Without indicator scalping. From theory to practice

Unfortunately, many traders to this day conduct discussions and disputes among themselves about the effectiveness of one or another tool that analyzes the market.

One part of traders are adherents technical analysis and recognize only indicators, another part of traders plunges headlong into fundamental analysis, however, there is a third category of traders who practice without indicator trading.

The most interesting thing is that despite all the controversy, each tool and approach to market analysis is simply individual, regardless of trading techniques.

The only thing that remains unchanged in the minds of traders is that it is impossible to scalp without auxiliary tools in the Forex market, and as a result, it is almost impossible to find strategies without using indicators in the market noise.

A completely logical question arises: is scalping on Forex possible without indicators and what tools can become its basis?

Surely you are interested in the question, why is scalping possible without indicators and can bring significant profit to the trader, because small time frames are constantly filled with market noise?

The answer is quite simple - all trading, one way or another, is tied to working with the trend, which is present on all time frames.

Yes, on older time frames the movements are larger and more sweeping, but no one has canceled micro trends, which have exactly the same structure and phases only with the condition that there is a slight difference in scale and time frame.

Basics without indicator scalping. Simple set of tools

As we already noted in our introduction, the trend that flat is also present on small time frames, and the price behavior itself is practically no different from higher time frames.

Thus, without indicator scalping, I can use any patterns of price behavior in certain trading sessions and graphical analysis tools as a basis.

Using graphical analysis tools, you can actively receive signals from trend lines, support and resistance levels, channels and ranges, Fibonacci lines and levels.

Also, reversal patterns such as head and shoulders, double and trophy bottoms, double and triple tops, and cups with handles are great for building scalping strategies without indicators.

In addition to reversal figures of graphical analysis, a strategy without indicator scalping can be built on the basis of candlestick analysis, using such figures as a hammer, a hanged man, three soldiers and three black crows, a belt grab, a morning and evening star, and so on.

For informational purposes, we will introduce you to a very simple “Three offensive candles” strategy without indicators.

Strategy three offensive candles. Without indicator scalping on M5

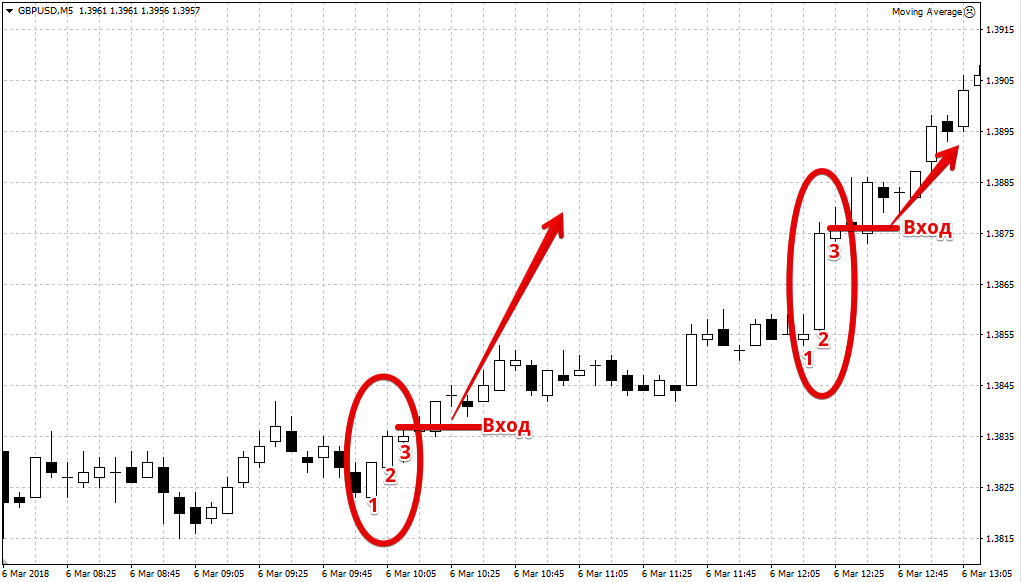

The “Three Offensive Candles” strategy is based on the prototype of the “Three White Soldiers” candlestick pattern, but in the strategy itself there is no clear reference to the type of figure, and the main thing is that three white or three black candles are recorded in a row.

More about candlestick analysis - http://time-forex.com/ys

Trading should take place on a five-minute chart, and any currency pairs are suitable for implementing the strategy, but instruments with high volatility are truly effective.

It is very important to note that this pattern most often occurs at the beginning of the European or American session, while trading during the Asian session is strictly prohibited. So, let's move directly to strategy signals and their implementation.

Buy signal:

1) Three bullish candles closed in a row on the chart. It is very important that the first candle is not huge, as happens with news.

A buy position is opened only after the candle closes. It is worth noting that by default the strategy does not apply either a profit or a stop order.

So if the price moves about 30 points against you, you must either block the loss by placing a buy order with exactly the same volume, or simply record the loss.

Exit from the market must be done according to trailing foot, which will allow you to pull out the maximum number of points. Example:

1) Three bearish candlesticks closed in a row on the chart. It is very important that the first candle is not huge, as happens with news.

As in the option with purchases, the loss is fixed by opening a counter order with the same volume if the price passes 30 points against the transaction. Exit from a position should be using a trailing stop. Example:

In conclusion, it is worth noting that scalping without indicators has a number of advantages, since your signals will almost never lag, and you can implement such strategies even on your mobile phone!