How to disable leverage

Forex trading has gained popularity precisely because of the presence of leverage, which makes it possible to use the broker's money when opening transactions.

But margin trading has both positive and negative sides; an increase in the volume of positions leads to a proportional increase in profits in successful transactions or losses in unsuccessful ones.

High leverage is the main reason for large drawdowns or even loss of deposits.

That’s why many newcomers ask such an interesting question – “How to disable leverage” and thereby reduce the risk of possible losses?

That is, these investors want to trade exclusively with their own money, when the financial result is proportional to the deposit and does not increase due to leverage.

At that time, if the transaction was carried out only with one’s own funds, then 1% was taken from a volume of $1,000, and the trader lost only $10. The difference is leverage size.

Trading only with your own deposit will also reduce the potential profit that you can get if the transaction is successful. Therefore, “the question is how to disable leverage?” These questions are asked more by those who not so much want to earn a lot as they are afraid of losing their money.

Disabling leverage

First of all, it should be said that when using leverage you are not obliged to open orders with the maximum volume available to you.

That is, with a deposit of 10,000 euros and a leverage of 1:100 on the account, no one forces you to open a deal for 1 million euros.

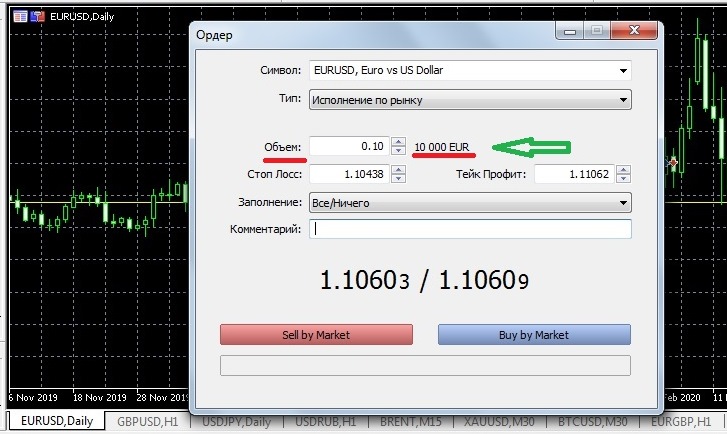

In the trading platform you can choose a smaller size:

Therefore, despite the 1:100 leverage available to you, you have the opportunity to choose a much smaller position volume.

Therefore, despite the 1:100 leverage available to you, you have the opportunity to choose a much smaller position volume.

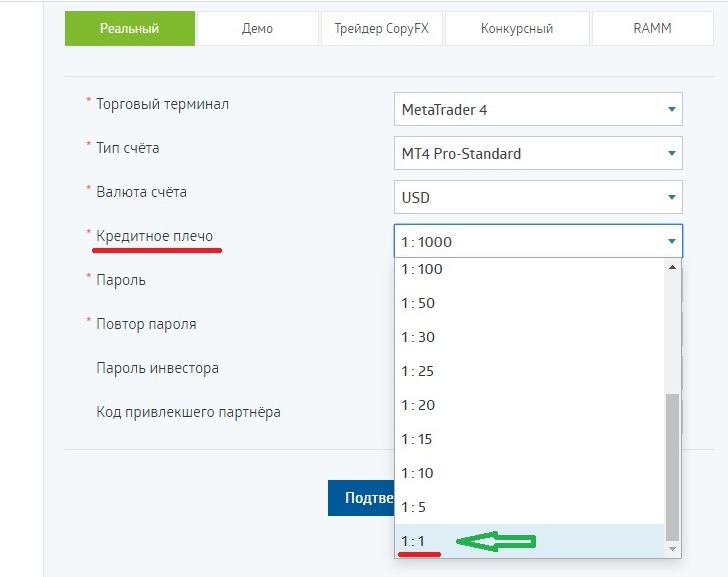

In addition, when registering with a broker , namely, when opening a new account, you can also select the maximum leverage size that will be used in trading:

And if you choose 1:1, then even if you want, you will not open a deal with a larger volume than the amount you have.

And if you choose 1:1, then even if you want, you will not open a deal with a larger volume than the amount you have.

You should choose this trading option only if the amount of your funds is quite impressive, since the price of currencies, shares or other assets rarely changes per day by more than tenths of a percent.

That is, with the same transaction of 10,000 euros and a change in the rate by 0.1% per day, you will earn 10 euros, and this is still a good scenario.

Read also - How much can you earn on Forex .