What is the best PAMM account from a leading broker and is it worth investing in it?

Over the past two years, the inflation rate has been rapidly increasing, and this requires active action to protect one’s capital.

At the same time, the situation on the investment market is quite ambiguous, the price of gold is marking time, the stock market is overbought, and bank deposits do not cover inflation.

Therefore, more and more people are paying attention to investments in PAMM accounts, which allow them to make good money in these difficult times.

At the same time, most newcomers are attracted by accounts that have shown maximum profitability for the reporting period; it is this indicator that is the decisive argument when choosing a manager.

But as a rule, the most profitable PAMM accounts often turn out to be the riskiest, and subsequent losses quickly eat up the profits.

The most effective option is to take into account all important indicators - profitability, lifespan, drawdown amount.

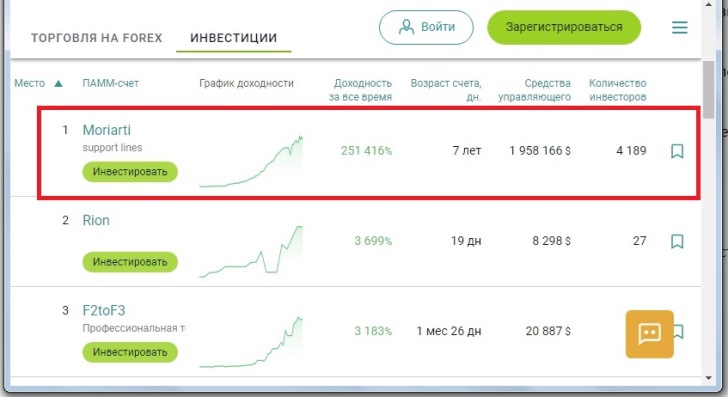

An excellent example of such an account is “Moriarti”, which rightfully occupies the top line in the PAMM rating from Alpari :

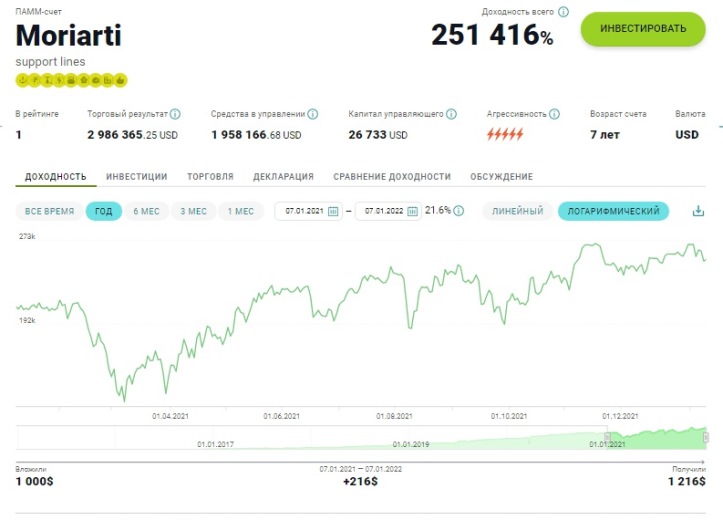

The mere fact that this account has existed for 7 years best characterizes its reliability and stability; it is not for nothing that almost 2 million US dollars are under management.

Profitability for the last year was 21.69%, and the manager's capital is $26,000:

At first glance, it seems that “Moriarti” is the best PAMM account in which you can safely invest money, but if you look at it more skeptically, then it is not without its shortcomings.

• Profitability – 21.69% for the last year. But if you invest less than $500, then 40% of this amount goes to the manager, that is, you are left with about 13%. For investments of more than $30,000, the manager’s share of the profit is reduced to 20%.

• Landings and losses – in February 2021, trading was carried out with a loss, which for the month amounted to -22.48%. Yes, after that the loss was compensated by the profits received in the following months, but how nervous the investors were when they realized that in a month they had lost more than they had earned in the previous year.

We can say that the “ Moriarti ” account is quite worthy of attention, but I would not recommend investing all your funds only in this, the best PAMM rating account from Alpari.

It is advisable to invest no more than 20% of the available capital in it, and divide the remaining funds between other accounts from the rating. Thus, protecting your savings from possible unpleasant surprises, and possibly increasing the profitability of investments.