Head and Shoulders Figure

The Head and Shoulders pattern is the most common reversal pattern in graphical analysis.

analysis.

Every beginner who comes to the Forex market one way or another comes across training on graphic figures, whether it be seminars, books, or just a video, the basics begin with graphic analysis.

The fact is that many traders use patterns without realizing how they are based and, especially, do not think about what facts they were created on. The figures appeared based on traders’ observations, namely, on patterns of price movement.

Many people consider figures to be some kind of super tool, but in fact they show us the patterns of crowd behavior.

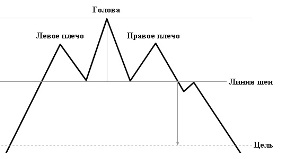

Head and shoulders is a reversal pattern that appears at the top of a trend and consists of three highs, and if you look from the outside, they resemble the head and shoulders of a person, because the central high is higher than the two neighboring ones.

It appears on both bullish and bearish trends, and on a bullish one it is built on the basis of three highs, and on a bearish one from three lows. The figure itself consists of a left shoulder, a head and a right shoulder.

These elements are mandatory, otherwise it is a completely different figure. If you try to think about why it occurs, you come to the conclusion that this is the machinations of major players. Indeed, if you look at the moment of its occurrence, you will notice that at this stage a clear trend has developed and only a very fool could fail to notice it. Many traders begin to peck at such an obvious trend and try to enter along it, but large players try to disrupt the stops of those who have just entered the market and, thanks to the first leverage, throw some traders out of the position.

Then, seeing a small pullback, players buy up the asset again, which leads to the formation of the so-called head, but large players again join in the sales, which leads to the formation of the right shoulder. Players, seeing the weakness of this trend, begin to massively dump their positions and exit purchases, which finally leads to a reversal of the trend. In general, this is really common behavior of the crowd in a panic to lose their money. You can see an example of a head and shoulders figure in the picture below:

Of course, the picture looks like an ideal version of the figure, which can only be seen in a textbook.

Of course, the picture looks like an ideal version of the figure, which can only be seen in a textbook.

In fact, we should not forget that Head and Shoulders is primarily a crowd behavior pattern, and as you have probably already observed on the price chart, such ideal waves simply do not exist. Therefore, your task is to see and find this image and try to transfer it to the chart. Now let’s actually talk about how to use this graphical tool.

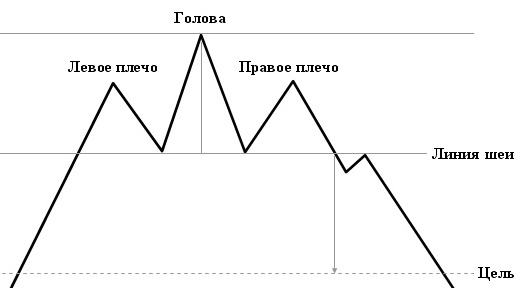

A head and shoulders pattern appears in front of you in a bullish trend.

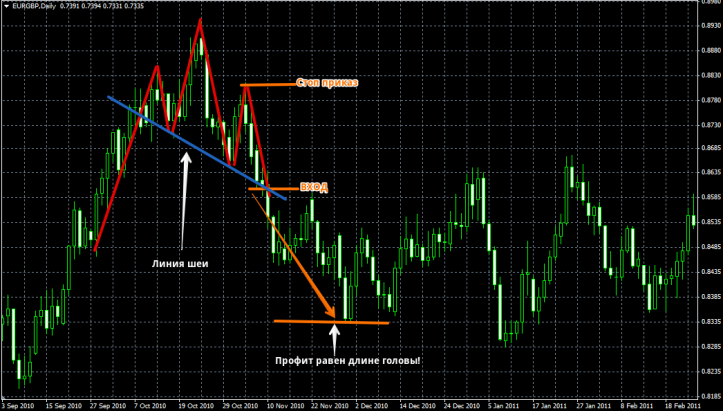

The next step is to draw the so-called neck line, which connects the two minimums that formed the shoulders. You will have a kind of support line. And now, in fact, if the price breaks through the neck line, then a sell order is opened. The stop order is placed at the level of the maximum of the right shoulder, and the profit is usually set equal to the size of the head in points. You can see an example of a sale in the picture below:

If a “Head and Shoulders” pattern appears in front of you in a bearish trend, draw a neck line along two local highs that appeared as a result of the formation of the left and right shoulders.

If a “Head and Shoulders” pattern appears in front of you in a bearish trend, draw a neck line along two local highs that appeared as a result of the formation of the left and right shoulders.

You will get a line that is the resistance level. If the price breaks the neck line from bottom to top, then we enter a buy position. We set the stop order at shoulder level, and set the profit according to the size of the head. Take a closer look at the picture below:

The main disadvantage of the figure is that many beginners, in pursuit of a trend reversal point, see it where it actually does not exist.

The main disadvantage of the figure is that many beginners, in pursuit of a trend reversal point, see it where it actually does not exist.

This is due to the fact that all graphical analysis is based on a subjective view of the market, so you should not chase this figure, but if you do see it, then you should be prepared that the trend may soon reverse.