Moving average strategy

Everyone has heard of the famous stock exchange saying that the trend is your friend. However, determining the direction of the trend and performing operations only on it is one of the most difficult tasks for every beginner.

In order to determine a trend in Forex, you need to use various trend tools, and if you want to build truly effective trading tactics, then you simply need to include trend indicators in your strategy set.

The moving average strategy is a trading tactic that is based on the most popular trend technical indicator Moving Average .

It is no secret that moving averages are the best ones to clearly display the current trend in the market, timely show entry points into the market, and also state the intended market reversal. The moving average strategy, which we will try to analyze in this article, uses three moving averages that show the entry point into the market, cut off false signals, and allow us to determine the global trend.

Installation

The moving averages trading strategy consists of standard MT4 indicators, so the only thing that needs to be installed is a ready-made template that will allow you to place indicators on the chart automatically and not drag and drop each one one by one. To do this, you need to download the ready-made template at the end of the article and place it in the Template folder.

To find the required folder, you need to launch the trading platform and open the root directory in the file menu. After you download the template, close the root directory and update the installed component in the Navigator panel. After updating, the file should appear in the list of templates.

To launch it, call the additional menu on the chart and select “Moving Average Strategy” from the list of templates. See the result of running the template below:

Components of the strategy.

Functions and settings The strategy is based on three indicators, and only two of them actually influence trading decisions.

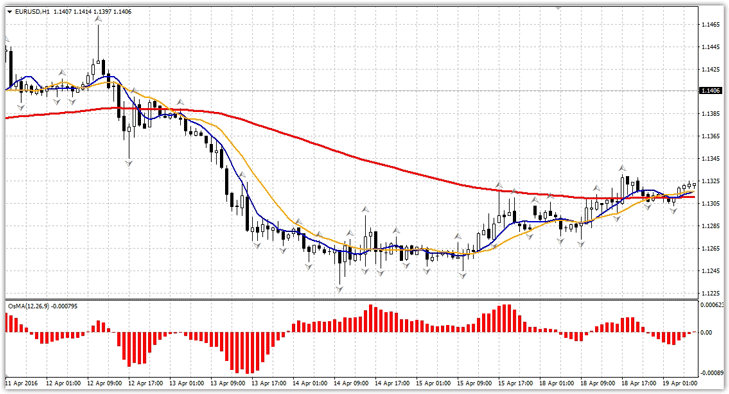

Thus, the strategy uses three moving averages with periods of 120, 7, 14. A moving average with a period of 120 is necessary to determine the main global trend, namely, if the price is above the red line, then there is an upward global trend in the market, and if the price is below it, there is a downward trend in the market global trend. In the strategy, placing the price relative to the moving average with a period of 120 is a guideline for making transactions.

Moving averages with periods of 7 and 14, and you can see them on the screen in yellow and blue, are responsible for the entry point.

So, when a fast moving average crosses a slow moving average, we receive a signal according to our strategy. It is very important to understand that signals will be taken into account only in the direction of price placement relative to a moving average with a period of 120. The

OsMa indicator in the strategy performs a fairly simple function - a trend filter and filtering out false signals.

Thus, you can buy only if the OsMa histogram is above its signal level, and you can sell if the histogram is below the signal level. The last third Fractal indicator is an optional tool and acts only as an assistant for determining where to place a stop order. Actually, by understanding which indicator is responsible for which function, you can easily change the parameters, adapting the strategy for trading on smaller time frames.

Moving average strategy signals.

There are two types of signals here, namely the main strong one and the additional weak one.

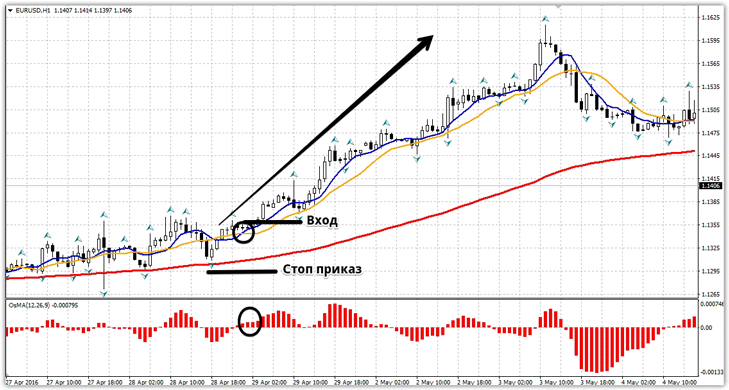

Both of these signals require certain conditions to be met, which we will discuss below. Basic buy signal:

1) The price is strictly above 120 in front of one moving average.

