What is the taxes tab for in the Metatrader trading platform?

When working in the Metatrader trading platform, at times you do not notice the emergence of new features of this software.

So this time, not all traders paid attention to the “Taxes” tab that appeared in the MetaTrader 4 trading platform.

Thanks to the new function, you can find out in advance how much taxes you will have to pay on your profits from Forex trading.

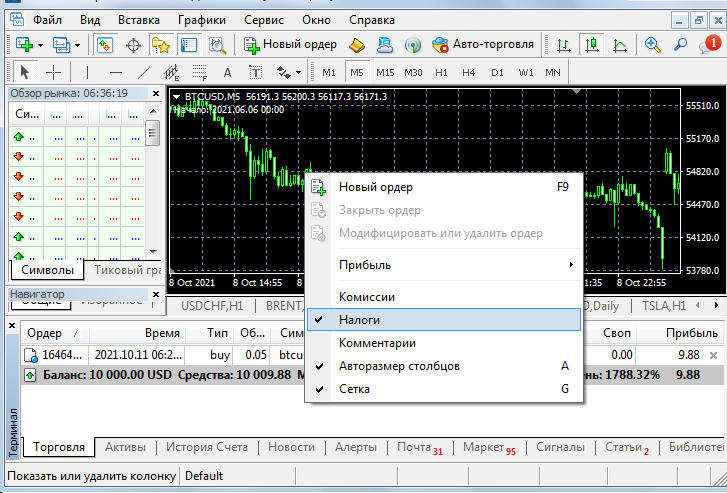

The “Taxes” tab is not always displayed by default; sometimes for it to appear you need to hover your mouse over the trade area (trade tab) and press the right button.

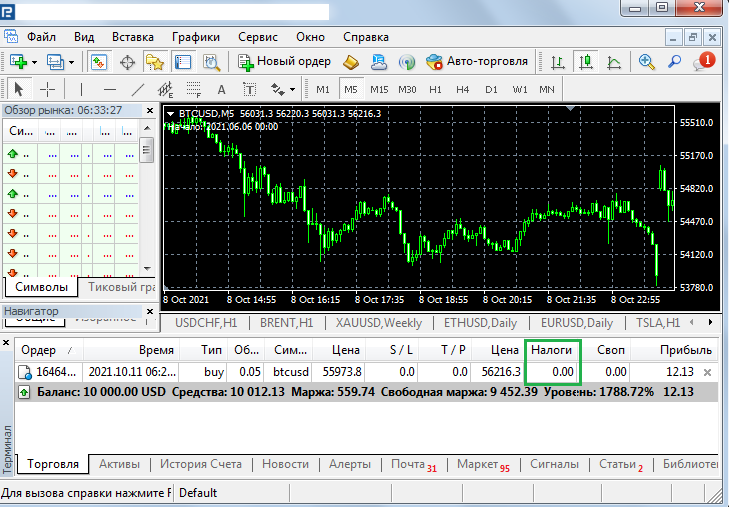

After this, check the box next to the inscription “Taxes”, as a result, in addition to the usual columns in the trade area, you will also have a column in which accrued taxes will be displayed.

After this, check the box next to the inscription “Taxes”, as a result, in addition to the usual columns in the trade area, you will also have a column in which accrued taxes will be displayed.

In fact, your broker is responsible for enabling this function; it is he who configures its operation and sets the tax percentage.

Technically, it looks like this - you are a resident of the Russian Federation and your profit is taxed at 13%, the broker sets this parameter in your account settings.

More information about taxation on Forex - https://time-forex.com/info/nalogi-s-zarabotka-na-foreks

After you have opened an order and started receiving profit, the accrued tax will be automatically calculated, and the tax itself will be written off only when this profit is withdrawn from the broker's account to your personal bank account.

That is, you have accrued $200 profit on your order, which means 200*13%/100 = $26 tax, if you close the order with this profit and try to withdraw it, then instead of $200, $176 will be available for withdrawal.

But why in some trading platforms, even when making a profit, the “Taxes” column still displays 0?

No need to be surprised, there are several possible answers:

The broker does not arbitrarily set up this function in your trading account, but you will still have to pay taxes when withdrawing funds.

The broker does not fall under the jurisdiction of the Russian Federation and does not collect taxes from its residents; you will be paid the full amount of profit, and you will pay taxes yourself at your request. Examples of such brokers - https://time-forex.com/spisok-brokerov

In this case, on the “Trade” tab in the “Taxes” column, a zero value will always be displayed, so this column can be hidden.

We can say that calculating taxes in the trading platform has no practical meaning; it is more of an informational amount, since the final profit can only be calculated at the end of the month, taking into account all open transactions and paid commissions .