishment using cryptocurrencies.

As for the minimum replenishment amount, most managers accept contributions from an amount of 100 US dollars. So it depends on how many accounts you want to invest in.

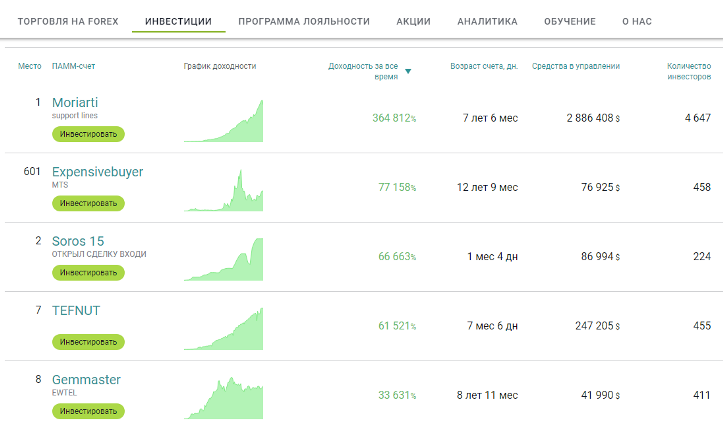

Selecting a manager - the easiest way is to use the rating and select managers who are at the top of the rating.

But to diversify investments and reduce risks, it is better to combine accounts with high profitability and accounts with minimal risk when forming an investment portfolio. The recommended portfolio size is from 5 to 10 accounts, and the available funds should be distributed between them.

Fortunately, there is plenty to choose from; ratings in large brokerage companies consist of several thousand PAMM accounts.

I hope you don’t have any questions about how to invest in a PAMM account, but I would like to warn you that this type of investment is not a guarantee of profit and your manager may end the month with both record profits and losses, so you need to wisely distribute funds between several managers .

Alpari website - www.alpari.com