Minute MAX MACD strategy

Scalping strategies, compared to other trading tactics, allow you to achieve increased profitability in a short period of time.

Moreover, with proper money management, as a rule, the risk per position in points is so minimal that if you used a trend strategy and received one stop order of 60 points, then when scalping you would have to allow 4-6 losing trades in a row, which would receive the same losses.

Such increased profitability is achieved by capturing any micro movements that can only be observed on the minute chart.

The minute strategy, like no other, requires the full presence of the trader and very cold-blooded trading tactics.

Scalping without a clear strategy is chaotic transactions that will never lead to anything good. That is why the MAX MACD minute strategy will allow you to make your trading systematic, without any unpredictable actions.

Based on the name, you probably already guessed that the strategy is adapted for trading on a minute chart, and the choice of a currency pair or metal rests strictly with the trader himself, since the strategy is universal.

The only requirement that is necessary to work with the strategy is the presence of an MT4 trading terminal, since the special indicator that is present in the trading strategy is tailored strictly for this platform.

Setting up the components for the Minute Strategy

Before you begin studying further material, go to the end of the article and download the required indicator and template. The process of installing a strategy in MT4 is quite simple; to do this, in an open terminal, go to the file menu and launch the data directory.

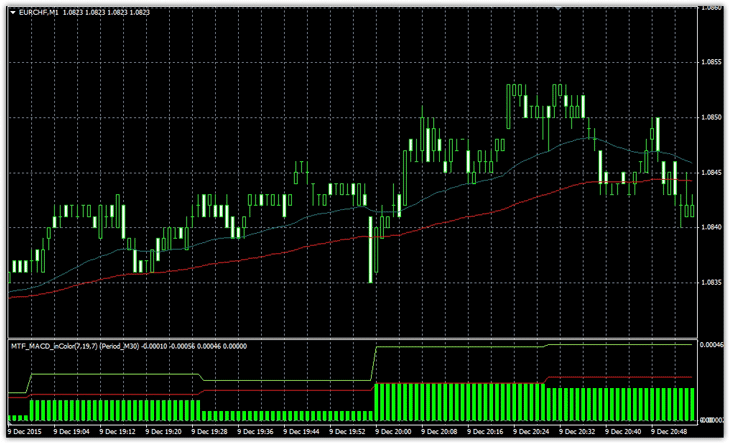

In the open directory, find the Indicators folder and drop the indicator into it, and the template must be placed in the Template folder. Without restarting the terminal, in the navigator panel, where the indicators are located, click refresh. After this procedure, just enter the list of your templates and launch the “Minute MAX MACD Strategy”. After launching the template, your strategy is ready to go, and your work schedule will look like this:

Trading signals. Information on indicators

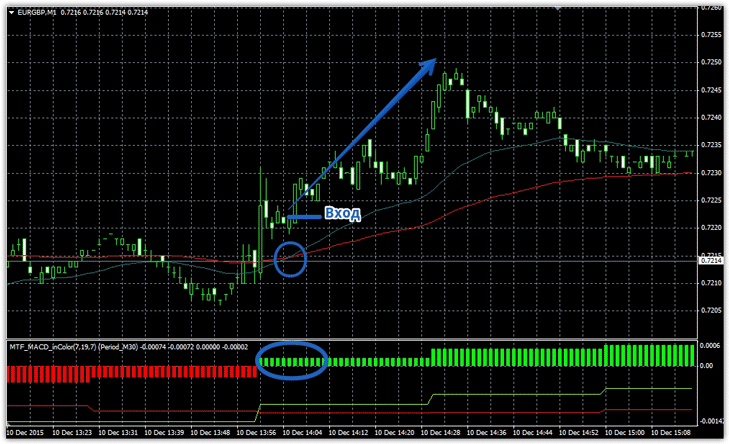

The foundation of this minute strategy is only three simple indicators, namely two trend moving averages with a period of 20 and 50, which you can see in the form of a red and blue line on the chart, as well as a modified MAX MACD oscillator, which is based on the familiar MACD .

In order to ensure that all transactions do not diverge from the main global trend, a higher time frame is set in the MAX MACD settings, namely m30, which allows you to filter out the majority of transactions that diverge from the main global trend.

All indicator settings are open, so you can always adjust the indicators in case of greatly changed market conditions. So let's get to the signals.

The buy signal is based on only two market conditions, namely:

1) The moving average with a period of 20 (blue) must cross the moving average with a period of 50 (red) from bottom to top.

2) The MAX MACD histogram column should be above zero and colored green.

We enter a position only when the candle closes. An example of a buy signal is shown below:

The sell signal is based on only two market conditions, namely:

1) The sliding average with a period of 20 (blue) should cross the sliding with a period of 50 (red) from top to bottom.

2) The MAX MACD histogram column should be below zero and colored red.

We enter a position only when the candle closes. An example of a sell signal is shown below:

You most likely have a question: why such a long period for moving averages, given that the work is carried out only on a minute chart? The fact is that when using moving averages with such a period, the emphasis is not on the quantity of signals, but on the quality, since it is when working with a large period that you can notice a strong deviation of the price from its average value and, as a rule, the signals justify themselves.

Setting stop orders. Capital Management

Initially, according to the rules of the stop strategy, it is recommended to use a static order, namely 10-15 points, depending on market volatility . However, I personally think that it is easier to place our stop orders at local minimums and maximums, and after analyzing the history, the average stop is 7-10 points. To exit a position, a simple formula is used, namely, we multiply your stop order in points by 1.5.

If we talk about money management, then the minute strategy, due to the large number of transactions per day, must be calculated in such a way that if your stop order is triggered, the loss does not exceed 1 percent of the deposit. Remember, scalping without strictly following all the rules can lead to the loss of your deposit.