Trading using Martingale

The fear of losing money and uncomfortable tension constantly haunts traders when trading systematically. For a normal trading strategy, getting five losing trades in a row is the usual norm, but such a series of losses puts strong psychological pressure on the trader.

For a normal trading strategy, getting five losing trades in a row is the usual norm, but such a series of losses puts strong psychological pressure on the trader.

Therefore, traders are always looking for a kind of Grail that would allow them to always get away with it, despite the wrong chosen direction of the transaction.

To avoid losses and psychological stress, martingale money management was adapted from gambling to stock markets.

Initially, martinegale trading was used exclusively in gambling games, such as heads or nuts, playing black/red in roulette. The essence of money management is that if you make a losing bet, you double your bet.

For example, you bet 1 dollar on black and lost it, then using the martingale you bet 2 dollars back on black and if you win, you win back your previous loss and at the same time earn 1 dollar.

The whole point is that you hope that, according to the theory of probability, black will come up sooner or later, but at the same time you double your bet until this happens.

As a result, a series of doublings can lead to the fact that you will bet a huge amount, but at the same time you will win only $1.

Forex trading using Martingale.

In the Forex market, martingale trading is used approximately in this way, however, there are some variations in the application of this strategy and subtleties, which will be discussed in this article. So, the first method of martingale trading is often called fixed.

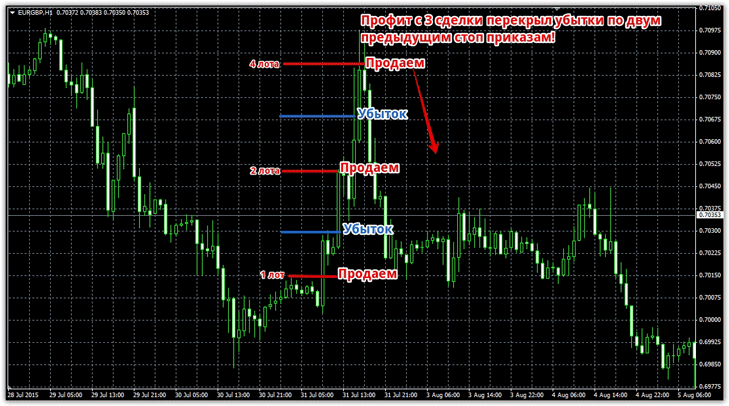

For example, using an indicator strategy, you receive a signal and set a stop order in the amount of 15 points and the same pro. If your trade suffers a loss, you wait for the next signal, but at the same time enter with a double lot. This doubling occurs until the trade closes in profit, and the total profit covers a series of unprofitable orders.

For example, we look at the picture below:

One of the advantages of this approach is that you will not see a large drawdown in your account, which could instantly destroy your deposit. However, with each increased lot , the size of the loss will greatly increase and the psychological load along with it, which very often leads to a rash action in the form of a multiple increase in volume in the hope that this time the transaction will be profitable.

One of the advantages of this approach is that you will not see a large drawdown in your account, which could instantly destroy your deposit. However, with each increased lot , the size of the loss will greatly increase and the psychological load along with it, which very often leads to a rash action in the form of a multiple increase in volume in the hope that this time the transaction will be profitable.

To apply this method, you need strong discipline with strict adherence to the lot growth plan.

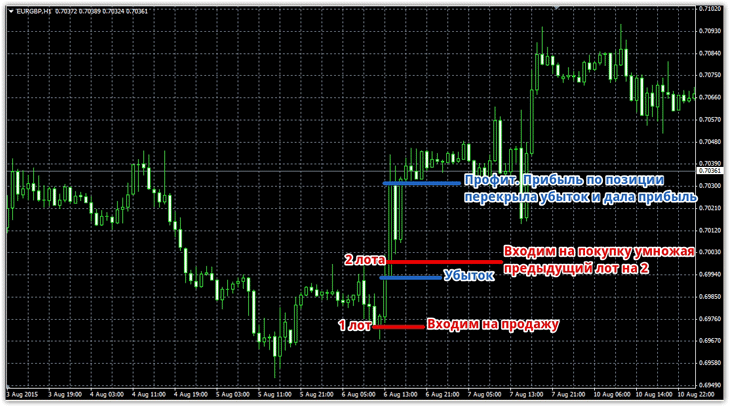

The second martingale trading method is called “Reversal”. The tactics are very simple and straightforward. Let's say you enter a sell position with one lot and set a stop order of 30 points, but the price goes against you.

When the stop is triggered, you immediately open a position with a double lot to buy, and if a profit is triggered, you start working with the original lot. Essentially, you agree that you have made a mistake with the direction of the trend and reverse the direction of the trade and do this until the profit is triggered and covers some of the losses.

Unlike the previous option, a profitable position in trend areas appears an order of magnitude earlier, and the series of unprofitable orders is smaller. But, despite the obvious advantage of the method, there is one big drawback. This money management model produces a very large series of losses if the market moves sideways in a narrow range.

Unlike the previous option, a profitable position in trend areas appears an order of magnitude earlier, and the series of unprofitable orders is smaller. But, despite the obvious advantage of the method, there is one big drawback. This money management model produces a very large series of losses if the market moves sideways in a narrow range.

It gets to the point where you have to reverse a very large number of times, and if the flat lasts for a couple of days, then you simply may not have enough funds to open a position

The third method is an improvement on the martingale system and involves averaging the position. The bottom line is that if you did not guess the direction, you do not close the order, but at a certain distance from the previous one, open a new one in the same direction, but with a double lot.

Essentially, you are building a network of open orders over a certain distance in the hope that the price will sooner or later make a rollback and, based on the sum of the last few profitable positions, you will completely cover your losses and come out in profit.

One of the advantages of using this method is that you will never actually see a stop order, since it is never used, and all losses are averaged. However, the size of the drawdown on open orders is, as a rule, simply huge, and if you take any money management rules , then you risk losing your entire deposit for a tiny profit. It is this model that is most often used in various advisors, however, due to drawdown, the loss of the deposit becomes simply instantaneous.

One of the advantages of using this method is that you will never actually see a stop order, since it is never used, and all losses are averaged. However, the size of the drawdown on open orders is, as a rule, simply huge, and if you take any money management rules , then you risk losing your entire deposit for a tiny profit. It is this model that is most often used in various advisors, however, due to drawdown, the loss of the deposit becomes simply instantaneous.

In order to reduce drawdown, some traders average positions not by doubling, but by multiplying by a certain coefficient that is smaller in size. But as the ratio decreases, the size of the rollback must be an order of magnitude larger to cover losses.

In general, martingale trading is a very common trading method, and it is practiced mainly by beginners. You need to understand for yourself that there is no point in running away from unprofitable trades, because fixing losses is part of the work process.

If you cannot do this, then you should be aware that by using martingale , you risk losing everything for the sake of profits that do not justify your expectations. In the future, a trader using martingale will sooner or later lose his account, especially when wide trend movements occur.