Currency exchange on the Forex exchange, frequently asked questions

Currently, people increasingly have to resort to exchanging one currency for another, some change money for their own needs, and others for speculative purposes.

At the same time, everyone understands that the most favorable exchange rate should be directly on the Forex currency exchange, since a minimum number of intermediaries are involved in the process.

In addition, due to the current situation, sometimes it is simply not possible to exchange currencies at a bank or exchange office, so many people ask the question - why not exchange money for Forex?

Indeed, exchanging currency on the Forex exchange has a lot of advantages - minimal commission, a large selection of currencies, the ability to complete the transaction online.

Nuances of currency exchange on the Forex exchange

Registration - firstly, in order to make an exchange you will need to open an account with a broker , only after that you can carry out the transaction.

In addition, you will have to confirm your identity with the appropriate documents - passport, place of residence.

You cannot withdraw the exchanged currency - that is, if you exchanged American dollars for Japanese yen in the trading platform, this does not mean that you can safely withdraw the purchased yen to your bank account.

In practice, everything is much more complicated, the transaction is considered completed only after it is closed, in our case, the sale of the yen for dollars, as a result you will again have American dollars in your account. Therefore, the currency purchased on Forex cannot be withdrawn to your bank account or withdrawn in cash:

You can only make money on the exchange rate if the yen you purchased goes up in price during the period of the transaction, then when you close the position you will make a profit from the increase in the exchange rate.

However, it should be noted that most brokers provide the opportunity to perform internal exchanges in the trader’s personal account. But at the moment, only the following assets can be the account currency - dollar, euro, ruble, gold, bitcoin, and exchange is carried out only between these assets.

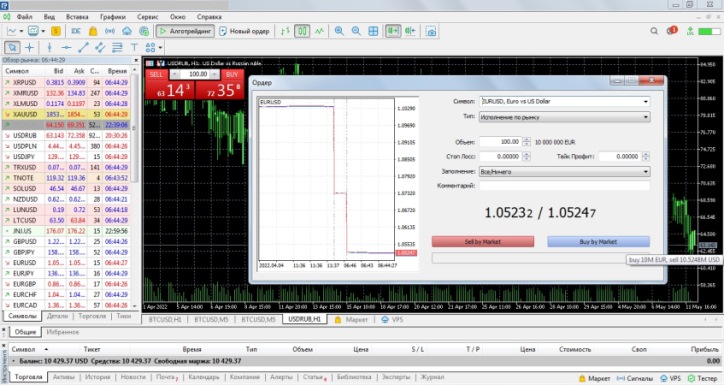

Trading platform - technically, currency exchange on the Forex exchange is more complicated than in a bank; in order to complete a transaction you will need to use a trading platform:

The software is free and quite simple, but it still takes some time to master. However, it should be noted that the trading possibilities using the trading platform are much wider than when simply exchanging one asset for another - using leverage, placing pending orders, uncovered transactions, etc.

Therefore, in conclusion, we can say that currency exchange for Forex is more suitable for non-cash, speculative or investment transactions, but with its help you will not be able to buy currency and hide it under the mattress at home.

That is, you can use this method to exchange the national currency for a harder one and store the funds with the broker for the required amount of time, and if necessary, make the exchange again and withdraw the money. A pleasant bonus is the high interest rate on deposits in foreign currency, which sometimes reaches 20% per annum - https://time-forex.com/inv/depozit-bolshoy-procent

Brokers with whom you can open an account - https://time-forex.com/reyting-dilingovyh-centrov