Optimal F program for risk adjustment in Forex

There are many different models of money management, but as practice shows, most of them are not used by traders, but either a static lot or a certain percentage of the deposit per position.

The most interesting thing is that the most common method of money management , in which a trader uses either a certain part of the deposit or a certain percentage for one transaction, which is essentially the same thing, can cause your deposit to be drained.

This may shock many, but the usual risk rule of 2 percent of the deposit or $100 per trade has caused the loss of millions of traders.

Unfortunately, most traders, when choosing a certain capital model, do not even think about whether it is suitable for them, but use it only because it is necessary or so said in most books.

The Optimal F program allows you to calculate the optimal share of capital that should be risked when opening a position. Using the program, you can find the optimal share value specifically for your trading tactics based on the transactions that you previously opened.

The program itself allows you to analyze how effectively you attract your funds during the trading process, which will allow you to further adjust your chosen capital management model.

Installation of the program and appearance

After downloading the program, you will find that it is designed in the form of a regular table for Excel, so you only need Excel and basic knowledge of working with the program.

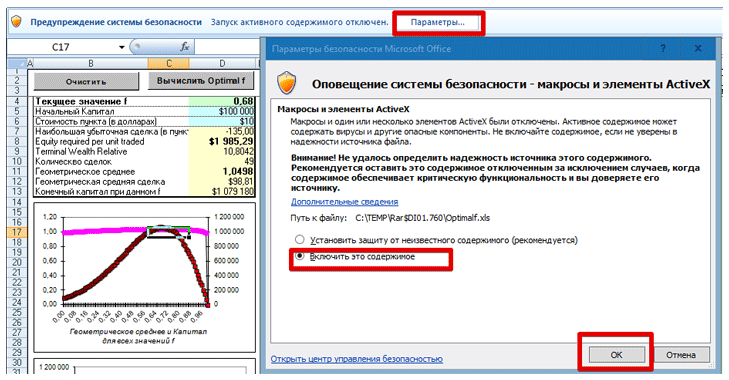

Once you launch Optimal F, a security message will appear at the top line asking you to give permission to use Macros.

After you do this, the program will work normally. Working with the program

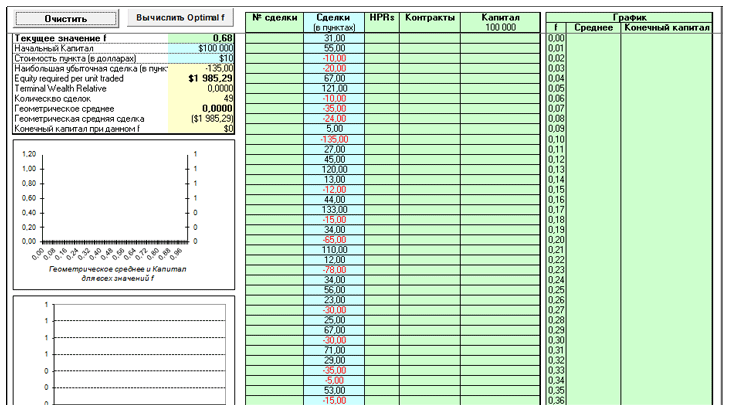

After the first launch of the program, you will see a table in which all transactions and the F optimal value are immediately calculated.

You will need to clear it by clicking on the “Clear” button in the upper left corner. After you do this, all tables will be automatically cleared, and you can proceed directly to calculations.

The first thing you need to do after you have cleared the table is to pay attention in the left corner to the columns “Initial capital” and “ Cost of one point in dollars ”.

Enter in these lines the size of your personal deposit, as well as the cost of one point for a specific instrument for which the risk share is calculated. After you have entered these values, go to the “Transactions in points” column and fill in for each of your transactions from history its profit with a positive or negative value in points.

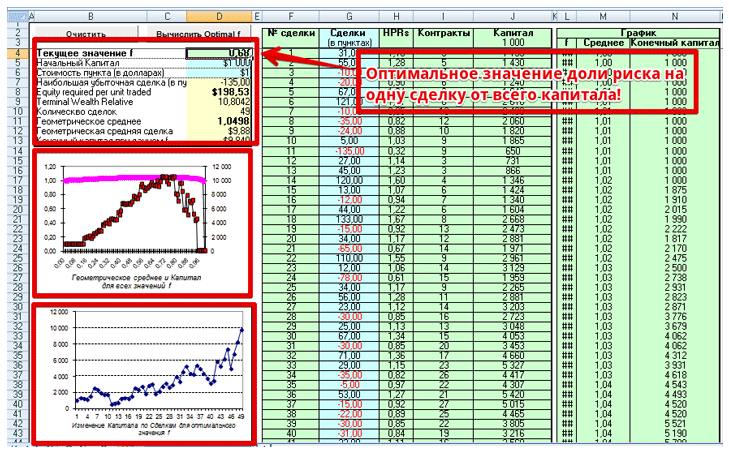

It is very important to enter the maximum number of trades as this will allow the program to calculate the optimal percentage of your capital that should be used in trading for maximum profit. After you have entered all the necessary values into the table in the upper corner, click on the “Calculate Optimal F” button. The program will automatically fill in all the necessary values and give you the optimal risk percentage per trade for your capital and strategy .

Also, the program will automatically calculate the maximum losing trade in points, show the geometric average, the geometric average trade, as well as the final capital that you would have received if you had used the optimal share that the program calculated for you.

Also, for clarity, the program builds a graph of the geometric average capital for all values of the optimal share, as well as a graph of changes in capital for the calculated optimal share of capital.

In conclusion, I would like to note that the program allows you to determine the optimal share of risk specifically for your trading tactics and deposit.

However, it is worth understanding that this value is dynamic, therefore, as the deposit grows and new transaction statistics accumulate, calculations should be made regularly and this value adjusted. Download Optimal F