Swing trading strategy

As you expand your circle of communication with traders, you come to the conclusion that for some unknown reason everyone likes to complicate their lives. Yes, exactly life and all because everyone constantly creates complex indicator trading systems, does not leave the monitor for days, and their entire personal life turns into a stock exchange game, where there is no time even for loved ones.

lives. Yes, exactly life and all because everyone constantly creates complex indicator trading systems, does not leave the monitor for days, and their entire personal life turns into a stock exchange game, where there is no time even for loved ones.

And everything would be fine, but with such an approach, success is also invisible, because constantly chasing after every item from the market, you will always be haunted by a series of mistakes, unforeseen losses due to your emotional state and strong psychological stress.

Swing trading is a special trading tactic in which all work is carried out on daily and weekly charts, and its main task is to take profits along the main trend and ignore intraday price fluctuations.

On average, one trade of a swing trader lasts for at least three days, and the main law of the strategy is to let profits grow, since the main trend is not as easy to change as it seems.

The vast majority chase trend reversals, but such tactics only destroy the deposit, because we simply do not have sufficient information, and indicator lines will never tell us for sure that the market is at its bottom or top.

Basic market conditions.

All the classics of stock market literature distinguish three market states, namely accumulation, trend state and distribution.

The first stage is initiated by large players with huge capital and information that is not available to us, so swing trading is never carried out in this phase.

The trend middle phase is an excellent moment for making money, since the price purposefully goes up and its direction is very difficult to break.

And finally, distribution is the phase where large players close positions, and naive newcomers enter according to a clear trend and lose their money. Therefore, the main task when using a swing trading strategy is to search for trending markets and enter in the main direction.

Basic entry signals for the swing trading strategy.

The swing trading strategy is based on simple signals that at first glance may seem trivial, but most often, thanks to simple approaches, the world's famous people have achieved stunning success. The first thing you need to do is select a list of currency pairs , stocks, futures that have a clear trend movement, namely downward or upward. We need to see the big picture, namely the global trend.

Having determined the direction of the trend, we understand in which direction we will make transactions. So, let's look at some signals that are used in the swing trading strategy.

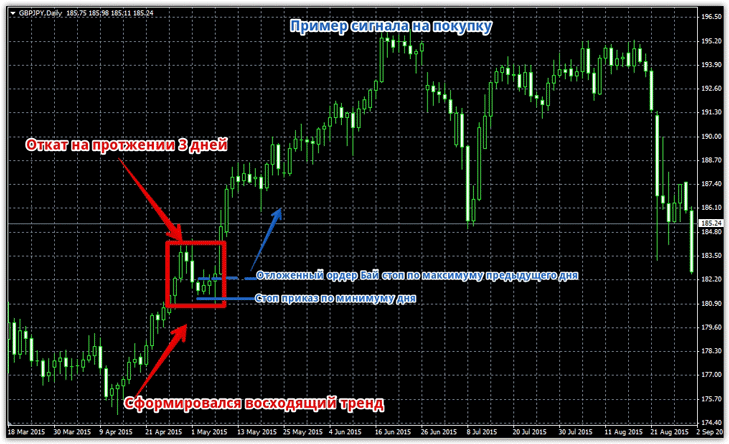

Buy signal.

In an uptrend, a pullback has formed that lasts 3-5 days. It is necessary to place a pending buy stop order at the high of the previous candle, and a stop order at the low. An example is shown in the picture below:

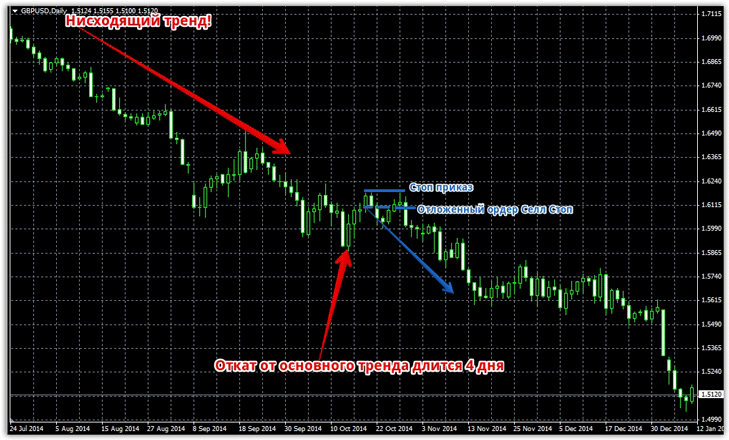

Sell signal.