2) The moving average with period 7 (blue) crossed the moving average with period 14 (yellow) from bottom to top.

3) OsMa histogram above the zero level.

It is very important to enter strictly on a closed candle, since the intersection of the moving averages may change in the event of a sharp change in price.

A stop order must be placed along the fractal arrow pointing down.

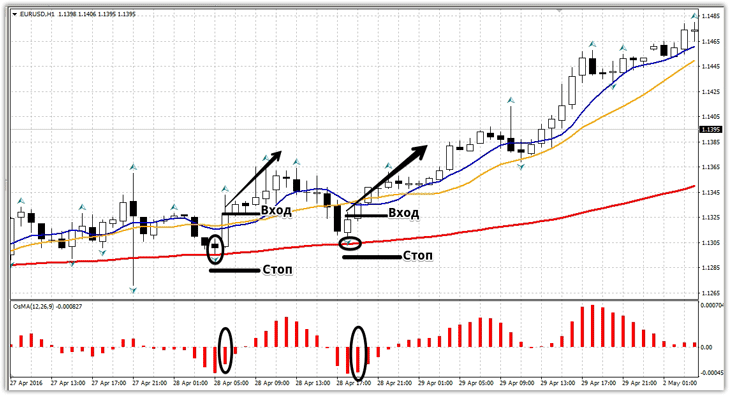

The basic basis for an additional buy signal is that the 120 period moving average acts as support.

So, an additional signal to buy: 1) The price dropped from top to bottom and touched the moving average with a period of 120.

2) We wait for the OsMa histogram column under the signal line to decrease.

We enter only on a closed candle, and place a stop order 5-10 points behind the moving average with a period of 120. Example:

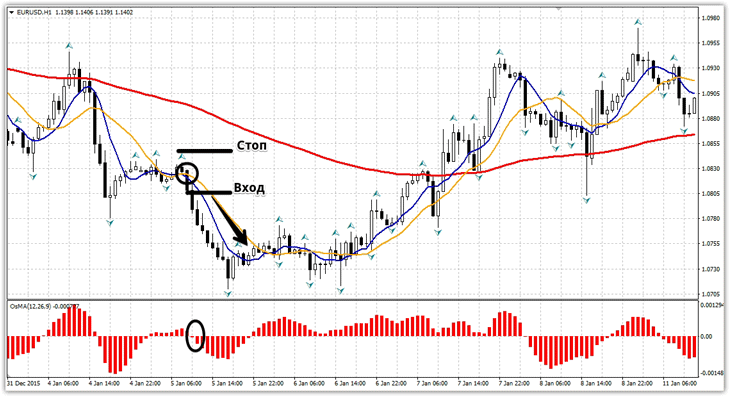

Basic sell signal:

1) The price is strictly below the 120th period.

2) The moving average with a period of 7 (blue) crossed the moving average with a period of 14 (yellow) from top to bottom.

3) OsMa histogram below the zero level.

It is very important to enter strictly on a closed candle, since the intersection of the moving averages may change in the event of a sharp change in price.

A stop order must be placed along the fractal arrow pointing upward.

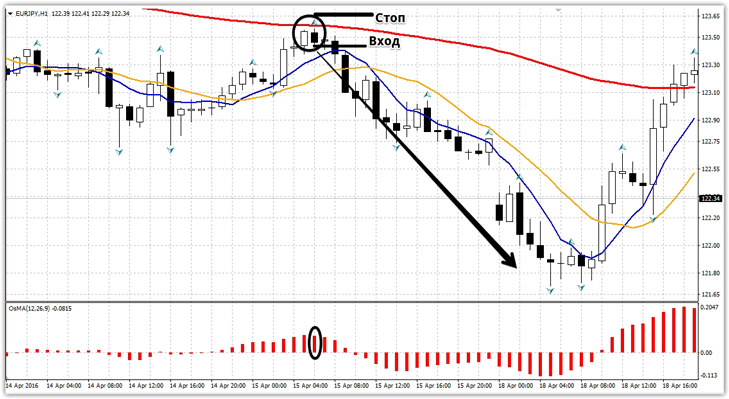

The basic basis for an additional sell signal is that the 120 period moving average acts as resistance.

So, an additional sell signal: 1) The price rose from the bottom up and touched the moving average with a period of 120.

2) We wait for the OsMa histogram column to decrease above the signal line.

We enter only on a closed candle, and place a stop order 5-10 points behind the moving average with a period of 120. Example:

In conclusion, it is worth noting that the moving average strategy is truly a working tool for catching profits in trending markets.

The disadvantage of the strategy is the weak lag of the signals, but this is nothing more than a technical feature of signal indicators rather than a disadvantage. Download the Moving Average strategy template .