Scalping by order book, a simple and effective earning strategy

Scalping is one of the most common trading tactics in both the stock exchange and the forex market.

Many traders confuse the concept of scalping with intraday trading, considering opening orders with small targets and stops to be the basis of this strategy.

In fact, such a blurring of the concept of scalping happened because there is no such depth of market in the Forex market, which simply led to a substitution of concepts.

This order book is present on the stock exchange, which allows you to assess the real market situation and make transactions with a target in a couple of ticks.

Platforms for scalping by order book

It is no secret to most traders that the MT4 and MT5 trading platforms have a fictitious order book, in which you will never see either the volume of transactions or the cash flows behind the sellers or buyers.

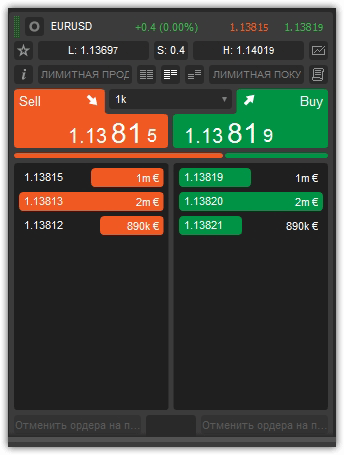

For this purpose, a completely new progressive ECN platform cTrader was developed, which for the first time had an exchange order book, where cash flows are visible.

In the cTrader trading platform, you have three different tools available to you, namely standard order book, price and VWAP. There is no fundamental difference between these tools; the only thing that changes is the presentation of information.

See an example from Trader below:

If you want to take part in trading on the Moscow Stock Exchange.

You will need the QUIK Junior trading platform. You can gain access to the stock market through a specialized broker, but only on the stock exchange is the order book the most informative, so if you are interested in real scalping by order book, then you simply need the QUIK trading terminal.

The QUIK terminal is shown below:

The basic principle of operation

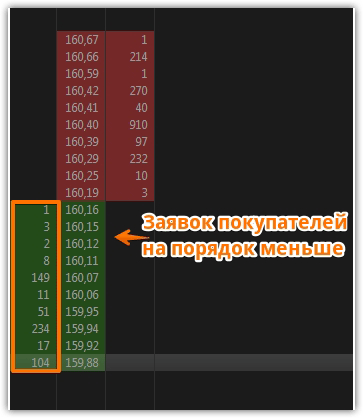

The order book is a table in which you can observe orders from both sellers and buyers at a certain price.

At the top, the price values are displayed in red, sellers' orders are displayed, and at the bottom, the values of which are highlighted in green, buyers' orders are displayed. It is no secret that the market is always provoked by price movements either by sellers or buyers, so tracking certain orders allows you to keep a certain vector.

The basics of scalping by glass

Before you start scalping, you need to understand that behind all orders in the glass there are real people who pursue their own goals.

When scalping in our case, no matter how strange it may sound, forget about the chart forever, since you will get all the necessary information directly from the glass. When scalping by order book, your main task is to determine what exceeds supply or demand.

To do this, you need to look directly at the red or green area of the order book and the number of orders. As a rule, the market moves towards the empty order book, namely in the direction where the number of orders is an order of magnitude smaller.

When implementing a strategy, your main task is after you have decided on the leaders in a given market situation, you need to identify the major players.

A major player is a kind of anchor for the trader, from whom all trading will be conducted. The main task of a scalper is to repeat the plan of a major player. After you have found out which side clearly has an advantage and have found a major player on the application, you must place an application in front of the major player in order to not only repeat his plan but also play ahead of the curve.

A completely logical question arises: why stands in front of a major player? To begin with, you must understand that when you stand in front of a major player, you have a kind of support in the form of his orders, and the price in the event of a move against you will primarily rest on his orders, which will most likely lead to a rebound in the direction you need.

Setting goals.

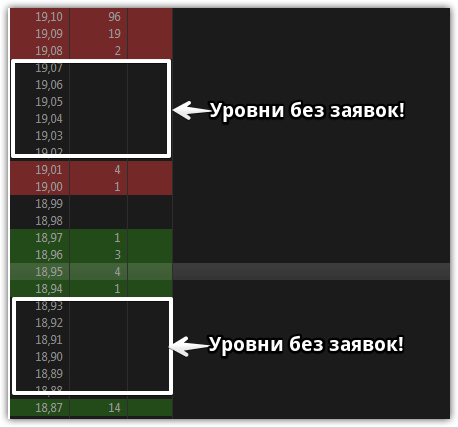

In order to understand what target your scalping operations can easily achieve in the event of a strong movement, you should enable the discharged order book feature.

So, the discharged one, in contrast to the standard one, displays areas where there are no requests from both sellers and buyers. Thus, if you see such zones, you can be completely sure that they are not protected by any orders, and the market will easily overcome these zones. An example of discharged and unprotected areas can be seen below:

It is worth noting that when implementing the “Scalping by order book” strategy, it is very important not only to be absorbed in the process, because the rate of changes in orders is really high, but also to monitor the risks, namely, to use special scripts and scalper drives.

Also, do not forget that when catching a large player, he, in turn, can place false orders and quickly withdraw them in order to deceive the crowd, so monitor such phenomena very clearly and do not jump into the market at the sight of every major investor.