Methods for taking profits in Forex

Many traders sin on entry points, because they are confident that their profitability directly depends on entering the market. However, in practice, often the inability to correctly record profits leads to a decrease in the balance.

The fact is that most traders, even if they do not admit it, have an inferiority complex in terms of taking profits.

Unfortunately, this complex appears almost at the very first stages of a trader’s development, so even pros may not suspect the reason for their losses.

Each of you who is actively trading has more than once noticed a situation where a multi-day profitable position along a trend becomes negative in one second after the publication of some news and causes damage to your balance.

If you are affected by this situation for the first time, you are a lucky person, but when a trader, to put it mildly, is repeatedly taken out of a profitable position by the footsteps, fear and fear of losing profits appears.

Basic profit taking methods

Conventionally, all methods of fixing profits can be divided into manual and automatic. The manual method of taking profit means early closing of an order manually without the intervention of a broker or your MT4 program. So, if we talk about manual methods of taking profits, we can distinguish two main methods, namely partial closing of a position, as well as positive locking of orders.

Partial closure

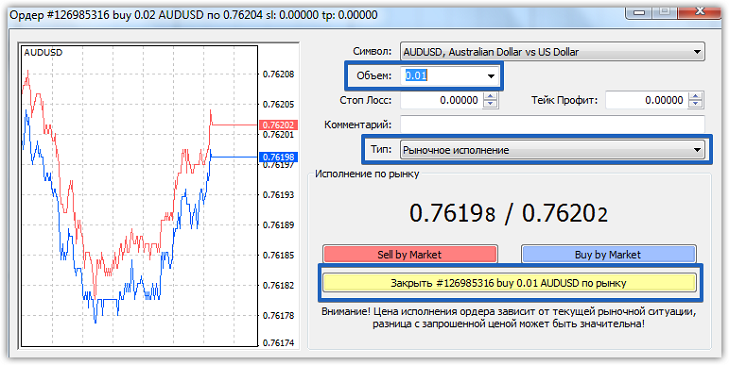

Forex traders using the MT4 trading platform do not even suspect that the position you opened can be closed not entirely, but partially. For example, if you opened a position with 1 lot and having received a certain profit, you doubt that the price will continue to move, you can fix part of the position, for example 0.5 lot, and leave half in the market.

In order to do this, double-click on your order and a window will appear in front of you in which you can modify the order. Select market execution in the “Type” tab. Next, in the “Volume” column, enter the volume of the position you want to close, and then select “Close”.

This approach allows you to save part of your profits from unforeseen situations, however, if you abuse this fixation method, you can lose a significant part of your funds due to your fears and fears.

Positive Locking

Some traders believe that locking orders is a method of limiting losses. However, in reality, using a lock can also lock in your profits. To do this, you will need to open an order in the opposite direction with an equal volume of your position. Since one order will bring a loss, and the second will bring profit, your profit will be fixed at the same level.

If we talk about the advantages and disadvantages of this approach, then the disadvantages include the loss on commission when opening an order. One of the advantages of this approach is the fact that, if you have experience, you can skillfully resolve the lock near strong support and resistance levels, turning a protective order into additional profit.

Fixed profit

Fixed profit is a standard function of your trading terminal, which is available both at the time of opening an order and at the time of modifying the order after it is closed. Fixing profit using Take Profit is the simplest, but at the same time the most effective method. However, in order to effectively use this method, you need to do careful work on the historical period in order to adjust your strategy to market volatility.

If we talk about automatic methods, there are only two of them, namely trailing stops directly in the trading terminal as a basic function or special advanced assistant advisors.

Trailing Stop Method

The essence of this profit-taking method is to ensure that the trading terminal automatically transfers your stop order to a specified number of points as the price moves. Thus, after a certain step, your protective order is transferred and profit is taken, and the more straightforward the trend in the market, the greater the distance in points you can take from it.

Actually, the disadvantage of standard trailing is its roughness, so various scripts and advisors allow you to make trailing more flexible using various parameters (indentation from the entry point, trailing step, and so on). However, it is worth understanding that due to increased volatility, you can be knocked out of the market much earlier than you would have established a simple profit.

Which method should you choose?

As you can see, each of the methods described above has its own advantages and disadvantages. When choosing a specific method, you first need to focus on your trading strategy, but you should understand that if you cannot control your emotions, then trailing stops, both in the terminal and with the help of special advisors, are an excellent solution to the problem.