How real is Bitcoin scalping, features of the strategy

Scalping is one of the most attractive areas in trading, which provides the trader with a fairly high profitability, which can be several times higher than the average profitability of any trend or intraday trading strategy .

However, having a clear algorithm of actions, namely a strategy, is far from sufficient to work with such a method of market analysis.

The fact is that the effectiveness of a scalper depends largely on the trading conditions of the broker, as well as the specifics of the selected asset.

So, if one strategy can show excellent results for one currency pair, it is far from a fact that such a strategy will show continuous losses for a completely different trading asset.

There is a direct relationship between the choice of asset and the effectiveness of the strategy, and in this article you will find out how promising Bitcoin scalping is and whether it is advisable to work with this cryptocurrency using scalping strategies.

Key points when scalping Bitcoin.

To select an asset for short-term strategies, there are a number of criteria, namely the number of points that the price passes per day, which is also volatility , the cost of the asset and margin collateral, the amount of leverage, and the cost of one point.

So, if we talk about the volatility of the asset, that is, the number of points that the price passes on average per day, Bitcoin has simply phenomenal indicators.

Thus, according to the latest data, the price on average overcomes 19 thousand points in different directions in one trading day, which no major currency pair can boast of.

This was primarily caused by the huge hype, which led to the enormous popularity of this instrument among investors.

However, due to the lack of large market makers who create liquidity, as well as the weak capitalization of Bitcoin compared to major currencies, all traders can observe constant quote gaps and the appearance of defective candles.

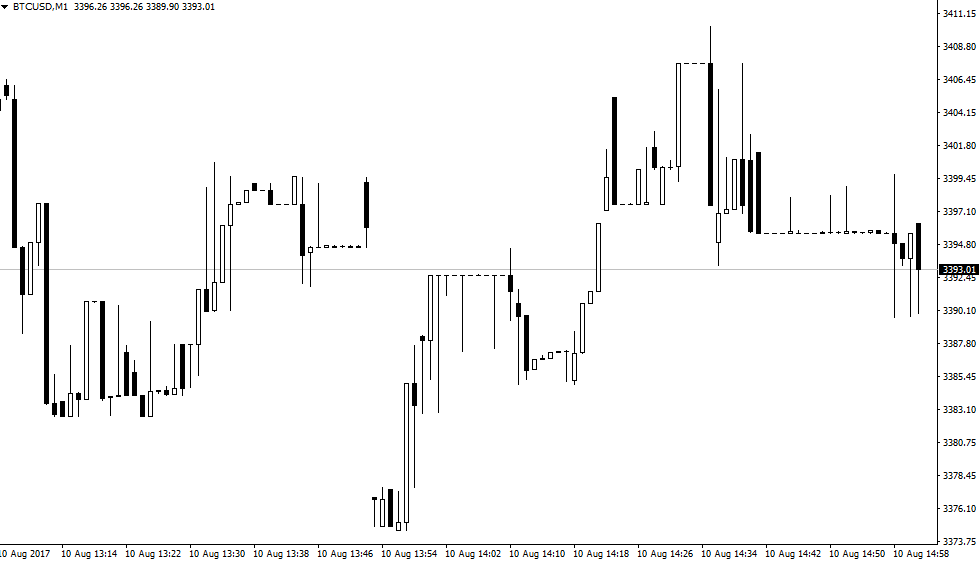

This situation occurs because any strong inflow or outflow of money from Bitcoin necessarily affects the market, which can be observed firsthand if you look at the working minute chart of any scalper:

Naturally, in such conditions it is quite difficult to oppose something to the market, since any technical analysis tools will show a biased picture of what is happening.

If we consider the trading conditions of the two largest brokers Roboforex and AMarkets for bitcoin, it turns out that the maximum trading leverage that a trader can use is 1 to 50, and the minimum volume for opening a position is one bitcoin.

Thus, having a leverage of 1 to 50, to open one transaction at a price of 40,000, you will need a margin of about $800.

Naturally, such trading conditions immediately eliminate traders with small capital, who, as a rule, come to scalping in order to disperse the deposit .

Also, a rather large spread, which, as a rule, fluctuates around 1000 points, does not indicate Bitcoin scalping.

If we take into account that the cost of a point is 1 cent, then when opening a position the trader will see a loss of -10 dollars on his balance sheet, which is quite a significant amount.

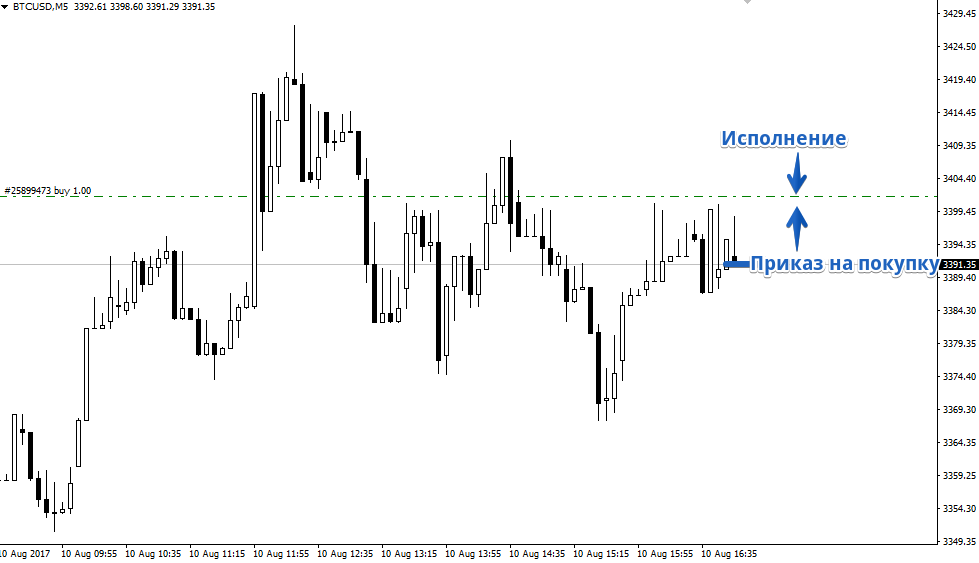

It is also worth mentioning the fact that due to the large spread, the opening price of the trade will be far from the price at which you observe the market signal.

As an example, I suggest looking at the last candle on the chart from which we received a market signal and the place where the position was activated due to a large spread. The price on the chart is not current at the moment.

In conclusion, we can only state the fact that in the classical sense, scalping Bitcoin on a one-minute or five-minute interval is simply impossible.

Because a huge spread for potential small targets (a few points or a couple of candles) from a mathematical point of view spoils the whole picture.

It is also important to mention the margin provision and the lack of large leverage , which would compensate for the lack of deposits of most traders.

However, for intraday trading with adequate goals, Bitcoin can be a very good choice; an intraday strategy using it will allow you to easily double your deposit in a short period of time.

It should also be noted that the trading conditions of brokers are constantly changing and you can clarify the current state of affairs by following the links to the websites of cryptocurrency brokers - https://time-forex.com/kriptovaluty/brokery-kriptovalut