A pullback has formed in a downtrend, which lasts 3-5 days. It is necessary to place a pending sell stop order at the low of the previous candle, and a stop order at the high. An example is shown in the picture below:

What to do if the rollback continues and the pending order does not fire?

Everything is very simple, you need to delete the old pending order and place it according to the rules on a new candle.

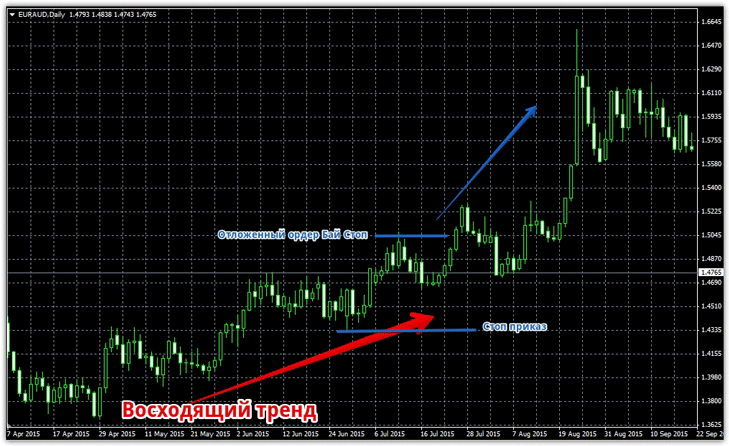

The second type of signal is based on the breakdown of an extreme point or so-called small support. The essence of this signal is that the price at a certain stage begins to roll back and has formed a minimum or maximum depending on the trend. This point becomes a kind of support or resistance, after breaking which the price with renewed vigor takes a new height or minimum.

So, for a buy signal, there must be a global bullish trend in the market, after which a rollback began in the opposite direction. At the point where the rollback began, we place a Buy Stop order, and a stop order at the local minimum. See an example below:

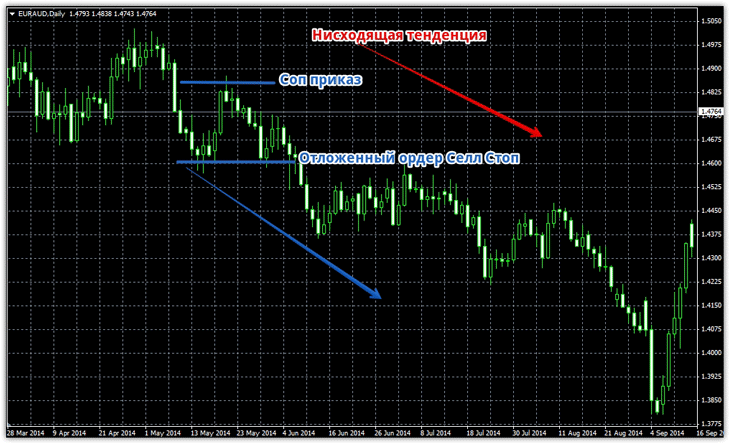

For a sell signal, the global downward trend, on which a 3-5 day pullback has formed, must continue in the market. At the point where the rollback began, we place a pending order Sell Stop , and a stop order at the local maximum. An example is shown in the picture below:

For a sell signal, the global downward trend, on which a 3-5 day pullback has formed, must continue in the market. At the point where the rollback began, we place a pending order Sell Stop , and a stop order at the local maximum. An example is shown in the picture below:

In general, the swing trading strategy is based on such simple signals. If we talk about the advantages of this strategy, we would like to highlight the absence of any psychological stress, since transactions are made a maximum of 1-2 per day, and they need to be held for several days, and on average about a week.

Thus, one position can cover a long period of a trend, and you, as a trader, do not overpay on broker commissions in the form of a spread. a swap for holding a position the next day , so before opening a long and short position, try to trade towards a positive swap and select a broker with a minimum commission.