Dollar currency pairs and trading them.

Any asset has its own characteristics and behavior, so before you start trading using any trading strategy, you should calculate three times whether your tactics are suitable for possible price changes, volatility, and chart behavior in different trading sessions.

any trading strategy, you should calculate three times whether your tactics are suitable for possible price changes, volatility, and chart behavior in different trading sessions.

Before starting a review of various dollar instruments, I would like to recall the three main groups of quotes in relation to the dollar, namely direct, reverse, and cross rates.

A typical example of a direct quote is USD/JPY due to its widespread use, but what do you understand in a direct quote, the USD symbol is always the first, followed by the symbol of another currency.

A direct quote shows how much a certain currency needs to be given for one dollar.

In a reverse quote, the USD symbol is located after another currency, for example GBP/USD, and shows us how many dollars we need to pay for 1 unit of currency, and in our case, for 1 pound.

The cross rate is characterized by the fact that USD is simply absent in this currency pair. Understanding the difference between the types of quotes is necessary for the correct interpretation of news, fundamental analysis , as well as technical analysis.

The most common and frequently used dollar currency pair is EUR/USD. Many resources recommend that everyone starting to trade with it. However, before you start trading, you must understand that technical analysis works very poorly on this instrument, and the pair is sensitive to all sorts of news and rumors.

As you probably already understood, we are dealing with an inverse quote, so if there is bad news on the USD, the chart of the currency pair will go up, and if there is positive news, the chart will go down. Due to the large turnover of funds when trading, you will not see strong speculative movements, as can be seen with exotic currency pairs, however, the pair has average volatility and often moves unpredictably within the day.

If we talk about pegs to trading sessions, then EUR/USD is very active in the European and American trading sessions, but in the Asian currency pair falls asleep and moves in the range from 5 to 15 points.

The second most popular dollar currency pair is considered to be GBP/USD due to the fact that the Pound is the third most traded currency in the world. The pair is characterized by very high volatility, and if on the Euro/Dollar 200 points passed by the price is rare, then on GBP/USD such daily movement is considered the norm.

This currency pair is very destructive for traders who use technical analysis due to its strong and unpredictable price jumps with instant pullbacks. However, there is a sensitive reaction to the release of news in the UK and the USA, and high activity can only be seen during the European and American trading sessions.

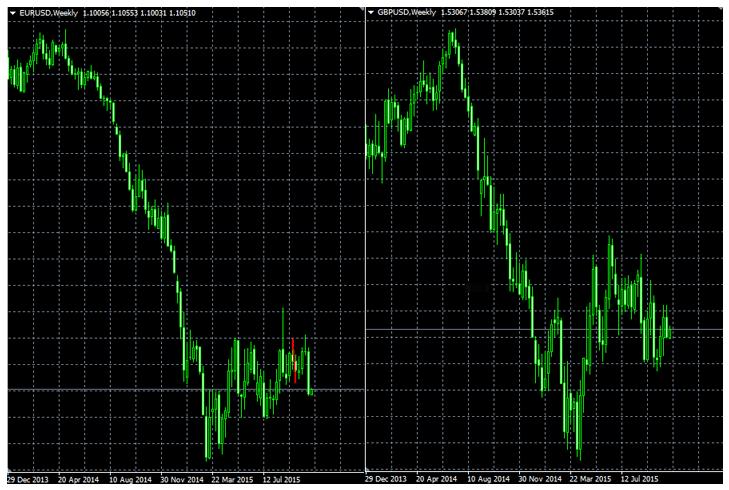

GBP/USD is a very complex currency pair, so I recommend that all beginners not even approach it. Another feature of this currency pair is its high correlation with EUR/USD, so if you have a signal to sell on one currency pair and buy on another, then you should think about the fact that the charts move almost the same way and something is wrong here That. We see the correlation of pairs in the image below:

The third commonly used dollar currency pair is USD/JPY. The popularity of using this currency pair is caused by the yen itself, since it is the main trading currency in the Asian region. The peculiarity of this pair is that it is very active during the Asian trading session, and simply put, all the main movement is observed at night.

The third commonly used dollar currency pair is USD/JPY. The popularity of using this currency pair is caused by the yen itself, since it is the main trading currency in the Asian region. The peculiarity of this pair is that it is very active during the Asian trading session, and simply put, all the main movement is observed at night.

The instrument is very volatile and poorly predictable, but responds well to the publication of news on the US economy and is sensitive to the statement of the head of the Central Bank of Japan. This dollar currency pair is attractive primarily to scalpers who make money on such unpredictable markets.

Also very interesting for most traders are such currency pairs as USD/CAD and AUD/USD. I specifically combined them into one group, since both Canada and Australia are considered highly dependent on commodity prices, since both countries are the largest exporters. However, the behavior of these currency pairs is radically different, and if CAD grows when oil prices rise, then AUD grows when prices for metals and minerals rise.

An interesting feature when trading USD/CAD appears in the form of a mirror correlation with the EUR/USD currency pair, with the main activity occurring during the American trading session. AUD/USD is very popular among investors, since we can observe a downward trend since the middle of 2013, and for this currency pair there is no specific link to trading sessions and the chart movements themselves are very predictable.

Technical analysis works well on both instruments, which is complemented by major fundamental news on the dollar. I suggest you familiarize yourself with the weekly chart of AUD/USD to understand the profitability of trading on this instrument:

Also, among the dollar currency pairs, I would like to highlight NZD/USD, which is also considered a commodity pair. However, unlike the two listed above, its rate proportionally depends on the price of copper, and if the price of copper rises, then the NZD/USD chart goes up. The currency pair has average volatility , lends itself very well to technical analysis, and is also characterized by constant trend movements, so it is of interest to both beginners and experienced investors. From mid-2014 to the present day, there has been a clear downward trend on the weekly chart, which you can see in the picture below:

Also, among the dollar currency pairs, I would like to highlight NZD/USD, which is also considered a commodity pair. However, unlike the two listed above, its rate proportionally depends on the price of copper, and if the price of copper rises, then the NZD/USD chart goes up. The currency pair has average volatility , lends itself very well to technical analysis, and is also characterized by constant trend movements, so it is of interest to both beginners and experienced investors. From mid-2014 to the present day, there has been a clear downward trend on the weekly chart, which you can see in the picture below:

In general, each dollar currency pair has a number of its own characteristics that must be taken into account. However, when choosing an instrument, try to focus your attention on your deposit capabilities, since the more exotic and less popular the pair, the higher its spread. Also, do not neglect our recommendations and work with poorly forecasted and highly volatile currency pairs , on which it is very difficult to apply technical analysis .

In general, each dollar currency pair has a number of its own characteristics that must be taken into account. However, when choosing an instrument, try to focus your attention on your deposit capabilities, since the more exotic and less popular the pair, the higher its spread. Also, do not neglect our recommendations and work with poorly forecasted and highly volatile currency pairs , on which it is very difficult to apply technical analysis .