Choosing the direction of a trade during a gap in Forex.

such a phenomenon as a gap  transactions at the wrong time,

transactions at the wrong time,

A gap is a price gap that occurs in cases when the market, for some reason, does not have time to display the price movement in the form of a quote.

The size of the price gap can vary from several points to several hundred points, depending on the strength of the factors that contributed to the appearance of the gap.

In which direction should trades be opened when a price gap appears?

It all depends on the situation in which the price gap occurred and its direction to the existing trend.

• A trend gap is a rather complex situation in which the price gap occurs in the direction of the existing trend.

It would seem that a deal should be opened in the direction of the price gap, but most often this type of gap is followed by a long correction , sometimes until the price gap is completely covered.

It would seem that a deal should be opened in the direction of the price gap, but most often this type of gap is followed by a long correction , sometimes until the price gap is completely covered.

It is this that can cause the stop loss to be triggered and, accordingly, the occurrence of losses, therefore, with a trend gap, short-term transactions are most often opened in the direction opposite to the direction of the price gap.

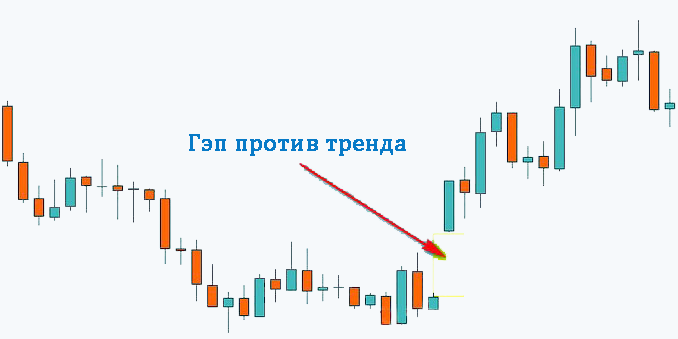

• A gap against the trend is a more attractive option, since this situation most likely indicates that a reversal has occurred, which means that a new price movement will last for some time.

Moreover, the opening of transactions does not occur immediately after the gap occurs, but after the completion of the first correction towards the newly formed trend.

Moreover, the opening of transactions does not occur immediately after the gap occurs, but after the completion of the first correction towards the newly formed trend.

Gap trading is one of the most common strategies on Forex , but despite its apparent simplicity in its use, there are a lot of features that should be taken into account when opening transactions. For example, it would be a good idea to inquire about the event that caused the price gap.