What to choose: investing in a PAMM account or subscribing to signals

Not every person likes the job of a trader, and not everyone has the specific abilities that are necessary for stock trading.

But everyone wants to earn money quickly and a lot, preferably without making any special efforts and without wasting time on study.

PAMM provides similar opportunities by investing in the stock trading of others and receiving rewards for the invested funds.

It should be noted that every year the possibilities for such investments are significantly expanding, and more and more different options are appearing.

Currently, an investor can not only invest in trust management, but also use the following options:

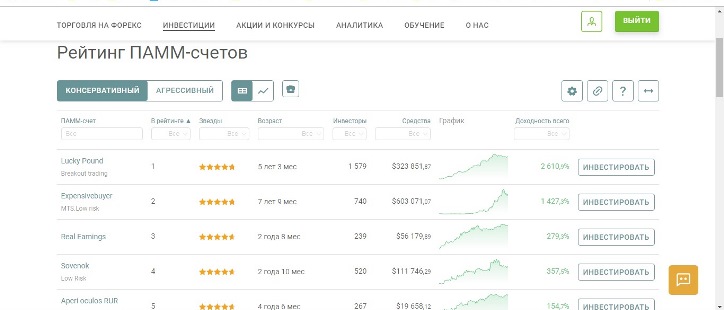

PAMM account – available from many brokers, it is practically one of the easiest ways to make money by investing funds.

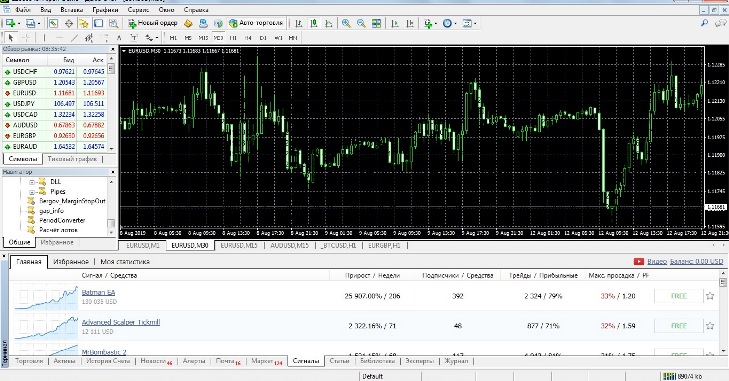

Signals in MetaTrader 4 – the user downloads the MetaTrader 4 trading platform from the broker he likes and installs it on a computer or other device.

Signals in MetaTrader 4 – the user downloads the MetaTrader 4 trading platform from the broker he likes and installs it on a computer or other device.

Then he funds his account and selects the signal provider he likes for opening trades on the “Signals” tab:

There are also special platforms designed for copying signals, but they are less common and therefore we will talk about them in other articles.

There are also special platforms designed for copying signals, but they are less common and therefore we will talk about them in other articles.

As a result, the future investor is faced with a difficult choice: should he choose PAMM or signals in the trading terminal?

To make the right choice, you need to compare both options.

• Complexity of the investment – it can be said that receiving signals may seem a little more difficult at first glance.

And to be more precise, you will need an order of magnitude more actions than when investing in PAMMs. Among other things, you will need to download the trader’s terminal, install it, register for MQL5, and also choose from whom to receive signals.

That is, you will have to spend an hour more time, not so much if you are going to invest a large amount.

• Choice – there are simply a huge number of signal suppliers in metatrader, but as for PAMM accounts, not everything is so simple. Only large brokerage companies , although not all of them have investment accounts.

If we evaluate the convenience of choice, then I liked the metatrader more, it immediately indicates the maximum amount of loss allowed by the trader and there is no need to click on the account itself as in the pam rating.

• Risk management is perhaps the most important issue; when investing in PAMM accounts, it is almost impossible to limit the amount of loss, after which the money will be withdrawn from the investment account.

And if it is possible, then this figure is rarely below 50%, that is, if circumstances are unfortunate, you will lose at least half of your funds.

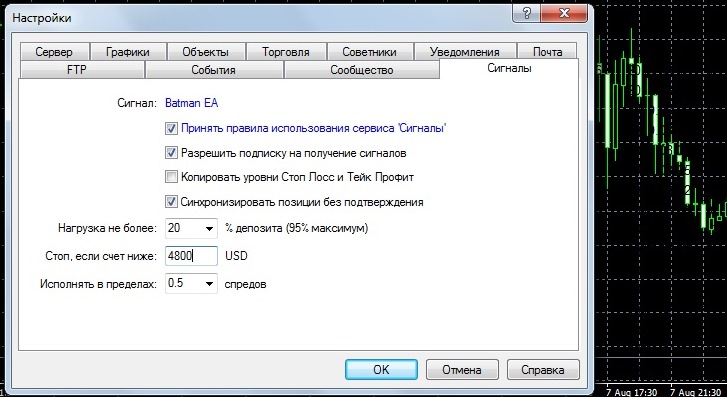

At the same time, in MetaTrader there is a choice; you can simply copy the signal provider’s stops or set your own:

At the same time, you can also set a lot of other parameters, such as the volume of transactions taking into account the size of your deposit, the maximum allowable loss and the maximum allowable spread .

At the same time, you can also set a lot of other parameters, such as the volume of transactions taking into account the size of your deposit, the maximum allowable loss and the maximum allowable spread .

In addition, we can’t help but mention the speed of withdrawal of funds. If in signals you simply cancel your subscription and the money is always available for withdrawal, then in Pamma you will have to wait from one to several accounts.

At the end of all that has been said, we can conclude that it is easier to invest in PAMM accounts, but it is safer and more comfortable to subscribe to signals in the trading terminal. Therefore, it is better to spend an extra hour or two, but be sure of the safety of your funds.